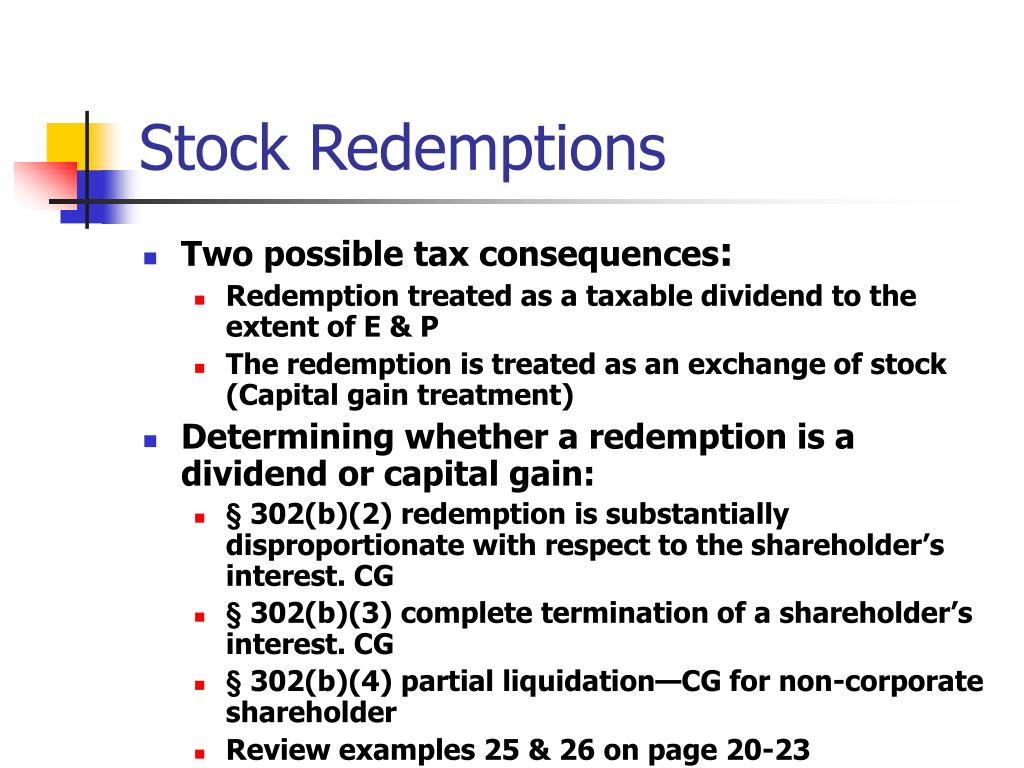

How are Stock Redemptions taxed? A redemption generally is a taxable event for the redeemed stockholder but may not be a taxable event for the redeeming corporation. For the redeemed stockholder, a redemption for cash or other property is taxed either as a dividend or as a sale or exchange of stock.

What is the tax treatment of a stock redemption?

For the redeemed stockholder, a redemption for cash or other property is taxed either as a dividend or as a sale or exchange of stock. A redemption generally is taxed as a dividend unless one of the exceptions applies.

How is a redemption transaction treated as a sale?

The redemption can be treated as an exchange or a sale, with the resulting gain or loss treated as a capital gain or loss. Alternatively, the redemption transaction can be treated as a distribution.

What is a distribution in redemption of stock under the law?

26 U.S. Code § 302. Distributions in redemption of stock. If a corporation redeems its stock (within the meaning of section 317(b)), and if paragraph (1), (2), (3), (4), or (5) of subsection (b) applies, such redemption shall be treated as a distribution in part or full payment in exchange for the stock.

Is stock redemption a capital gain or ordinary income?

Stock redemption: Capital gain or ordinary income? Sec. 302 affords a shareholder the advantage of sale or exchange (capital gain transaction) treatment on redeemed stock but only if the redemption meets one of several tests. This site uses cookies to store information on your computer.

How is the redemption of stock treated?

The general rule for a stock redemption payment received by a C corporation shareholder is the payment is treated as a taxable dividend to the extent of the corporation's earnings and profits (similar to the financial accounting concept of retained earnings).

Can stock redemption treated as nontaxable?

Under the normal S corporation distribution rules, the redemption distribution is treated as a nontaxable return of capital to the extent of the adjusted basis of stock, followed by capital gain from the deemed disposition of stock (Sec. 1368(b); Rev.

Are redemption checks taxable?

In holding that a redemption was essentially equivalent to a dividend (and thus taxable as ordinary income), the U.S. Supreme Court in Davis, 397 U.S. 301 (1970), focused on the fact that there was no meaningful reduction in the shareholder's interest.

How do you account for stock redemptions?

Accounting for Redemptions on the Corporation's Books Debit the treasury stock account for the amount the company paid for the redemption. Credit the company's cash account for any payments already made to the shareholder. Credit accounts receivable for any future payment obligations.

Which of the following requirements must be met for a redemption to be treated as substantially disproportionate?

For a redemption to qualify as substantially disproportionate: (1) your interest after the redemption (in both all voting stock and all common stock) must be less than 80% of your interest before the redemption and (2) you must possess less than 50% of the voting power of all voting stock after the redemption.

What conditions must be met for a redemption to be treated as a sale by the redeeming shareholder?

A redemption is treated as a sale if it is “substantially disproportionate,” which requires: the shareholder to own less than half the voting stock after the redemption; and. the shareholder's percentage of both voting and nonvoting stock to be reduced by more than 20%.

Is a stock redemption a distribution?

A redemption is treated as a sale or exchange in the following situations: The distribution is not essentially equivalent to a dividend. It is substantially disproportionate with respect to the shareholder. It is in complete redemption of all of the stock of the corporation owned by the shareholder.

Is the redemption of stock dividends a taxable event?

Redeem and be tax-free The CTA declared that redemption of shares cannot be treated as dividends unless the shares are previously issued as stock dividends and the time and manner of such redemption is essentially equivalent to dividend distribution.

What is a stock redemption agreement?

A stock redemption agreement is an agreement between a shareholder and a corporation for the corporation to repurchase that shareholder's stock, effectively buying out the shareholder.

Do redemptions reduce earnings and profits?

IRC Sec. 312(n) (7) says redemptions shall not reduce the corporate E&P by more than (1) the amount "properly chargeable to earnings and profits," and (2) the related stock's ratable share of the E&P.

What is the difference between buyback and redemption?

What are share buybacks and redemptions? A share buyback happens when a company pays shareholders current market share value to reabsorb a portion of its ownership. Share redemptions occur when a company requires shareholders to sell a portion of their shares back to the company.

What is redemption in accounting?

Redemption is the return of an investor's principal on a fixed income security such as a bond, mutual fund or preferred stock.

What is the letter ruling for stock redemption?

The letter ruling deviates from prior judicial and IRS guidance on how to determine whether a stock redemption is a capital gain transaction. Specifically, it fails to evaluate whether the redemption resulted in a "meaningful reduction" of the shareholder's interest.

Why is the redeemed shareholder denied the sole shareholder beneficial tax treatment?

Because the redeemed shareholder held 100% of the stock both before and after the redemption , the Court denied the sole shareholder beneficial tax treatment. The Court also made clear that the business purpose of pro rata distributions is irrelevant in this determination.

Is a redemption a capital loss?

If the redemption would result in a loss on the stock, it is a capital loss, so the IRS may consider recharacterizing the transaction as essentially equivalent to a dividend to reach its desired result: the less tax-favorable ordinary loss.

Is a redemption an isolated transaction?

First, the IRS makes two key points: The redemption was an isolated transaction, and no other shareholder is obligated to purchase any of the redeemed stock. These factors imply that the redemption was not made pursuant to an overall plan, and no other shareholders were redeemed simultaneously.

What are the tax consequences of selling stock?

1. Tax Consequences of the Selling Stockholder. A selling stockholder generally recognizes a capital gain or loss on the taxable sale of stocks. If the shares were held for more than one year, a non-corporate stockholder recognizes a long-term capital gain or capital loss. 2.

How are dividends taxed?

How are Stock Dividends taxed? Dividends generally are paid either in either cash or additional shares of stock. Additional shares of stock are also known payment-in-kind or PIK dividends. Most investors are aware of tax consequences when dividends are paid in cash.

What is preferred stock?

Preferred stock PIK dividends, whether paid in the form of common stock or preferred stock, are generally taxed under the same rules that apply to cash dividends.

Is PIK dividend taxable?

Common stock PIK dividends generally are not taxable to the recipient under IRC Section 305 unless one of the exceptions applies. Some exceptions, for example, may include i) any stockholder can elect to receive the distribution either in stock or property (including cash), and ii) the distribution is disproportionate.

Is a payment in kind dividend taxable?

Payment in Kind Dividends’ taxation is based on whether they are common stock or preferred stock PIK dividends. Stock Sales typically result in tax consequences for the selling stockholder, but not the buyer. Stock Redemptions is typically a taxable event for the redeemed stockholder but may not be a taxable event for the redeeming corporation.

Is a stock sale taxable?

A taxable sale of stock of a corporation generally is not a taxable event for the corporation or the buyer. Instead, the buyer receives a cost basis in the corporation’s stock and the buyer’s basis in the corporation’s stock is later used to calculate the buyer’s taxable income or gain (or the amount of any loss) when such stock is disposed.

Is a redemption for cash taxable?

For the redeeming corporation, a redemption for cash generally is not a taxable event for a corporation. However, the redeeming corporation recognizes income or gain (but not any losses) on a distribution of property (other than cash).

What is a qualified trade after a distribution?

Immediately after the distribution, the distributing corporation is actively engaged in the conduct of a qualified trade or business. (3) Qualified trade or business For purposes of paragraph (2), the term “ qualified trade or business ” means any trade or business which—.

What is subsection a?

Subsection (a) shall apply if the redemption is not essentially equivalent to a dividend. (2) Substantially disproportionate redemption of stock. (A) In general. Subsection (a) shall apply if the distribution is substantially disproportionate with respect to the shareholder. (B) Limitation.

When was 338 E 2C added?

For purposes of section 338 (e) (2) (C) of the Internal Revenue Code of 1986 (as added by section 224), any property acquired in a distribution to which the amendments made by this section do not apply by reason of paragraph (2) shall be treated as acquired before September 1, 1982 .”. Effective Date of 1980 Amendment.

When is a stock redemption considered an exchange?

A redemption of stock that was included in the gross estate of the decedent qualifies as an exchange if it is used to pay estate taxes and expenses. The redemption must have been made by the earlier of 90 days after the period of limitations on the assessment of the federal estate tax – 3 years ...

How to determine if a stock redemption is a sale?

The 1 st test treats the stock redemption as a sale if it terminates the shareholder's entire interest in the corporation.

Why do you have to redeem your preferred stock?

Common reasons for redemptions include: an obligation under a buy-sell agreement to purchase stock of any shareholder who offers it for sale; to go private by redeeming all shares traded publicly, thereby restricting ownership to private investors; to retire preferred stock so as to eliminate the dividend payments.

What is the attribution from an entity rule?

The attribution-from-an-entity rule: any shares of stock owned by a partnership, limited liability company ( LLC ), or an S corporation are considered owned proportionately by the owners of the entity. This attribution-from-an-entity rule also applies to a shareholder who owns more than 50% of a C corporation.

How much is E&P reduced to?

So if a corporation with E&P equal to $1,000,000 redeems 25% of its outstanding stock by paying $400,000 and the redemption is treated as a stock sale, then its E&P is reduced to $250,000 ($1,000,000 × 25%). If the stock redemption is treated as a dividend payment, then the entire $400,000 can be used to reduce E&P.

What is the purpose of retiring preferred stock?

to retire preferred stock so as to eliminate the dividend payments.

What is E&P reduction?

The reduction in the corporation's earnings and profit (E&P) depends on the tax consequences to the shareholder. If it is deemed a sale, then E&P is reduced by the ratable portion of the E&P that is attributable to the redeemed shares. However, if redemption payment is treated as a dividend, then the entire amount is subtracted from E&P.

What is stock redemption?

If none of the other existing owners is interested in purchasing the shares, the shares can be sold back to the corporation. This is known as a “stock redemption for tax purposes.”. The redemption can be treated as an exchange or a sale, with the resulting gain or loss treated as a capital gain or loss. Alternatively, the redemption transaction can ...

What happens if a redemption is not equivalent to a dividend?

If the redemption is not equivalent to a dividend (a subjective test that occurs where there is no meaningful reduction in shareholder’s interest). If there is a partial liquidation. If the proceeds of the redemption are used to pay death taxes. The shareholder would compute the gain or loss as to the difference between ...

Can a shareholder eliminate ownership in an S corporation?

There are many situations where a shareholder may want to eliminate or reduce ownership in an S-corporation. One may be the need for additional cash as a result of the economic downturn stemming from the COVID-19 shutdown. If none of the other existing owners is interested in purchasing the shares, the shares can be sold back to the corporation.

Is a redemption a disproportional distribution?

A distribution that originates from a redemption does not cause a disproportional distribution, so a there is no risk of violating S-corporation eligibility rules. Again, each redemption depends on the facts and circumstances of the redeeming corporation and the shareholder.

What is the tax rate for long term capital gains?

The tax rate for long-term capital gains and qualified dividends continues to be 15% for individuals with a marginal tax rate on ordinary income of 25% or greater whose taxable income falls below the levels for the new 39.6% regular tax rate, and 0% for individuals with a marginal tax rate on ordinary income of 10% or 15%.

When is stock basis determined?

While the general rule is that stock basis is determined as of the end of the S corporation’s tax year, the basis of stock disposed of during the year is determined immediately before the disposition occurs (Regs. Sec. 1.1367-1 (d) (1)).

What is a suspended passthrough loss?

In a complete redemption, suspended passthrough losses (losses not previously deducted because of basis limitations) remaining after the basis of the redeemed stock has been reduced to zero do not reduce gain, or increase loss, resulting from the redemption.

Why do shareholders have to consent to the election?

Because all affected shareholders must consent to the election in the case of a complete termination of a shareholder’s interest, and because all shareholders must consent to the election in the case of a qualifying disposition , the shareholders should consider addressing this issue in the shareholder or redemption agreement.

When does the deemed sale rule not apply?

This means that the deemed sale rule does not apply when (1) there is no trade or business, (2) the trade or business is a passive activity for the transferor (the redeemed shareholder), or (3) the S corporation is in the trade or business of trading in financial instruments or commodities.

Is a loss under Sec 465 at risk carryover?

Losses limited by the Sec. 465 at-risk rules are eligible for indefinite carryover (the same as losses suspended under the basis limitation rules). However, unlike the basis limitation rules, at-risk basis is increased for gain recognized on disposition of stock.

Can you deduct suspended passive losses?

When a taxpayer disposes of an entire interest in a passive activity to an unrelated party in a fully taxable transaction, suspended passive losses (and any loss from disposition of the activity) can be deducted first against current net passive income and then against nonpassive income .

What is a redemption of stock?

A redemption of stock owned by a shareholder of a corporation may be characterized as a “sale or exchange” under IRC Section 302 or as a “dividend” payment under IRC Section 301. The manner in which the redemption is characterized will determine the tax treatment afforded the redemption and, more specifically, may impact whether the shareholder must report the income realized on the transaction as capital gain or ordinary income as well as the amount of income that must be reported.

Is the information provided herein applicable in all situations?

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Is a redemption a dividend?

the redemption is “not essentially equivalent to a dividend”; the redemption is “substantially disproportionate”; the redemption is for all the shareholder’s stock; the redemption is a “partial liquidation” of the distributing corporation; or. the redemption is for stock of a public regulated investment company.

Overview

- 2019-03-04A stock redemption is an acquisition by a corporation of its own shares in exchange for cash or property, for the purpose of either retiring the shares or holding them as treasury stock. Common reasons for redemptions include:

Issue

- To determine whether a redemption is a stock sale, IRC §302 provides for 2 objective tests. The 1st test treats the stock redemption as a sale if it terminates the shareholder's entire interest in the corporation.

Example

- Thus, noting that the total outstanding stock declines by the number of redeemed stock, the following equation must be true in regards to voting power and to stock value to satisfy Test #2: So if a corporation with E&P equal to $1,000,000 redeems 25% of its outstanding stock by paying $400,000 and the redemption is treated as a stock sale, then its E&P is reduced to $250,000 ($1,…

Controversy

- Some shareholders have argued in court that redemption should be treated as a sale because it is not equivalent to a dividend; however, acceptance of this argument by the Internal Revenue Service (IRS) and the courts has varied.

Ownership

- Because the tax treatment of a stock redemption is determined by the stockholder's ownership percentage of the corporation, IRC §318 lists 4 rules to determine if there is any indirect ownership, or constructive ownership, of the stock, which is includable in the percentages. IRC §318 provides a waiver of the family attribution rule, where a stock redemption will be considere…

Effects

- Payment of cash to redeem stock has no effect on taxable income of the corporation, but if it distributes property, then it must recognize a gain, but not losses, as if the property were sold for the fair market value to the stockholder. The reduction in the corporation's earnings and profit (E&P) depends on the tax consequences to the shareholder....

Purpose

- A redemption of stock that was included in the gross estate of the decedent qualifies as an exchange if it is used to pay estate taxes and expenses. The redemption must have been made by the earlier of 90 days after the period of limitations on the assessment of the federal estate tax 3 years after the return is filed or within 60 days after a final decision by the tax court if a petition f…