It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year. The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (MAGI) amount reaches the annual limit for your filing status.

Full Answer

How does student loan interest affect my tax return?

Here’s how to calculate your student loan interest tax deduction: Get your 1098-E. If you paid $600 or more in interest on a qualified student or parent loan over the course of the year, your lender or servicer should send you an IRS Form 1098-E. They should also submit a copy of your 1098-E to the IRS. This form reports the amount of ...

Can I deduct my student loans on my taxes?

Dec 06, 2020 · How much student loan interest can you deduct on your taxes? The short answer is that you can deduct $2,500 in student loan interest in both the 2020 and 2021 tax years. But there's a little more...

How is interest on student loans calculated?

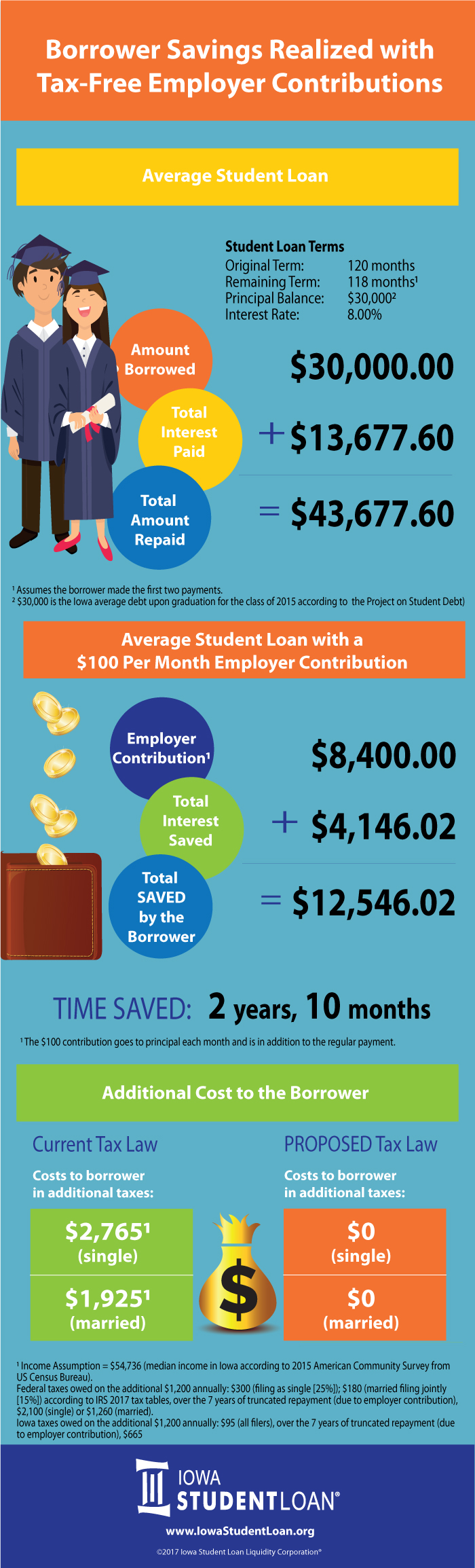

Oct 06, 2021 · Student loan assistance from employer is an employee benefit where the employer makes payments to pay for part or all of an employee’s student loans. Employers can either make payments (principal or interest) to the employee or the student loan lender directly. Prior to March 2020, student loan repayments of any amount were taxable.

What is the tax-free amount for student loans?

Dec 01, 2020 · Under the CARES Act's exclusion, any amount paid by an employer toward student loan interest is not eligible for a student loan interest deduction by the employee. Employers may be able to work around this restriction by targeting their payments to apply to just principal, thereby allowing the borrower's payment to cover the interest and qualify for the student loan …

How does interest paid on student loans affect tax return?

While the principal amount of your student loans is not tax deductible, the interest you pay on your student loans might be. Depending on your income and tax-filing status, you may be able to deduct up to $2,500 in student loan interest from your taxable income each year.Feb 21, 2022

Is it worth claiming student loan interest on taxes?

The student loan interest deduction is an above-the-line tax deduction, which means the deduction directly reduces your adjusted gross income. You input the amount of deductible interest, and it reduces your adjusted gross income. Being able to claim the deduction without itemizing could be a big benefit.

Why is my student loan interest not tax deductible?

You can't claim the student loan interest deduction if your modified adjusted gross income (MAGI) exceeds certain limits. For most people, your modified adjusted gross income (MAGI) is simply your adjusted gross income (AGI) before any adjustment for student loan interest payments.Oct 13, 2021

Will IRS take refund for student loans 2021?

The bottom line. The student loan tax offset has been suspended through Nov. 1, 2022. If you have federal student loans in default, your 2021 tax return won't be taken to offset your defaulted loan balance if you file your 2021 tax return by the filing deadline.Feb 24, 2022

What is room and board?

The cost of room and board qualifies to the extent that it is not greater than the amount determined allowable by the school attended. For example, if you took out a loan for living expenses and the school allows $2,000 per semester but your cost of living off campus is $3,000 then only $2,000 of the loan would qualify.

What is the MAGI limit?

The modified adjusted gross income (MAGI) limit is less than $75,000 or $155,000 for a married filing joint return. MAGI is your adjusted gross income on your tax return before subtracting any deduction for student loan interest. The deduction can be taken even if you do not itemize your deductions.

Can you deduct interest on a loan?

If you receive a loan from any of the following then you cannot deduct the interest: spouse, brothers, sisters, parents, grandparents, children, grandchildren or trusts. You may get a lower interest rate from family but that interest will not be tax deductible.

What is considered a student loan?

In a nutshell, for a loan to be considered a "student loan" in the eyes of the IRS, it must have been taken out for the sole purpose of paying qualified education expenses for you, your spouse, or a dependent at the time the loan was obtained. And the student must have been enrolled on at least a half-time basis in a degree, certificate, ...

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Follow him on Twitter to keep up with his latest work!

When is student loan debt exclusion?

36 This exclusion applies to loans discharged after 2017 and before 2026.

Why do employers offer student loan repayment assistance?

On their own, an increasing number of employers have created student loan repayment assistance programs to help recruit and retain quality employees. To make student loan repayment more manageable, the U.S. Department of Education offers several forms of income-driven repayment plans for federal student loans.

What is hardship distribution?

A hardship distribution is included in income and subject to the early - withdrawal penalty. 49 A distribution is made on account of hardship if the distribution is necessary to satisfy an immediate and heavy financial need. 50 Whether an employee has an immediate and heavy financial need is determined based upon all the relevant facts and circumstances. 51 A financial need could be considered immediate and heavy even if it was reasonably foreseeable or voluntarily incurred by the employee. 52

What is the Cares Act?

The CARES Act, enacted in March 2020, provided relief to students in several ways. First, federal student loans were automatically placed into administrative forbearance until Sept. 30, 2020, which meant payments were not required until that time. Interest did not accrue on the suspended payments nor was the interest capitalized into the loan balance. 9 In August 2020, President Donald Trump issued a memorandum extending similar relief until Dec. 31, 2020. 10 Because only government - held federal student loans are covered by these actions, millions of student loan borrowers with private loans and commercially issued federally guaranteed loans are not provided relief. Private lenders may offer their own help, however; borrowers should contact their lender for assistance. For example, private lenders have entered into an agreement with several states to provide student relief options similar to what the CARES Act did for those with federal student loans. 11

Is student loan debt forbearance?

116-136, and a presidential order, government-held federal student loans are in administrative forbearance through the end of 2020, meaning that no payments need to be made on the loans and interest does not accrue on the suspended payments during that time.

What happens if an employee fails to pay student loan?

If an employee fails to meet contractual obligations under an employer's student loan repayment assistance program, he or she may be required to repay a portion, or all, of the benefit received, depending upon the requirements of the program. Employees who recognized income as a result of the employer's paying their student loan debt and who in a later year are required to repay all or a portion of the student loan payment to the employer, may be able to take a deduction under the claim - of - right doctrine for the amount repaid in the year of repayment. 21

When does the Cares Act expire?

As of this writing, the CARES Act's exclusion from income for employer - made student loan repayments is set to expire after 2020. The exclusion is subject to a $5,250 limit and is not phased out. The student loan interest deduction is phased out based upon income.

How much interest can you deduct on student loans?

If you’re not familiar with all the details of the deduction, here’s how it works: Those with federal or most private student loans are usually able to subtract up to $2,500 a year in interest payments they’ve made on their loans from their gross income, reducing their tax liability.

When will student loan interest be waived?

The payment pause and interest waiver for most federal student loan borrowers didn’t begin until March 13, 2020. That means that you may have made payments to your loan’s interest for two or three months of the year that you can still deduct from your gross income.

How are student loan interest rates determined?

Private student loan interest rates are determined by the lender that made the loan and are based on your credit history and that of your cosigner, if you have one. The interest rate may be variable or fixed for the life of the loan, depending on the contract you signed when you took out the loan.

What is capitalization of interest?

Capitalized Interest. Interest capitalization is when Unpaid Interest is added to the Unpaid Principal. This occurs at certain times during the life of the loan, typically at the end of the grace period, a deferment, or a forbearance.

How to access 1098-E?

To access your Form 1098-E, log in to your account and select Tax Statements in the left menu. Or call 844-NAVI-TAX (844-628-4829) and get your eligible interest amount through our automated voice system. Remember: You don't need a physical copy of the form to file your taxes.

Do student loans accrue interest?

About Student Loan Interest. The longer you take to pay off your loan, the more interest will accrue, increasing the amount you will need to repay. Interest rates vary depending on the type of loan and lender, as well as the year the loan was disbursed if it is a FFELP or Direct Loan from the U.S. Department of Education.

Can you deduct student loan interest on your taxes?

Interest is calculated as a percentage of the amount you borrowed. You may be able to deduct interest paid on your eligible student loans on your federal tax return, which could reduce your taxable income.

What line is student loan interest on taxes?

Your student loan interest reported on line 31900, with other non-refundable credits reported on lines 30000 to 33500 of your income tax and benefits return gives you a total of 15% reduction on your taxes.

Can you claim student loan interest on tax return?

If you combined any qualifying loans with non-qualifying loans, you cannot claim the interest paid as student loan interest. For example, if you took out a home equity line of credit to pay for university, that doesn’t count as a qualifying loan, and you cannot claim the interest as student loan interest on your tax return.

What is the discount for student loans?

Many lenders offer a small rate discount, typically 0.25 percentage points, for setting up automatic payments. Student loan refinancing can be an option to help you replace high-interest student loans with a newer loan at a lower rate.

Is variable rate student loan lower than fixed rate?

Fixed rates, on the other hand, can be higher at first but are locked in through repayment and won’t change. 4 Many lenders also offer lower rates on shorter student loan terms.