Aflac will pay $100 when a covered person receives treatment for a covered sickness or accidental injury in a hospital, including an observation room or an ambulatory surgical center, for a period of less than 23 hours and a charge is incurred. Does Aflac pay for lost wages? Aflac provides benefits for both total and partial disability.

Full Answer

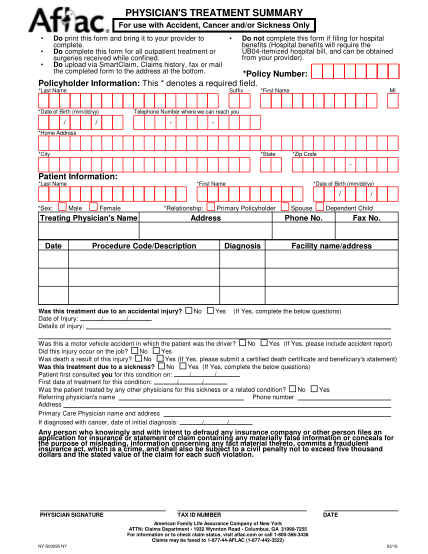

How do I fill out Aflac physician treatment summary form online?

Use its powerful functionality with a simple-to-use intuitive interface to fill out Aflac Physician Treatment Summary Form online, eSign them, and quickly share them without jumping tabs. Follow our step-by-step guide on how to do paperwork without the paper. Use Get Form or simply click on the template preview to open it in the editor.

What is Aflac Insurance?

Aflac is a Fortune 500 company, providing financial protection to more than 50 million people worldwide. When a policyholder or insured gets sick or hurt, Aflac pays cash benefits fairly, promptly, and often in one day for eligible claims, directly to the insured (unless assigned otherwise).

How do I contact Aflac health care providers?

Health Care Providers. Aflac supports the exchange of real-time based eligibility, claims status transactions and electronic claims transmission under the Affordable Care Act. For information or support, call Emdeon at 866.742.4355 and select Option 4, or visit Emdeon.com.

What are Aflac's stated objectives and objectives?

Aflac's stated objectives include the decrease of its environmental impact, for which the company is into a partnership with the Clean Air Campaign to encourage employees to engage with greater frequency in alternate commuting methods.

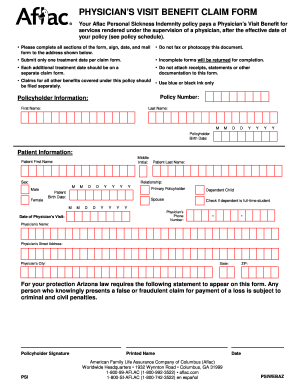

What is Aflac physician visit claim?

Your Aflac Personal Sickness Indemnity policy pays a Physician's Visit Benefit for services rendered under the supervision of a physician, after the effective date of your policy (see policy schedule).

What documents does Aflac need to submit a claim?

Accidental death - Certified death certificate & beneficiary statement claim form. Police report - Required for MVA and any other occurrence investigated by the police. Physician's office notes. Emergency room - ER or urgent care report.

What is a UB04 form for Aflac?

(This allows Aflac to request additional documentation on your behalf.) Emergency room (ER). Itemized hospital bill (IHB). UB04 (itemized hospital bill).

How long do I have to submit an Aflac claim?

How long do I have to file a claim? A. There is a one-year timely filing provision in your certificate. Please review the provision and call us with any questions.

Does Aflac deny claims?

Decline: An applicant is denied coverage with Aflac for specified reasons. Denial: The process of reviewing a claim and deciding that, due to the terms of the policy contract, no benefits are due for the claim.

How much does Aflac pay for an MRI?

Major Diagnostic Exams Aflac will pay $200 if a covered person requires one of the following exams for injuries sustained in a covered accident: CT (computerized tomography) scan, MRI (magnetic resonance imaging), or EEG (electroencephalogram).

What is the difference between UB-04 and CMS-1500?

The UB-04 (CMS-1450) form is the claim form for institutional facilities such as hospitals or outpatient facilities. This would include things like surgery, radiology, laboratory, or other facility services. The HCFA-1500 form (CMS-1500) is used to submit charges covered under Medicare Part B.

What is required on a UB04?

The minimum requirement is the provider name, city, state, and ZIP+4. Do not enter a PO Box or a Zip+4 associated with a PO Box. The name FL 1 should correspond with the NPI in FL56. FL2: Pay to or Billing Address - Name of the provider and address where payment should be mailed.

Which is an example of a health care setting that would use the UB-04 claim to bill institutional services?

The UB-04 claim form is used to submit claims for outpatient services by institutional facilities (for example, outpatient departments, Rural Health Clinics and chronic dialysis centers).

How does AFLAC pay out?

We will pay the amount shown for injuries received in a covered accident if you receive treatment in a hospital emergency room and receive initial treatment within 72 hours after the covered accident. This benefit is payable only once per 24-hour period and only once per covered accident.

How do I get my money from AFLAC?

Use Aflac SmartClaim to get paid fast.Direct Deposit allows you to get paid fast.Click Direct Deposit and follow the instructions for registration.Please allow one business day for Direct Deposit enrollment to take effect.

Does AFLAC cover pre existing conditions?

Disability caused by a Pre-existing Condition will not be covered unless it begins more than 12 months after the Effective Date of coverage. Aflac will not pay benefits for a Disability that is being treated outside the territorial limits of the United States.

Quick steps to complete and eSign Aflac Physician Treatment Summary Form online

Use Get Form or simply click on the template preview to open it in the editor.

The best way to generate an electronic signature for a PDF file in the online mode

Are you looking for a one-size-fits-all solution to eSign aflac physicians treatment summary form? signNow combines ease of use, affordability and security in one online tool, all without forcing extra ddd on you. All you need is smooth internet connection and a device to work on.

Find out other Aflac Physician Treatment Summary Form

If you believe that this page should be taken down, please follow our DMCA take down process here.

What does Aflac hospital policy cover?

Aflac will pay $100 when a covered person receives treatment for a covered sickness or accidental injury in a hospital, including an observation room or an ambulatory surgical center, for a period of less than 23 hours and a charge is incurred.

Does Aflac pay for lost wages?

Aflac provides benefits for both total and partial disability. Even if you’re able to work, partial disability benefits may be available to help compensate for lost income. Regardless of any other disability insurance you may have, including Social Security, we will pay you directly.

Does Aflac cover broken teeth?

We will pay for no more than two fractures per covered accident, per covered person. We will pay no more than one benefit for broken teeth per covered accident, per covered person. Coma duration must be at least seven days and must require intubation for respiratory assistance.

What expenses does Aflac cover?

Policyholders can use these benefits however they choose for expenses such as travel costs for treatment, mortgage or bill payments while out of work, child care or other unexpected costs – expenses that major medical was never designed to cover.

Can anyone buy Aflac insurance?

You must be 18 or older to apply for Aflac insurance. Availability varies by product; see your local Aflac agent for details. The out-of-pocket expenses displayed are estimated at 40% of the total medical cost, assuming that average major medical plans cover approximately 60% of the expense.

Is Aflac dental good?

Aflac Dental Insurance is a good option that is not too pricey and is good for basic dental care. Aflac is an insurance company that I could afford with a very small budget compared to other insurance companies because I had called a lot of different dental insurance companies and received really high quotes.

Is it worth having two dental insurances?

Having multiple dental insurance policies is acceptable. In fact, having more than one dental insurance policy can offer you additional benefits and help you save on out-of-pocket costs. However, having multiple dental insurance policies is not necessary.

What is Aflac insurance?

/ ˈæflæk / ( A merican F amily L ife A ssurance C ompany) is an American insurance company and is the largest provider of supplemental insurance in the United States. The company was founded in 1955 and is based in Columbus, Georgia. In the U.S., Aflac underwrites a wide range of insurance policies, but is perhaps more known ...

How much does Aflac pay back?

A United States General Accounting Office study found that the policies paid back as little as 35% of premiums (Aflac said its cancer insurance paid back 62.4%). In comparison, New York State requires most major-medical policies to pay back 82% and group policies to pay back 75%.

What is the Aflac Duck?

The Aflac Duck. Since December 1999, the company's identity and brand has become more widely recognized in the United States as the result of TV commercials featuring the Aflac Duck, who frustratedly quacks the company's name to unsuspecting prospective policy holders.

When did Aflac start selling cancer insurance?

The company signed 6,426 policyholders in its first year. Aflac pioneered cancer insurance in 1958. Beginning in 1964, the company decided to focus sales on worksite settings, eventually through policies sponsored by employers and funded through payroll deductions.

When did Aflac change its name?

In 1964, the company name was changed to American Family Life Assurance Company of Columbus. In 1990, the company adopted the Aflac acronym, although the official name of the underwriting subsidiary remains American Family Life Assurance Company of Columbus. Aflac announced the appointment of Frederick J.

Where is the Aflac headquarters?

Aflac operates in the United States and Japan, and has its worldwide headquarters and corporate offices in an eighteen-story tower just east of Downtown Columbus, Georgia, in an area known as MidTown. The Aflac tower is the tallest building in the city. As of June 30, 2015. [update]

Who is the actor in the Aflac Duck commercial?

The Aflac Duck character has now starred in more than 30 commercials. In many of these commercials, character actor Earl Billings also appears. The Aflac Duck is enshrined on Madison Avenue's Walk of Fame as one of America's Favorite Advertising Icons.

What is Aflac insurance?

Founded in 1955 in Columbus, Georgia, the American Family Assurance Company of Columbus, Aflac for short, is the best-known provider of supplemental insurance — especially payroll deduction insurance through employers. Aflac has an A+ rating from A.M. Best, a credit rating agency for the insurance industry.

What happens if you don't have Aflac?

If you get hurt or sick and incur expenses not covered by your primary health insurance, you may get a timely, helpful payout from Aflac. It’s important to have an emergency fund for these types of situations, but if you don’t, a payment from Aflac could help you out during a stressful time.

What is supplement insurance?

Supplemental insurance is designed to work alongside your primary insurance coverage to fill in gaps. For example, if you get injured or sick, your health insurance policy might not cover everything, or you may not get paid if you’re not working.

Is Aflac a scam?

Here are some of Aflac’s negatives: Products may not be needed. There’s a good chance you don’t need any of Aflac ’s insurance policies, especially if you have good health, life and disability insurance policies. According to Clark, supplemental insurance is “not a rip-off and it’s not a scam.

Does Aflac have supplemental insurance?

But Aflac may be the only big insurance company that has supplemental coverage as its primary focus. I don’t know how this benefits you concretely. But I’d almost always rather buy from a company that specializes in a certain product than one that sells it as a throw-in, especially if I have questions. Group insurance.

Does AFLAC pay payroll taxes?

You pay for an Aflac insurance policy via a payroll deduction. In other words, the money comes out of your paycheck much like payroll taxes. However, you can buy some types of policies directly through Aflac.

Does supplemental insurance cover stroke?

Some kinds of supplemental insurance offer only very specific coverage: If you’re diagnosed with cancer, cancer insurance would pay you a cash benefit. But there’s a wider range of payout options. If you suffer a stroke, maybe you want an up-front lump sum or maybe you want smaller payments as you go through therapy.