A patent is considered an intangible asset; this is because a patent does not have physical substance, and provides long-term value to the owning entity. As such, the accounting for a patent is the same as for any other intangible fixed asset, which is: Initial recordation. Record the cost to acquire the patent as the initial asset cost.

Full Answer

What is the accounting for a patent?

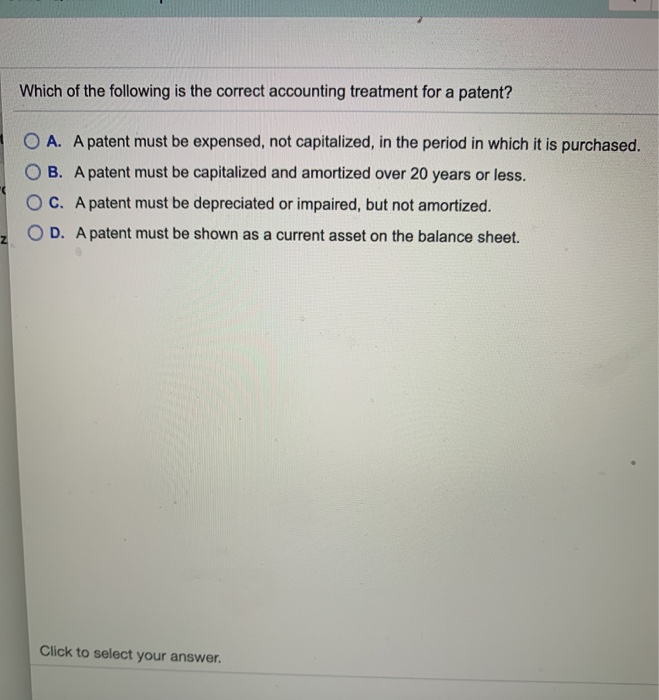

Accounting questions and answers. Which of the following is the correct accounting treatment for a patent? O A. A patent must be expensed, not capitalized, in the period in which it is purchased. B. A patent must be capitalized and amortized over 20 years or less. OC. A patent must be depreciated or impaired, but not amortized. OD. A patent must be shown as a current …

Should a patent be capitalized and amortized over 20 years?

Select one: O A. A patent must be shown as a current asset on the Statement of financial position. OB. A patent must be capitalized and amortized over 20 years or less. O C. A patent must be depreciated or impaired, but not amortized. O D. A patent must be expensed, not capitalized, in the period in which it is purchased.

What is the initial asset cost of a patent?

Which of the following is the correct accounting treatment for a patent? A) A patent must be shown as a current asset on the balance sheet. B) A patent must be depreciated or impaired, but not amortized. C) A patent must be capitalized and amortized over 20 years or less.

Is a patent an asset or liability?

Oct 17, 2021 · As such, the accounting for a patent is the same as for any other intangible fixed asset, which is: Initial recordation. Record the cost to acquire the patent as the initial asset cost. If a company files for a patent application, this cost will include the registration, documentation, and other legal fees associated with the application. If the company instead bought a patent …

How are patents treated in accounting?

A patent is considered an intangible asset; this is because a patent does not have physical substance, and provides long-term value to the owning entity. As such, the accounting for a patent is the same as for any other intangible fixed asset, which is: Initial recordation.Oct 17, 2021

What is patent in accounting with example?

A patent is an intangible asset to a company. Patents are similar to goodwill or natural resource rights. They are not expensed when bought; instead they are amortized of the useful life, which is 20 years.

How do you account for patent fees?

Debit the patent's total cost to the patent account in a journal entry in your accounting records when you acquire the patent. A debit increases the patent account, which is an asset on the balance sheet. The cost includes the purchase price plus any legal or other fees necessary to use the patent.May 19, 2018

Are patents amortized?

Amortization refers to spreading the price of a patent over its useful life. Depreciation refers to spreading the price of a tangible asset over its estimated life. Since patents are intangible, they're amortized. Only gadgets that have an identifiable financial life span can be amortized.

What does patent mean in medicine?

Patent (adjective): Open, unobstructed, affording free passage. Thus, for example, the bowel may be patent (as opposed to obstructed).

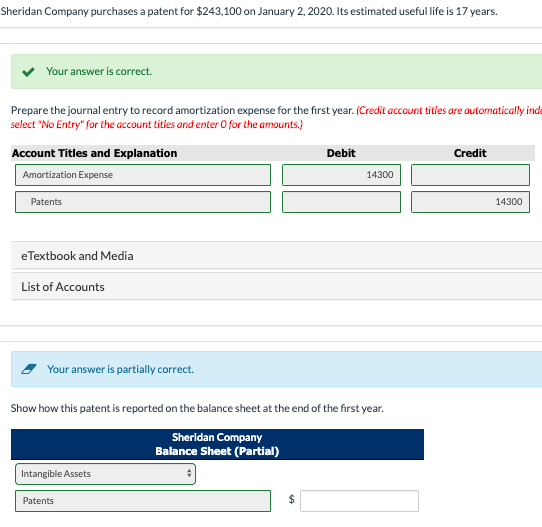

How do you record a patent on a balance sheet?

When a patent is acquired, Generally Accepted Accounting Procedures requires that it be included on the business's balance sheet at its fair value. “Fair value” is the cost to acquire the patent. If the business purchased the patent, it should be valued at the cost to acquire the patent from the former owner.

What type of account is patent account?

real accountPatent account is an intangible asset and hence, is classified as a real account.

Can patent costs be expensed?

The legal and filing costs associated with the patent are carried as an intangible asset and are expensed ratably over 15 years. An accrual basis taxpayer is also allowed to amortize (expense) the costs of the patent ratably over a 15 year period.

Is patent a liability or asset?

Patents are an intangible asset, meaning that they are not attached to any physical entity.Jan 19, 2022

Are patents depreciated or amortized?

Depreciation refers to spreading the cost of a tangible asset over its estimated life. Since patents are intangible, they are amortized. Only items that have an identifiable economic life span can be amortized.

When should you amortize a patent?

The legal life of a patent is the time until it expires. For example, if your company has a patent that expires in 20 years, but is only expected to be profitable for 10 of those years, the amortization period should be 10 years.

Are patents amortized for tax purposes?

Amortization of intangibles, also simply known as amortization, is the process of expensing the cost of an intangible asset over the projected life of the asset for tax or accounting purposes. Intangible assets, such as patents and trademarks, are amortized into an expense account called amortization.

How long will McHenry's machine last?

McHenry's management expects to use the machine for 26,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $45,000. The machine was used for 3700 hours in 2018 and 5200 hours in 2019.

How much iron ore is in Cameron Mine?

Cameron Corp. purchased a mine on January 1, 2018, for $530,000, which is estimated to contain 35,000 tons of iron ore. There is no residual value. The business extracted and sold 7500 tons of ore in 2018 and 10,800 tons of ore in 2019.

How to account for patents?

How to account for a patent. A patent is considered an intangible asset; this is because a patent does not have physical substance, and provides long-term value to the owning entity. As such, the accounting for a patent is the same as for any other intangible fixed asset, which is: Initial recordation. Record the cost to acquire the patent as the ...

What is the amortization method for patents?

Amortization. The owner of the patent gradually charges the cost of the patent to expense over the useful life of the patent, usually using the straight-line amortization method. Impairment. If a patent no longer provides value, or a reduced level of value, recognize an impairment to reduce or eliminate the carrying amount of the asset.

Do patents have to be recorded as assets?

In many larger companies with higher capitalization limits, this means that patents are rarely recorded as assets unless they have been purchased from other entities for significant amounts of money.

Is R&D a capital expense?

R&D expenditures. Note that the research and development (R&D) costs required to develop the idea being patented cannot be included in the capitalized cost of a patent. These R&D costs are instead charged to expense as incurred; the basis for this treatment is that R&D is inherently risky, without assurance of future benefits, ...

Can a patent be amortized?

A patent asset should not be amortized for longer than the lifespan of the protection afforded by the patent. If the expected useful life of the patent is even shorter, use the useful life for amortization purposes. Thus, the shorter of a patent's useful life and its legal life should be used for the amortization period.

How many hours does a Roark machine last?

The equipment has a residual value of $20,000, and has a life of 1,000,000 hours. Roark uses the activity-based method of depreciation. In year 1, Roark used the machine 30,000 hours, and in year 2, Roark used the machine 50,000 hours.

How long does a Lester car last?

After two years, Lester estimates that the remaining service life of the car is four years.