When debentures are issued at premium, the amount of premium is credited to Debenture Premium Account. Debenture Premium Account is a capital profit and is transferred to Capital Reserve Account. When debentures are issued at discount, the amount of discount is debited to ‘Discount on Issue of Debentures Account.

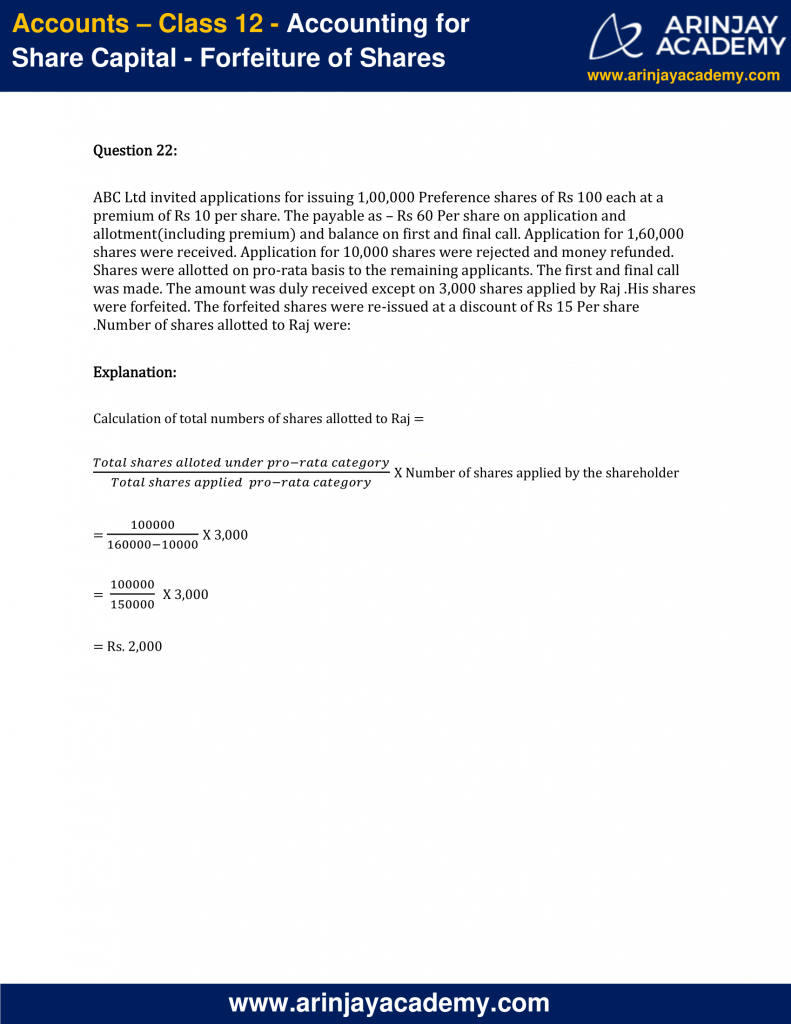

What is the premium on debentures issued by a company?

(c) Debentures are issued at 25% Premium. A Company can issue debentures to serve as collateral security for a loan or for Bank Overdraft. A collateral security can be realised by its possessor if the original loan is not paid on the due date.

What are debentures in accounting?

Debentures in Accounting A debenture is a document that acknowledges the debt. Debentures in accounting represent the medium to long term instrument of debt that the large companies use to borrow money. The term debenture is used interchangeably with terms bond, note, or loan stock.

What is the issue procedure for debentures?

The issue procedure with regard to debentures is the same as that of shares. The amount due on debentures may be paid in installments, such as, Application, Allotment and Calls.

How will you treat premium received on issue of debentures?

The premium is a capital gain for company so it is to be credited to 'Securities Premium Reserve A/c'. The amount of premium on debentures should not be transferred to profit and loss account because it is not a profit arising from the normal operations of the company.

What are the journal entries when debentures issue on premium?

There are different journal entries in connection with the issue of debentures: On the receipt of Application Money. On allotment, the application money on debentures allotted is transferred to debentures account. Amount Due on Allotment (Along with Premium)

What are the accounting treatment of debentures?

Accounting For Debentures Class 12 Notes AccountancyDebenture is an instrument of loan.Debenture has common seal of the company.Debenture is redeemable at a fixed and specified time.Debenture-holders are the creditors of company not owners.Debenture is a form of long-term borrowed capital.More items...

How do you record debentures in accounting?

In the same way, when the company issues a debenture at a discount, the amount is debited to the discount on the issue of debentures account. The amount is shown on the asset side of the balance sheet, under the head miscellaneous expenses, until written off.

How are debentures treated in financial statements?

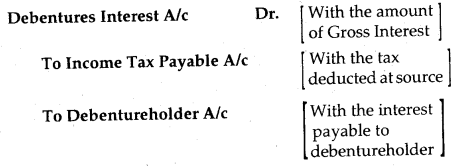

Treatment of Interest on Debentures The rate of interest is a prefix value to the debenture, say 9% Debentures and, therefore, is payable even if the company incurs a loss. It is a charge against profit. Interest payment may be subject to tax deducted at source (TDS).

What is the treatment of loss on debenture issue in books?

The amount of loss or discount on issue of debentures has to be not be written-off during the year of its issue since the benefit of the debentures would accumulate to the enterprise till their restitution or redemption. The loss or discount, hence, considered as a capital loss.

Can debentures be issued at premium?

Debentures can be issued at par, at a premium or at a discount. They can also be issued for consideration other than cash or as a collateral security. (c) If debenture money is received in more than two instalments Additional entries: (i) On making the first call Debenture First Call A/c Dr.

Where is premium on redemption of debentures shown in balance sheet?

Premium on redemption of debentures is shown under liabilities side of the Balance Sheet, so, it is a personal account. This premium is payable by the company on redemption of the debentures to the debenture-holders.

What are the accounting treatment of expenses and losses on issue of debentures?

These expenses are usually written off through the Profit & Loss Account in installments. Alternatively, 'Securities Premium Reserve Account' or Capital Reserve may be used to write off 'Expenses on Issue of Debenture'. Journal Entry to write off 'Expenses on issue of Debentures': Profit & Loss A/c (OR) Dr.

How are debentures shown in balance sheet?

Debentures are shown in the balance sheet of the company under the item Secured loans. Debentures are usually secured against the assets of the company. In case of debentures they are not secured by providing a collateral or security. These debentures have a charge on the assets.

Why is premium debenture important?

It is an important element or source of fund generation for the corporation and the Government. Debentures issued at Premium is yet another instrument which a company uses to make its debenture more reputable in the market.

When are debentures issued?

Debentures are said to be issued at a premium when the amount collected for it, is greater than the nominal value (face value) of the debentures. In other terms, it is when the issue price is greater than the face value of the debentures.

What is a debenture write off?

3. For writing off the expenses or the commission paid or discount allowed on any issue of shares or debentures of the company. 4. For providing for the premium payable on the redemption of redeemable preference shares or debentures. 5.

What is the purpose of the redemption of debentures?

Firstly, for issuing fully paid bonus shares to the members. 2. For writing off preliminary expenses of the company. 3.

What is the excess of issue price over the face value?

Hence, the excess of issue price over the face value is nothing but the amount of premium or Securities Premium.

What is a debenture issued for?

A Company can issue debentures to serve as collateral security for a loan or for Bank Overdraft. A collateral security can be realised by its possessor if the original loan is not paid on the due date.

What is the issue procedure for debentures?

The issue procedure with regard to debentures is the same as that of shares. The amount due on debentures may be paid in installments, such as, Application, Allotment and Calls. When debentures are issued at premium, the amount of premium is credited to Debenture Premium Account. Debenture Premium Account is a capital profit and is transferred to Capital Reserve Account.

What is a loss on issue of debentures?

The loss on issue of Debentures – Discount on Issue of Debentures or Premium Payable on Redemption – appears in the Balance Sheet. This is because they are losses – treated as Capital Losses. It is a fictitious asset which must be written off as early as possible.

Where is the discount on a debenture?

The amount of discount should be shown on the asset side of the Balance Sheet, under the head ‘Miscellaneous Expenditure, until written off.

Can you write off a profit and loss account?

It may not be possible to write off the entire loss against the Profit and Loss Account in the year in which the discount is allowed. As such the amount of discount is written off gradually over a number of years against Profit and Loss Account i.e. distributable profits.

What does it mean to issue a debenture at a premium?

Debenture issue at a premium. Debentures are issued at a premium means that the value of the debenture issued is more than its face value. Generally, the premium is collected at the time of allotment, other entries remain the same. Therefore, the entry relating to the allotment will change. The new entry will be.

What is a debenture in accounting?

A debenture is a document that acknowledges the debt. Debentures in accounting represent the medium to long term instrument of debt that the large companies use to borrow money. The term debenture is used interchangeably with terms bond, note, or loan stock.

What is issue of debentures?

The company can issue debentures at par, premium, or discount at the time of their issue. The amount that is due on the debenture can be paid in installments, for instance, Application, Allotments, and Calls.

What happens when a company issues a debenture?

When the company issues the debenture at a premium, the amount of premium is credited to Debenture Premium Account which is a capital profit. Further, the company transfers the amount of Debenture premium Account to the capital reserve account.

Why do companies issue debentures?

A company sometimes issue debentures to serve as the collateral security for a loan or for bank overdrafts. The collateral security comes into force only when the principal security fails to pay the given loan. When the loan is paid, such debentures revert back to the company.

When is a debenture issued at a discount?

Debenture issue at a discount. The debenture is issued at a discount when the amount of debenture received is less than its face value. The discount on debenture is allowed at the time of allotment. Other entries remaining same the new allotment entry is.

Can a company issue debentures at par?

The company can issue the debentures at par, premium, and discount. Further, the company can also redeem or repay the debentures at par, premium or discount. The company specifies the terms of redemption when the debentures are first issued.

What is issue at premium?

If debentures are issued at a price more than its nominal value (face value) such an issue is called issue at a premium. For example, if a debenture of Rs. 1000 is offered at 1,050, it is a case of issue of debentures at premium. The excess of issue price over face value is premium.

Is premium a profit or loss?

The premium is a capital gain for company so it is to be credited to ‘Securities Premium Reserve A/c’. The amount of premium on debentures should not be transferred to profit and loss account because it is not a profit arising from the normal operations of the company.

What is the premium on redemption of debentures account is?

When the Debentures are redeemed (payback) at the price above the face value. This excess amount is called a premium on redemption.

What will be the treatment of premium on redemption of debentures account?

Premium on redemption of debentures account is the liability. Thus credited at the time of issue of debentures.

Journal entries of premium on redemption of debentures

Following are the journal entries and accounting treatment of premium on redemption of debentures at the time of issue and repayment.

When is a debenture issued at a discount?

When the issue price of the debenture is less than its face value the debenture is said to be issued at a discount. Amount of discount on issue of debentures is generally adjusted at the time of allotment.

What is the procedure for issue of debentures?

Procedure for issue of debentures is the same as that for issue of shares. The intending investors apply for debentures on the basis of prospectus issued by the company. The company may ask for the payment of entire amount of debenture on application or on both application and allotment.

Why are bonds issued at premium?

The bonds were issued at a premium because the stated interest rate was higher than the prevailing market rate.

How is $7,722 amortized?

The premium of $7,722 is amortized by using either the stralght=line method or the effective-interest method. Again the straight-line method will be discussed first, then the effective interest method will be discussed for both the discount and premium examples.

What is the difference between cash and bonds payable?

Cash is debited for the entire proceeds, and Bonds Payable is credited for the bonds’ face amount. The difference, in this case, is a credit to the Premium Bonds account of $7,722. The Premium on Bonds Payable is called an adjunct account because it is added to the Bonds Payable account in determining the bonds’ carrying value.

What is the effect of the journal entry at July 1, 2020?

The journal entry at July 1, 2020, and each interest payment date thereafter is: The effect of this and subsequent entries is to decrease the carrying value of the bonds as the premium account is reduced each period.

What is exhibit B?

Exhibit ‘B’ presents an amortization schedule for this bond issue, on a straight-line basis. The journal entry at July 1, 2020, and each interest payment date thereafter is: Exhibit ‘B’. The effect of this and subsequent entries is to decrease the carrying value of the bonds as the premium account is reduced each period.

Does the borrower receive all of the funds at the time of the issue?

Although the borrower receives all of the funds at the time of the issue, the matching convention requires that it be recognized over the life of the bond. Again, another way to view this is to consider what the company will ultimately repay the bondholders versus what it received at the time of issuance.