Your medical provider can sue you for an unpaid bill, in which case the court decides on the punishment. One of the most common measures is wage garnishment. This means that they will take a certain amount of money off your income regularly until the debt is settled. You cannot go to jail for an unpaid medical bill

Full Answer

Why are some people not paying their medical bills?

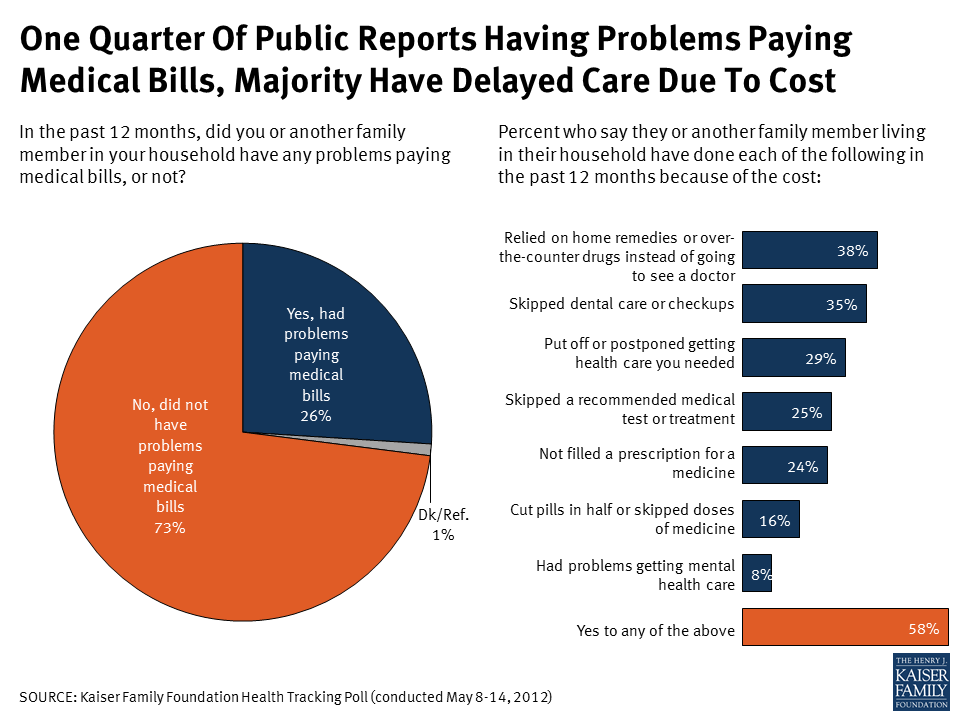

In the U.S. some people are not paying their medical bills because they literally can't afford them. According to a 2019 report from T he Journal of General Internal Medicine, About 137.1 million U.S. adults faced financial hardship due to medical bills.

Can a hospital refuse to treat you if you owe money?

Hospitals have even been known to refuse care to patients who still owed previous debts. How to avoid it: Paying for medical bills on a low-interest credit card is a good way to avoid being indebted to them. Also, don’t use home loan money to pay for medical bills, because it can put your home at risk.

How can I avoid costly medical bills?

Here are some tips for avoiding costly medical bills. Before receiving services, confirm with the provider that they are in your insurance plan's provider network. For more advanced services, such as surgery, confirm that all the participating providers are also in the network.

Can you fight a medical bill you thought insurance would pay?

Getting hit with a medical bill you thought your insurance would pay is an all-too-common situation. There are two ways to combat surprise medical bills, whether they come from an emergency situation or from a healthcare professional: Prevent them in the first place or fight them later.

What are the consequences of not paying medical bills?

When you don't pay your medical bills, you face the possibility of a lower credit score, garnished wages, liens on your property, and the inability to keep any money in a bank account. Any one of those things can stifle you financially.

How do I fight outrageous medical bills?

However, just finding the error is only the start of your medical billing dispute.Call The Medical Provider Billing Department. ... File An Appeal With Your Insurance Company. ... File An Appeal With Your Medical Provider's Patient Advocate. ... Contact Your State Insurance Commissioner. ... Consider Legal Counsel. ... Final Thoughts.

How do I dispute a medical debt?

If you do not agree with your health insurer's response or would like help from the California Department of Insurance to fix the problem, you can file a complaint with us online or by calling 1-800-927-4357.

Can medical debt be forgiven?

How does medical bill debt forgiveness work? If you owe money to a hospital or healthcare provider, you may qualify for medical bill debt forgiveness. Eligibility is typically based on income, family size, and other factors. Ask about debt forgiveness even if you think your income is too high to qualify.

What is the No surprise act?

Effective January 1, 2022, the No Surprises Act (NSA) protects you from surprise billing if you have a group health plan or group or individual health insurance coverage, and bans: Surprise bills for emergency services from an out-of-network provider or facility and without prior authorization.

What is the minimum monthly payment on medical bills?

But there is no law for a minimum monthly payment on medical bills. If that were true, hardly anyone would need to file bankruptcy for medical debts. The truth is that the medical provider can sue or turn you over to collections if they are not satisfied with the amount that you are sending in.

Are medical bills on your credit report a HIPAA violation?

HIPAA does not regulate credit reporting of medical bills. The FCRA does. And the FCRA does not allow deletion of reported debt even in the case of a HIPAA violation. But the creditor may be willing to delete the reporting if you threaten to sue them for violating the law.

Can unpaid medical bills affect your credit?

Most healthcare providers do not report to the three nationwide credit bureaus (Equifax, Experian and TransUnion), which means most medical debt is not typically included on credit reports and does not generally factor into credit scores.

Will medical debt collectors settle for less?

Conclusion. On average, you can expect your debt collector to settle for 48% of your total medical debts. Working with an agency can help you get a better deal than if you try to negotiate alone.

How do you write a hardship letter for medical bills?

Dear Sir or Madam: I am writing to notify you of my inability to pay the above-referenced bill for (describe your condition and treatment). I have received the enclosed bill (enclose a copy of the documentation received from the billing company), but I am unable to pay the bill as outlined.

How often do hospitals sue for unpaid bills?

The study, published Dec. 6 in the journal Health Affairs, found that lawsuits over unpaid bills for hospital care increased by 37% in Wisconsin from 2001 to 2018, rising from 1.12 cases per 1,000 state residents to 1.53 per 1,000 residents. During the same period, wage garnishments from the lawsuits increased 27%.

How long until medical debt is forgiven?

seven yearsWhile medical debt remains on your credit report for seven years, the three major credit scoring agencies (Experian, Equifax and TransUnion) will remove it from your credit history once paid off by an insurer.

What are the measures hospitals take to collect money?

Hospitals will often go to extreme measures to collect on money owed them, including hounding the patient with debt collectors, suing, garnishing wages, placing liens on property, and even pursuing the patient’s spouse. Hospitals have even been known to refuse care to patients who still owed previous debts.

What is medical billing advocate?

It’s also helpful to know that medical billing advocates (for example, the Medical Billing Advocates of America) exist to help clients reduce or eliminate unreasonable medical charges. Companies like this negotiate with hospitals to remove unnecessary or unfair charges from patients’ bills.

How to avoid ice packs?

How to avoid it: If you foresee a need for things like tissues or ice packs, bring your own or have a friend bring you one, rather than pay mind-boggling fees for them . You can also contact a medical billing advocate, a company that negotiates hospital bills for a fee.

What is double billing?

3) Double-billing. Often a medical bill can include separate charges for items that were included in other bills. For example, hospitals sometimes charge separately for the sheets and pillows on a hospital bed, a cost that is usually included in the price of the room. It’s also possible to see a charge for the scrubs, ...

Do medical bills come in lump form?

Often medical bills come in lump form, without showing exactly what is being charged for. But if you have the foresight to ask for an itemized bill, you may see charges that seemingly come from nowhere – treatments you don’t recall receiving, or services you were told were included.

Is balance billing illegal in California?

How to avoid it: Thankfully, balance billing is already viewed with scorn by the general public. It is illegal with regard to Medicare, and California has even made it illegal in general.

Do insurance companies pay in-network doctors?

The insurance carrier has pre-set rates they will pay the in-network doctors, but sometimes you will wind up being cared for by a doctor who doesn’t have a contract with your carrier. Often these doctors want to be paid much more than the insurance companies are willing to shell out.

Why are people not paying their medical bills?

In the U.S. some people are not paying their medical bills because they literally can't afford them. According to a 2019 report from T he Journal of General Internal Medicine, About 137.1 million U.S. adults faced financial hardship due to medical bills.

Why are medical bills not paid?

It’s not a personal failure, however; it’s a common affliction. In the U.S. some people are not paying their medical bills because they literally can't afford them.

How to negotiate a medical bill?

If you want to negotiate your bill, speak with your healthcare provider’s medical billing manager—the person who actually has the authority to lower your bill. Don’t wait until your bill is delinquent or in collections, at which point your credit score will be seriously damaged.

What is a medical billing advocate?

Medical billing advocates are insurance agents, nurses, lawyers, and healthcare administrators who can help decipher and lower your bills. They’ll look for errors, negotiate bills, and appeal excessive charges. Expect to pay an advocate around 30% of the amount by which your bill is reduced.

How to respond to medical debt?

People commonly respond to medical debt by delaying vacations, major household purchases, cutting back on household expenses, working more, borrowing from friends and family, and tapping retirement or college savings accounts. If you’re faced with medical debt you can’t pay, try these tips for reducing what you owe so you can minimize ...

How many people face financial hardship?

According to a 2019 report from T he Journal of General Internal Medicine, About 137.1 million U.S. adults faced financial hardship due to medical bills. And the problem doesn’t just affect low-income households or uninsured consumers; those with robust incomes and insurance can face it, too.

Who can help with medical billing?

Few are experts in medical billing. A savvy choice is to enlist the help of someone who is: a medical caseworker, debt negotiator, or medical billing advocate. These professionals might be able to reduce what you owe when you can’t or are too timid to try.

What happens if you don't pay medical bills?

According to a 2020 survey, almost a third of working Americans are currently carrying balances from prior healthcare costs, and 28% of them still have medical bill debt of over $10,000. And here’s what happens if you don’t pay medical bills: phone calls and letters. That may not sound extreme, but once your medical bill debt is sold ...

What to do if you can't afford to pay medical bills?

If you can afford to pay off your medical bill debt quickly after a doctor’s office visit or procedure, ask for a prompt pay discount. This simple question could save you a healthy percentage off your bill. If you cannot, avoid discovering what happens if you don’t pay medical bills by explaining to the hospital or doctor’s office ...

Does debt die in the future?

In short, your debt never dies and while the calls and threats may someday fade, your credit will likely show the scars of your unpaid bills and a lower credit score could impact your ability to buy a home (or get the best interest rates on) cars and other large purchases on credit in the future.

What to say when you get a phone call asking that you cut your bill?

“When you get a phone call asking that you cut your bill, ‘because the settlement was too low and I can only get you $1, 000,’ reply by stating, ‘Please send me a copy of the draft, settlement agreement and client’s proposed disbursement.’

What is a doctor's lien?

“In all 50 states,” Steel points out, “the Doctor’s Lien, or Letter of Protection as it is also called in some states, creates a fiduciary relationship, making the lawyer trustee of settlement funds for the benefit of the client, the doctor and, finally, the attorney.

What is a lien in chiropractic?

Specializing in personal injury cases and representing chiropractors for over 35 years, Steel explains that a lien, “It is a binding, enforceable, written contract signed by the patient, attorney and health care provider requiring bills to be paid from the proceeds of settlement prior to the individual receiving any funds.”

Abstract

This ongoing column is dedicated to providing information to our readers on managing legal risks associated with medical practice. We invite questions from our readers. The answers are provided by PRMS, Inc.

Footnotes

To submit a question, e-mail Elizabeth Klumpp, Executive Editor, moc.mocdemxirtam@ppmulke. Include “Risk Management Column” in the subject line of your e-mail. All chosen questions will be published anonymously. All questions are reviewed by the editors and are selected based upon interest, timeliness, and pertinence, as determined by the editors.

What is the number to call MedHelp?

Call MedHelp, Inc. today at 443 524-4457 or toll-free at 1-800-275-6011 and let our team assist you in choosing the right solution. www.medhelpinc.com. Also, you can follow us on Facebook. Categories: Patient Care | Tags: medical bills, medical practice, and payments.

Is it better to collect money or not?

Collecting no money at all is the worst. It is better if you can at least bring in some money, even if it’s not everything at once. Many practices, however, try to insist on patients paying their medical bills in their entirety. With such high deductible plans these days, they are not always in a position to make payments in full.

What to do if medical bills are too expensive?

Make Payment Arrangements. Payment plans are always a viable option to consider if your medical bills are too costly to handle in a single transaction. However, it’s important to make timely payments and contact the medical provider immediately if your financial situation changes.

What happens if you don't update your health insurance?

If you don’t, your claim will be rejected, and you may have to cover the cost of treatment.

What happens if you don't get your insurance?

While it’s fairly simple for the billing staff to resubmit the claim to your new insurance company, you could end up in the hot seat with the collections department if you don’t get everything straightened out upfront.

How many people believe healthcare is a serious problem?

According to this study, 42% of the respondents believe that healthcare costs are a serious problem and spend all or most of their savings on large medical bills. In addition, 20% do not believe they get good value for their healthcare; the same percentage say that paying for prescription drugs is a struggle.

Do you have to confirm with the provider before you sign on the dotted line?

Prior to signing on the dotted line to receive services, confirm with the providers that they are in your network. For more advanced services, such as surgery, you should also speak with the head practitioner to confirm that all the providers rendering services also take your insurance.

Is health insurance an investment?

Updated Aug 16, 2020. Health insurance is supposed to be an investment that protects you from financial ruin in the event of a medical emergency. However, for millions of Americans, this definitely isn’t the case.

Do hospitals have in-house programs?

Some hospitals and medical providers have in-house programs or are connected with organizations that provide assistance to patients who are in dire financial straits and struggling to cover their medical expenses. Speak with the billing department to learn more.