Which type of property does not qualify for 1031 exchange?

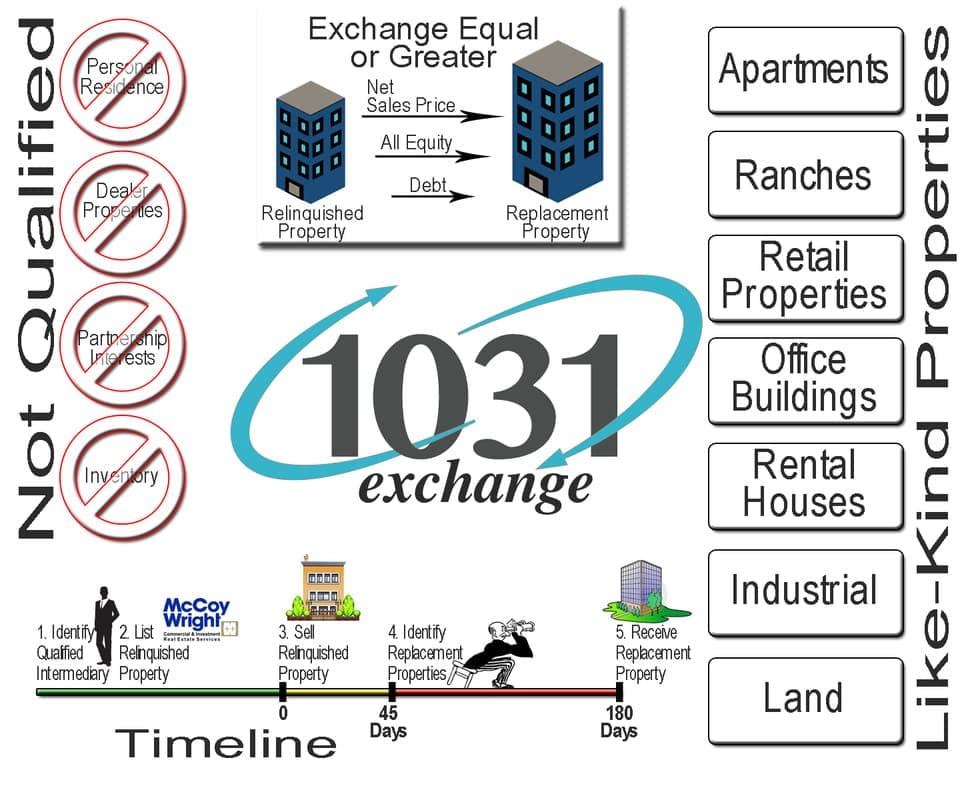

Under IRC §1031, the following properties do not qualify for tax-deferred exchange treatment: Stock in trade or other property held primarily for sale (i.e. property held by a developer, “flipper” or other dealer) Securities or other evidences of indebtedness or interest. Stocks, bonds, or notes.

Which properties do not qualify for a like-kind exchange?

Understanding Like-Kind Properties Securities, stocks, bonds, partnership interests, and other financial assets are excluded from the definition of like-kind property.

What does section 1031 apply to?

A 1031 exchange gets its name from Section 1031 of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value.

What qualifies as replacement property?

What Is a Replacement Property? Replacement property is any property that is received in place of property that has been destroyed, lost, or stolen. Replacement property can be personal or business property and can include various types of assets, such as real estate, equipment, and vehicles.

Can you 1031 a rental property?

The IRS has determined that many forms of real estate can be used for a 1031 exchange including any property used for a business which includes a store, manufacturing facility or office building. Investment property can also be used for a 1031 exchange, which includes rental properties.Sep 8, 2018

Does 1031 apply to primary residence?

Normally the IRS does not allow you to conduct a 1031 exchange with your primary residence. That's because the home that you live in isn't being used as an investment property or being held for business purposes. Instead, your primary residence is used to provide shelter for your family.Oct 1, 2021

What is the three property rule in a 1031 exchange?

The Three Property Rule is defined under IRC Section 1031, which states that an exchanger or taxpayer executing a delayed exchange has 45 calendar days from the closing date of the sale of their relinquished property to formally identify a replacement property or properties.Dec 9, 2020

Can you 1031 a second home?

The sale of a vacation property or a second home will qualify for tax-deferred exchange treatment if the following safe harbor requirements have been met: The subject property has been owned and held by the investor for at least 24 months immediately preceding the 1031 Exchange ("qualifying use period"); and.

What is like-kind property for a 1031 exchange?

What is a like-kind investment property? Like-kind refers to the nature of the investment. Any type of investment property can be exchanged for another type, or like-kind investment property. For example, a single-family rental can be exchanged for a duplex, raw land for a shopping center, an office for apartments.

Can you buy multiple properties in a 1031 exchange?

You are allowed to identify up to three properties. You can acquire one, two, or all three properties. What if you have more than three properties that you'd like to use in the exchange? This is possible through a couple of 1031 exchange rules called the 200% and 95% rules.Mar 11, 2020

What must happen to the replacement property within the 180 day period in a 1031 tax-deferred exchange?

The acquisition of your replacement property must be completed by the earlier of: 180 days of the transfer of your first relinquished property; or. The due date of filling your federal income tax return for the year in which you transferred the first relinquished property, including extensions.

Which of the following types of property are ineligible for like-kind treatment?

Inventory held for resale and most financial instruments, such as stocks and bonds, are ineligible for like-kind treatment. Reason: These assets are not eligible for like-kind treatment even if they are similar assets.

What is a like kind property?

The term “like-kind” refers to the nature or character of the property not its grade or quality.

What is like kind in real estate?

The term “like-kind” refers to the nature or character of the property, ignoring differences of grade or quality. For example, unimproved real property is considered like-kind to improved real property, because the lack of improvements is a distinction of grade or quality; the basic real estate nature of both parcels is the same. Treas.

What is stock in trade?

Stock in trade or other property held primarily for sale (i.e. property held by a developer, “flipper” or other dealer) Securities or other evidences of indebtedness or interest. Stocks, bonds, or notes. Certificates of trust or beneficial interests. Interests in a partnership.

What is a 1031 exchange?

Section 1031 Exchange of Real Property Rules Explained. In the Tax Cuts and Jobs Act (TCJA), Section 1031 was amended to apply only to exchanges of real property , leaving taxpayers questioning what qualifies as “real property” under these new rules. The Internal Revenue Service (IRS) and Treasury Department addressed these questions as well as ...

What is incidental personal property?

Under the final rules, incidental personal property is both: Typically transferred with real property in a standard transaction. The aggregate fair market value does not exceed 15% of the aggregate fair market value of the replacement property.

Is a 1031 exchange taxable?

In order to receive full benefit of a 1031 exchange, the property owner’s replacement property should be of equal or greater value. If the value of the replacement property is less than the value of the property sold, the difference is considered “cash boot” and is taxable. Gains treatment in the transaction. ...

What is the 95% rule?

95% rule: Allows property owner to identify as many properties as they would like as long as they acquire properties valued at 95% of their total or more. The due date, including extensions, for the tax return for the tax year in which the transfer of the property given up occurs.

Is boot taxable?

Boot being received in the transaction (i.e., unlike property or cash), which becomes taxable. If liabilities are included in the transaction, the party relieved of the liability is treated as receiving cash in the amount of the liability.

Is Doeren Mayhew legal?

This publication is distributed for informational purposes only, with the understanding that Doeren Mayhew is not rendering legal, accounting, or other professional opinions on specific facts for matters, and, accordingly, assumes no liability whatsoever in connection with its use. Should the reader have any questions regarding any of the news articles, it is recommended that a Doeren Mayhew representative be contacted.

Can you reverse exchange a 1031?

Reverse exchange: It may be possible to acquire the replacement property before selling the property to be exchanged and still qualify for 1031 treatment. The replacement property would need to be transferred to an exchange accommodation titleholder and a qualified exchange accommodation agreement must be signed.

What is a 1031 exchange?

Key Takeaways. A 1031 exchange is a swap of properties that are held for business or investment purposes. The properties being exchanged must be considered like-kind in the eyes of the IRS for capital gains taxes to be deferred.

How long do you have to close on a replacement property?

You must close on the new property within 180 days of the sale of the old. 5 . The two time periods run concurrently, which means you start counting when the sale of your property closes. If you designate a replacement property exactly 45 days later, for example, you'll have just 135 days left to close on it.

What is a Starker exchange?

Classically, an exchange involves a simple swap of one property for another between two people. But the odds of finding someone with the exact property you want who wants the exact property you have is slim. For that reason, the majority of exchanges are delayed, three-party, or Starker exchanges (named for the first tax case that allowed them).

Is real estate a 1031 exchange?

Now, only real property (or real estate) as defined in Section 1031 qualifies. 4

What happens if you don't get cash back?

If you don't receive cash back, but your liability goes down —that, too, will be treated as income to you, just like cash. Suppose you had a mortgage of $1 million on the old property, but your mortgage on the new property you receive in exchange is only $900,000.

Can you move in right away if you swap your home?

If you want to use the property you swapped for as your new second or even primary home, you can't move in right away. In 2008, the IRS set forth a safe harbor rule, under which it said it would not challenge whether a replacement dwelling qualified as an investment property for purposes of Section 1031. To meet that safe harbor, in each of the two 12-month periods immediately after the exchange. 9

Can you change your 1031 form?

In effect, you can change the form of your investment without (as the IRS sees it) cashing out or recognizing a capital gain. That allows your investment to continue to grow tax-deferred. There's no limit on how many times or how frequently you can do a 1031.

What are the requirements for a 1031 exchange?

Are stocks or bonds eligible for a 1031 exchange? 1 Stock in trade or other property held primarily for sale 2 Stock, bonds, or notes 3 Other securities or evidences of indebtedness or interest 4 Interests in a partnership 5 Certificates of trust or beneficial interests 6 Choses in action

What is a primary residence?

A primary residence, second home, or vacation property does not qualify as investment or business property. Likewise for properties "held for resale".

What is replacement property?

As its name suggests, a replacement property is "like-kind" to a relinquished property if they are similar assets. For example, farmland is like-kind to other farmland. However, like-kind properties need not be exactly the same. (After all, no two properties are exactly the same.

Is real estate like kind?

Most real estate will be like-kind to other real estate. For example, real property that is improved with a residential rental house is like-kind to vacant land" (FS 2008-18). You can understand “quality” generally as the value of a property, however that is measured.