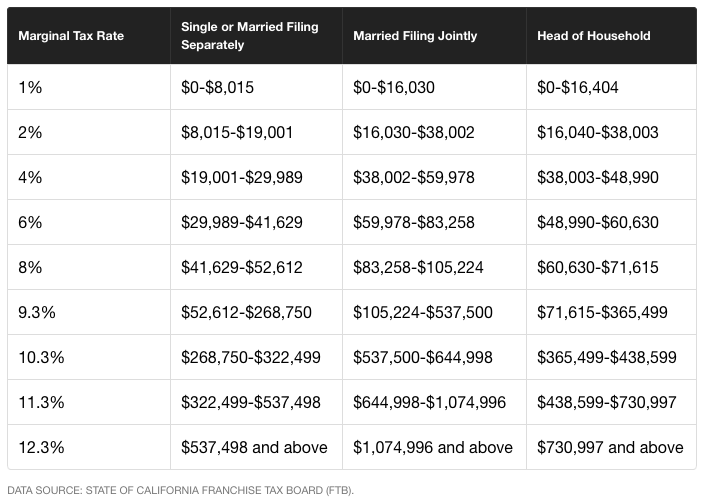

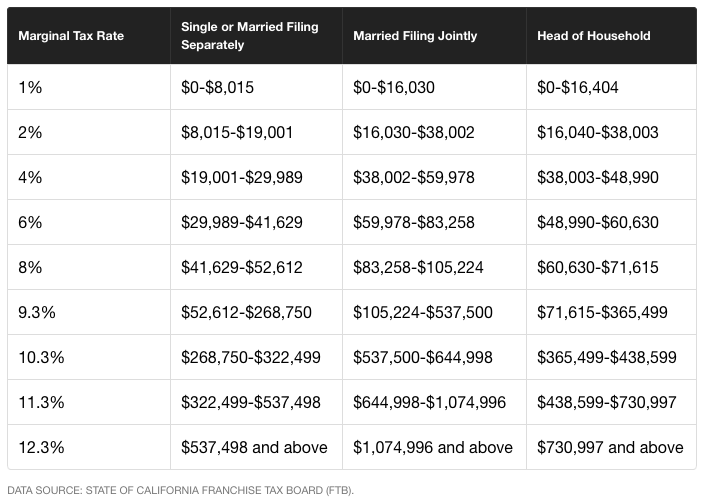

In other words, there's no preferential treatment for short-term capital gains. Whatever tax bracket you fall into based on your total income is what you'll end up paying on your capital gains, because those short-term gains will essentially just get added directly to your other income.

Full Answer

Will capital gains tax rates change in 2018?

· For starters, long-term capital gains are still defined as gains made on assets that you held for over a year, while short-term capital gains come from assets you held for a year or less. Long-term...

Who gets the tax benefits of capital gains tax?

· A 0% long-term capital gains tax rate applies to individuals in the two lowest (10% and 15%) marginal tax brackets. A 15% long-term capital gains tax rate applies to the next four brackets -- 25%,...

What is the new capital gains tax structure?

· In sum, capital gains enjoy very favorable treatment under the tax code, as they are taxed at preferential rates and provide asset owners with opportunities to …

What are rate thresholds for capital gains tax?

· The tax rate on a net capital gain usually depends on income. The maximum tax rate on a net capital gain is 20 percent, but for most taxpayers a zero percent or 15 percent rate will apply. In addition, capital gains may be subject to the net investment income tax of 3.8 percent when income is above certain amounts.

Do capital gains receive preferential tax treatment?

For tax purposes, short-term capital gains are treated as ordinary income on assets held for one year or less. Long-term capital gains are given preferential tax rates of 0%, 15%, or 20%, depending on your income level.

What is the capital gains tax for 2018?

2018LONG-TERM CAPITAL GAINSRateSingleMarried Filing Jointly0%$0-$38,600$0-$77,20015%$38,600-$425,800$77,200-$479,00020%$425,800+$479,000+

What amount of capital gain is subject to the preferential capital gains rate?

The Center for American Progress would tax capital gains as ordinary income with a 24.2 percent cap (28 percent including the surtax)....The Tax Break-Down: Preferential Rates on Capital Gains.Revenue from Reform Options on Capital GainsPolicySavings (2014-2023)Provide complete exemption for investment in small business stock-$5 billion9 more rows•Aug 27, 2013

What gets preferential tax treatment?

Tax preference items may include net income from oil and gas deposits, deductions from accelerated depreciation, the exercise of stock options, and investment tax credits, among others.

Did capital gains change in 2018?

So, for 2018 through 2025, the tax rates for higher-income people who recognize long-term capital gains and dividends will actually be 18.8% (15% + 3.8% for the NIIT) or 23.8% (20% + 3.8% for the NIIT)....Capital Gains Rates Before and After the New Tax Law.Tax RateLong-term capital gains and qualified dividends15%$2,601 – $12,70020%$12,701 and up1 more row

How is capital gains tax calculated?

Capital gains and losses are calculated by subtracting the amount you paid for an asset from the amount you sold it for. If the selling price was lower than what you had paid for the asset originally, then it is a capital loss. You can then use this amount to calculate your capital gains tax.

What is capital gains tax preference?

Lower rates are not the only way the tax code gives preferential treatment to capital gains, however. Unlike wages or salaries, which are taxed when earned, capital gains are not taxed as the asset grows in value—they are taxed only when the asset is sold. This gives owners of capital assets the ability to defer tax.

What is preferential rate?

Definition & Meaning: This reduced/lower rate of interest is called a 'preferential rate'. Normally at most, a 'preferential interest rate' on a loan is a couple of percentage points lower than a bank's 'standard interest rate'.

What is the capital gains exemption for 2021?

You may qualify for the 0% long-term capital gains rate for 2021 with taxable income of $40,400 or less for single filers and $80,800 or less for married couples filing jointly.

What are preference items?

: an item (as an amount of depreciation) favorable to a taxpayer in the ordinary computation of tax liability that is taxed in the computation of alternative minimum tax.

How do I offset capital gains tax?

You can offset capital gains with capital losses experienced during the tax year or by carrying it over from a previous year with a strategy known as tax loss harvesting. Using tax loss harvesting, investors can lower tax consequences by selling securities at a loss.

What are AMT adjustments and preferences?

How is AMT calculated? The AMT starts with regular taxable income and applies its own system of “adjustments” and “preferences.” These are calculations that add more income to or remove deductions from regular taxable income to arrive at alternative minimum taxable income (AMTI).

What Is A Long-Term Capital Gain?

A capital gain occurs when you sell property, such as a stock, at a price that's greater than what you paid for it. For example, if you bought a st...

How Are Long-Term Capital Gains Taxed?

The reason for the distinction is that long-term capital gains are taxed at more favorable rates than short-term gains. Short-term capital gains ar...

The 2018 Long-Term Capital Gains "Tax Brackets"

Based on the 2018 IRS tax brackets, here's a breakdown of which taxable income ranges correspond to each long-term capital gains tax rate:Data Sour...

These Income Brackets Could Change

The 2018 long-term capital gains tax structure could change significantly if the GOP passes a tax reform bill. While neither bill that has been rev...

Will capital gains taxes be the same in 2018?

In other words, your long-term capital gains taxes in 2018 will be virtually the same as they would have been if no tax reform bill was passed.

Will the short term capital gains tax rate change in 2018?

While nothing significant changed in the capital gains tax structure, or in the long-term capital gains tax rates, your 2018 short-term capital gains tax could change because of the new tax brackets. Generally lower marginal tax rates and different income thresholds for most tax brackets combine to produce a potential short-term capital gains tax ...

Is the 3.8% tax on capital gains the same as the income threshold?

Also, for both types of capital gains, it's worth noting that the 3.8% net investment income tax that applies to certain high earners will stay in place, with the exact same income thresholds. This is part of the Affordable Care Act, which, as of this writing, Congress has not successfully repealed or replaced, so this tax remains.

What is the tax rate for long term capital gains?

For starters, long-term capital gains are still defined as gains made on assets that you held for over a year, while short-term capital gains come from assets you held for a year or less. Long-term gains are taxed at rates of 0%, 15%, or 20%, ...

Will the capital gains tax change in 2018?

The 2018 long-term capital gains tax structure could change significantly if the GOP passes a tax reform bill. While neither bill that has been revealed thus far changes the capital gains tax rates, both would change the income ranges to which each rate would apply.

What is capital gain?

A capital gain occurs when you sell property, such as a stock, at a price that's greater than what you paid for it. For example, if you bought a stock for $40 per share and sold for $50, you'd have a $10 capital gain for each share you sell. The IRS sorts capital gains into two categories: long-term and short-term.

Is a sale of an asset a capital gain?

If you sell an investment or other asset at a profit, the sale results in a capital gain. Long-term capital gains are taxed more favorably than short-term gains, and because the tax brackets have changed slightly for 2018, the long-term capital gains tax structure has changed slightly as well.

Is long term capital gains taxed?

Long-term capital gains are taxed more favorably than short-term gains , and because the tax brackets have changed slightly for 2018, the long-term capital gains tax structure has changed slightly as well.

Is capital gains taxed as ordinary income?

Short-term capital gains are taxed as ordinary income, which means your marginal tax rate will apply to your short-term gains as well. Meanwhile, long-term capital gains are taxed at one of three potential rates -- and all are much lower than the corresponding marginal tax rates.

What is the tax rate for long term capital gains?

A 0% long-term capital gains tax rate applies to individuals in the two lowest (10% and 15%) marginal tax brackets.

How long is a short term capital gain?

A long-term capital gain is made on an asset you owned for at least 366 consecutive days.

Capital gains and dividends accrue overwhelmingly to the wealthy and are taxed at preferential rates

A capital gain is the profit from selling an asset such as a stock or other financial instrument, an interest in a business, or real estate. The gains from the sale of such assets held more than one year are considered long-term gains and taxed at special low rates.

Cutting capital gains taxes would result in a massive, unnecessary tax cut for wealthy Americans

Despite the fact that inequality has only increased since the pandemic began, 9 some in the administration have said that next year they would seek to cut the top capital gains rate further. President Donald Trump has said that he wants to cut the top rate from 20 percent to 15 percent.

There is no evidence that cutting capital gains rates would help the economy

As policymakers look to pull the United States out of the current economic crisis, they should look to policies other than cutting capital gains rates, which would be one of the least effective forms of economic stimulus.

Both capital gains rates and the tax base have a substantial impact on revenues

With $1.2 trillion of capital gains and dividends reported in 2018, cutting capital gains tax rates would lose a substantial amount of revenue, while increasing rates would raise a substantial amount of revenue.

Conclusion: Income from wealth should be taxed like income from work

Cutting capital gains taxes would be extremely misguided. Instead, Congress should work to rebalance the tax code by increasing rates on capital gains and dividends and equalizing the treatment of capital income and income from wages and salaries. There are currently several proposals that work to achieve this goal.

Endnotes

The 3.8 percent net investment income tax applies to individuals with more than $200,000 of adjusted gross income ($250,000 for couples). The Medicare tax on wages is 2.9 percent—with half paid by employees and half by employers—and ACA implemented an additional 0.9 percent tax on earnings exceeding $200,000 ($250,000 for couples).

What is the maximum tax rate on capital gains?

The tax rate on a net capital gain usually depends on income. The maximum tax rate on a net capital gain is 20 percent, but for most taxpayers a zero percent or 15 percent rate will apply. In addition, capital gains may be subject to the net investment income tax of 3.8 percent when income is above certain amounts.

How to determine a capital gain or loss?

To determine a capital gain or loss on an asset, sellers must compute the difference between the basis, usually what they paid for the property, and what they received for it. Capital gains and losses are either long- or short-term, depending on how long the taxpayer holds the property.

Is capital gains short term or long term?

Capital gains and losses are either long- or short-term, depending on how long the taxpayer holds the property. The gain or loss is short-term for taxpayers who hold it for one year or less.

How much can you deduct from your taxes if you have capital losses?

Capital Losses. Taxpayers whose capital losses are more than their capital gains can deduct the difference as losses on their tax returns, up to $3,000 per year, or $1,500 if married and filing a separate return.

Can you carry over a capital loss on your taxes?

When their total net capital loss is more than the limit they can deduct, taxpayers can carry it over to next year's tax return. Capital loss deductions are applicable to the sale of investment property, but not on the sale of property held for personal use.

I. The Build Back Better Act and the Tax Reform Act of 1986

In late fall 2021, the Build Back Better Act 2 was considered under congressional budget reconciliation rules which would allow the bill to pass in the Senate with a simple majority, though that majority is in serious question given W.Va.

II. The Origin of the Capital Gains Preference

Capital gains are gains from the sale or exchange of capital assets such as stocks and bonds, real estate, and artworks. Under the current tax law, long-term capital gains, which are gains from capital assets held for more than one year, are taxed at 20 percent.

III. Policy Debate Then and Now

Preferential rates for capital gains are thus the U.S. historical norm, as well as in many developed countries around the world. 28 This norm has been challenged, especially in times of significant social, political, and economic turmoil.

Conclusion

Capital gains rates have fluctuated up and down with shifting political winds and very briefly merged with ordinary rates under the 1986 Act.

Despite the goal of simplifying taxes, this key provision builds even more complexity into the system for investors

Tax reform bills have passed both the House and the Senate, and a joint conference is working to try to reconcile the two measures and come up with a compromise solution that both chambers of Congress can pass.

How tax reform would treat dividend and capital gains income

Under current law, investors pay preferential rates on qualified dividends and long-term capital gains. If you're in the existing 10% or 15% brackets, then you'll pay a 0% rate.

Expect even longer worksheets

For those looking for simpler tax preparation, the way that tax reform deals with dividend and long-term capital gains income doesn't really do a good job of achieving that goal.

Better than the alternative

As much as investors won't like more complicated tax returns, preserving the preferential rates for dividend and long-term capital gains income is better than what lawmakers could have done.

Premium Investing Services

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Is there a tax treatment for short term capital gains?

In other words, there's no preferential treatment for short-term capital gains. Whatever tax bracket you fall into based on your total ...

What is capital gains tax?

Capital gains taxes are the tax liability that the federal government charges on capital gains. Some state income tax agencies also levy capital gains taxes at the local level, adding to your total tax burden. Capital gains taxes have some features that are different from the way that many other taxes work.

How to calculate capital gains tax?

In order to calculate capital gains taxes, you have to go through several steps: 1 Identify positions in which you have a capital gain or capital loss. 2 Sort out the gains and losses by whether they're short- or long term. 3 In each category, use losses to offset gains and come up with a net gain or loss. Then if you have a gain in one category and a loss in the other, come up with an overall net figure across both short- and long-term gains and losses. 4 Apply the appropriate tax rate to the result.

Do you have to pay capital gains tax on investments?

The most valuable for investors is that you don't have to pay capital gains taxes until you actually sell your investment. Put another way, no matter how much an investment that you own has risen in value, you won't have to pay any taxes on those gains for as long as you hold onto the investment.

Is real estate subject to capital gains tax?

Just about anything that you can invest in with an aim toward selling it to another investor at a higher price at some point in the future is later subject to capital gains tax. The other category is real estate. Some people make investments in real estate, in which case it falls into both categories.

Can you claim capital gains on real estate?

For example, if you're a real estate developer, you generally can't claim capital gains tax treatment on your profits when you sell a piece of property.

What is the first factor in determining the appropriate tax rate for capital gains?

The first and most important factor in determining the appropriate tax rate is how long you held the investment in question.