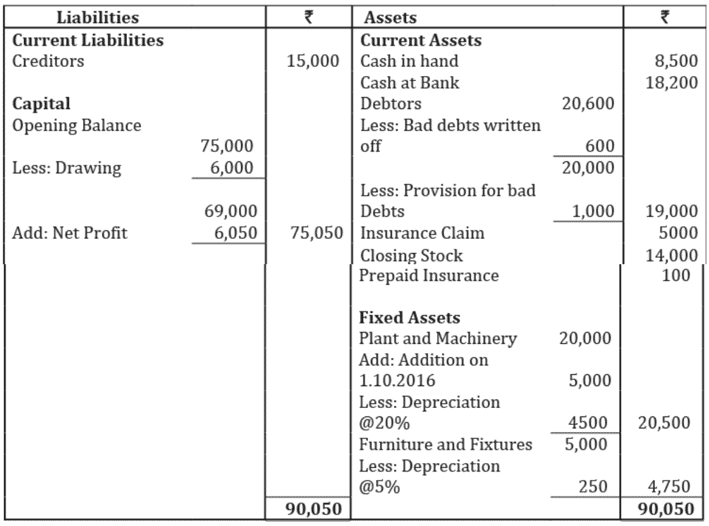

So what is the accounting for Convertible Notes? Convertible Notes are loans – so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt’s maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

What are convertible notes?

Snap to raise $1.25B through private placement of convertible senior notes due 2028

- Snap (NYSE: SNAP) to issue $1.25B of convertible senior unsecured notes due March 1, 2028 in a private placement.

- Initial purchasers will have an option to purchase up to an additional $200M of notes.

- Interest on the notes will be payable semi-annually in arrears.

How does a convertible note work?

The Three Components:

- The interest rate determines the annual interest that will accrue. ...

- The discount rate is the amount of additional equity the investor will receive when the note converts to equity as compensation for investing early.

- The cap rate determines how much equity the investor will receive upon conversion.

What is a convertible bond in accounting?

Accounting for Convertible Bonds. Convertible bond is a type of bond which allows the holder to convert to common stock. The conversion can be done at any time before the maturity date and it depends on the bond holder’s discretion. It allows the holder to choose between receiving the guaranteed interest on bonds or convert to the company’s ...

What is convertible debt in accounting?

convertible debt can present unique and complicated accounting matters for the issuer. Under U.S. GAAP, Convertible debt is considered a “hybrid” financial instrument consisting of interest-bearing debt, referred to as the “host”, and certain embedded features requiring evaluation for bifurcation and separate

Is a convertible note an asset or liability?

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Are convertible notes debt or equity on balance sheet?

As the name implies, 'convertible notes' usually result in debt funding being converted into equity, providing the investor with upside returns.

How is a convertible bonds treated on a balance sheet?

When the convertible bonds have been issued and sold, the business will take in cash, which will boost assets. On the other side of the balance sheet, liabilities will increase by the same amount, since a convertible bond is a liability.

How are convertible notes treated for tax purposes?

Generally, a convertible note is considered debt until it is converted. This means that even though the convertible note is convertible into stock, the conversion feature of the note (which is treated as an option for tax purposes) is ignored in the exchange.

Should convertible notes be treated as debt?

Using convertible notes or issuing shares is one of the companies' significant decisions when raising investment funds. Though convertible notes can help a startup get its operations up and running, equity doesn't have to be repaid as debt does.

Where do convertible notes go on balance sheet?

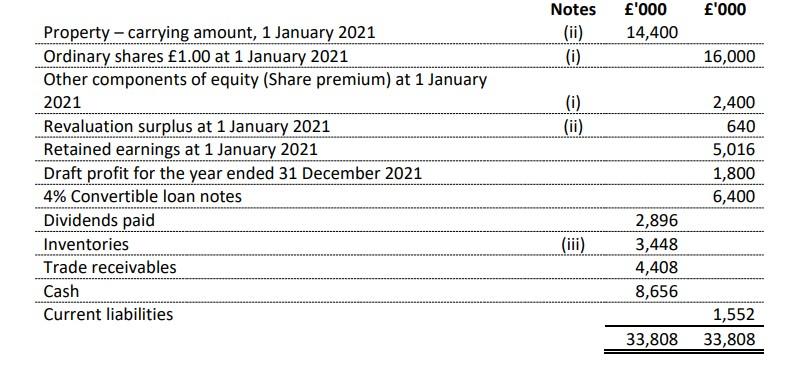

Because convertible bonds have a maturity of greater than one year, they appear under the long-term liabilities section of the balance sheet.

Is convertible bonds a current liability?

Convertible debt may become current Generally, if a liability has any conversion options that involve a transfer of the company's own equity instruments, these would affect its classification as current or non-current.

Is a convertible bond a debt or equity?

A convertible bond is a fixed-income corporate debt security that yields interest payments, but can be converted into a predetermined number of common stock or equity shares. The conversion from the bond to stock can be done at certain times during the bond's life and is usually at the discretion of the bondholder.

What is the journal entry for issuing convertible bonds?

The debit side of the journal entries for the issuance of convertible debt will include the compensation account. Usually, companies receive cash through the bank for these bonds. Therefore, it is most likely that this account will be the company's cash at the bank account.

How do you account for a convertible debt?

The equity & liability portion for the convertible bonds can be calculated using the Residual Approach. This approach assumes that the value of the equity portion is equal to the difference between the total amount received from the proceeds of the bonds and the present value of future cash flows.

Do you pay taxes on convertible notes?

A Convertible Note is not Stock For the holders of “Qualified Small Business Stock,” IRS Section 1202 provides an exemption from paying taxes on a gain. Section 1244 allows the investor to write off the investment as an ordinary business loss rather than a capital loss.

Do convertible note holders get a k1?

However, for investors who are concerned about investing in LLCs and receiving Schedule K-1 forms, the benefit of investing through a convertible security is that you will not receive a Schedule K-1, since you aren't an owner of equity in the company.

What is convertible bond?

Convertible Bonds entitle the bondholders to convert their bonds into a fixed number of shares of the issuing company, usually at the time of their maturity . Thus, convertible bonds have features of both equity as well as liability. Convertible notes do not mandate conversion.

What is the liability portion of a convertible bond?

The liability portion of the convertible bonds is the present value of the future cash flows, calculated by discounting the future cash flows of the bonds ( interest and principal) at the market rate of interest with the assumption that no conversion option is available.

Do convertible bonds have coupon payments?

On a yearly basis, coupon payments will be made to the bondholders. As mentioned earlier, convertible bonds are issued at a lower rate of interest. For taking the actual financial cost into the picture, interest will be charged to the Profit & Loss Account on the effective rate of interest, which will be higher than the nominal interest. The difference between the effective interest and nominal interest will be added to the value of the liability at the time of interest payment.

Do convertible bonds have equity?

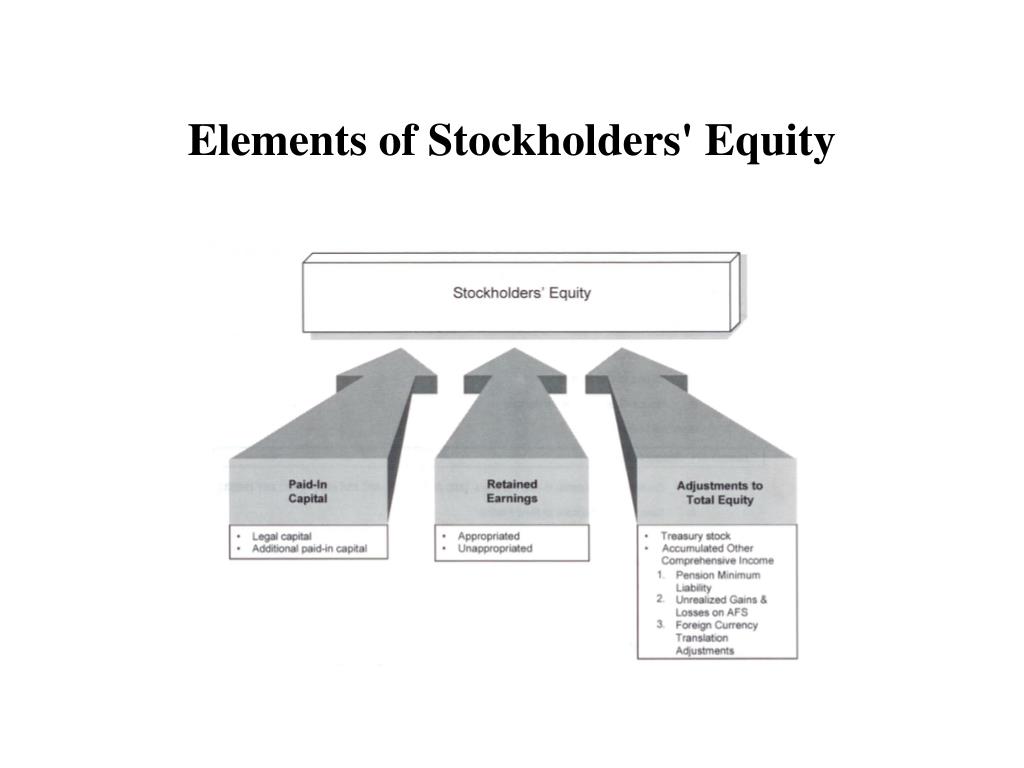

Since the convertible bonds have features of both liability (debt) as well as equity, it makes more sense to account for the liability portion and equity portion separately. This will help to give a true and fair view of the Financial Statements of the organization because of the following two reasons:

Can bondholders exercise conversion option?

Bondholders may exercise the conversion option, and in this case, shares will have to be issued to the bondholders as per the conversion ratio. In this case, both the equity and liability portion accounted will be de-recognized and equity share capital & reserves will have to be accounted for.

What is the advantage of convertible notes?

In essence, issuing convertible notes does not compel the issuer and investors to come up with a value of the company (future company) at the time when they might not be able to properly perform valuation, i.e., when the company is just an idea that needs implementation.

What is a convertible bond?

Convertible Bond A convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined number of shares in the issuing company at certain times of a bond’s lifetime. A convertible bond is a hybrid security. Pro-Rata Right. Pro-Rata Right A pro-rata right is a legal term ...

What is valuation cap?

The valuation cap represents an additional reward for investors taking a risk by investing at the very beginning stage of a company’s formation . It entitles convertible noteholders to convert to an equity stake in the company at the lower of the valuation price, or valuation cap, in the subsequent financing rounds.

What is the maturity date of a note?

4. Maturity date. The maturity date is the date when a note becomes invalid because it is due. Thus, the maturity date refers to a date when a company needs to repay the notes, paying off both the principal and interest.

What is convertible note?

Within venture capital financing, a convertible note is a type of short-term debt financing that’s used in early-stage capital raises. In other words, convertible notes are loans to early-stage startups from investors who are expecting to be paid back when their note comes due. But, instead of being paid back in principal with interest—as would be ...

Why do investors use convertible notes?

Startups and investors choose to use convertible notes because they’re simple and fast. Since convertible notes are a type of debt, they give you the ability to avoid the complications of a priced round where you actually issue shares of stock.

What is the valuation cap on a convertible note?

Here are four terms of convertible notes that are important to understand: Valuation cap: Generally just referred to as the “cap,” the valuation cap is the value at which the noteholder’s loan (both principal and interest, which accrues as paid-in-kind) converts into equity.

What is the advantage of convertible notes?

By using a convertible note, you and your investors can determine your valuation at a later time when you have concrete data like growth numbers, sales, and customers. As we mentioned, this generally happens during another financing round.

What is a note in a startup?

This is the “note.”. The note will include a due date at which time it’s mature and the balance will be due, along with interest.

Do convertible notes carry interest?

As a type of loan, however, the convertible note must carry interest. The interest rates on convertible notes are usually low, as investors are looking to receive equity in your company and not for you to actually have to pay the loan back in cash.

Can you extend the maturity date on a convertible note?

Your investor may decide to extend the maturity date on your convertible note and push you toward raising your Series A funding round. The investor might negotiate terms, increasing the discount or lowering the cap, but it may potentially be worth it if you can get your loan extended.

What are convertible notes?

The convertible notes issued by Entity A are therefore classified as compound financial instruments because they contain both debt and equity components: 1 Debt - Contractual cash flows of 10% annual coupons and a cash repayment of $1,000, and 2 Equity - Conversion feature to convert the liability to equity of the issuer.

When an issuer has an obligation to repurchase financial instruments in certain circumstances, IAS 32 Financial Instruments:

When an issuer has an obligation to repurchase financial instruments in certain circumstances, IAS 32 Financial Instruments: Presentation, paragraphs 16A to 16D include exceptions to the usual principles for classifying instruments as financial liabilities. In some cases, such instruments could be classified as ‘equity’, despite an entity having an unavoidable obligation to pay out cash. However, this exception does not typically apply to convertible instruments and is not applicable in this example.

Does entity A have an obligation to issue a variable number of shares?

Entity A does not have an obligation to issue a variable number of shares. If exercised, the option will result in Entity A issuing 10,000 shares to the holder. There is no foreign currency element because the issuer’s functional currency and the currency of the convertible instrument are the same.

Is conversion option remeasured?

We can see that when the conversion feature is classified as equity, it is not remeasured. Also, even if the conversion option is not exercised, the amount recorded in equity is not reclassified (or ‘recycled’), although it could be transferred from one equity reserve to another.

Is a convertible note a compound financial instrument?

The convertible notes issued by Entity A are therefore classified as compound financial instruments because they contain both debt and equity components: Debt - Contractual cash flows of 10% annual coupons and a cash repayment of $1,000, and. Equity - Conversion feature to convert the liability to equity of the issuer.

Convertible Notes Explained in Less Than 5 Minutes

Kristen works as a freelance writer for The Balance covering small business topics and terms pertaining to entrepreneurship, business finance, and more.

Definition and Examples of Convertible Notes

A convertible note is a short-term debt agreement that allows funds from investors to eventually be converted into equity.

How a Convertible Note Works

Convertible notes work similarly to a loan and are used in the early rounds of financing for a business. The investor providing the funds acts as a lender. The convertible note agreement sets a maturity date, by which the business must pay back the loan with interest or give the option to convert the amount owed into equity .

Types of Convertible Note Key Terms

There are several key terms businesses and investors should understand before engaging in business concerning convertible notes, such as the discount rate, valuation cap, maturity date, and interest rate.

What happens if a convertible note is exercised?

If the conversion option is exercised or no such option exists and the conversion is automatic, the convertible notes are replaced by share equity. This will require the company to remove both the separate debt and equity components it was previously recognizing and in its place bring to account the new shares issued in their place.

What does IFRS 9 require?

So what does IFRS 9 require? In order to achieve the fair reporting of these hybrid instruments the reporting entity must separate out the debt and equity portions and ensure the full borrowing costs are reflected in the accounts.

What is convertible debt instrument?

Definition. A convertible debt instrument is a compound financial instrument (sometimes called a hybrid), i.e. it has characteristics of both debt and equity funding for a company. The convertible note allows the holder to convert the instrument at a specific price and time window into a particular number of a firm’s shares.

Why is interest charged on income statement?

Subsequently, interest is charged to the income statement (statement of financial performance) based on the effective interest rate, which is usually higher than the nominal rate, to reflect the true opportunity cost of the financial liability.

Why are investors willing to accept lower rates?

And second, investors are prepared to accept lower rates for the risk as they can gain exposure to the upside potential of future gains in share price as the company grows.

Why are convertible notes so popular?

Why the popularity of Convertible notes? Start-Ups use convertible Notes at early stages to raise money to defer valuation questions to a later stage. These are debt financing agreements with a conversion feature that turns them into equity – Usually Preferred Stock. These are usually used in early-stage seed deals with your early investors but can also be used at later funding round stages, usually as a bridge-financing tool. Convertible Notes have a stated interest rate and maturity date. Maturity Dates on convertible debt from Venture Capitalists usually average around 12 to 18 months, sometimes even less than a year, making this type of agreement ideal if you’re coming off of zero revenue and have high expectations for an impending product launch. Extensions are the norm if you are in the midst of a Series-A financing round.

What happens when convertible notes are converted into equity?

When the convertible notes are converted into Equity – the loans and their accrued interest are in effect moved from the balance sheet’s liability section to the balance sheet’s equity section based on the priced round. Since convertible note holders usually take a risk at an earlier stage than the Series A investors, they may have a discount provision in their convertible notes.

Should convertible debt be higher than AFR?

Due to this fact, the interest rates on convertible debt should not be too much higher than the AFR rates set by the Treasury Department as the main incentive for investors is not to earn the maximum interest of their investment.

Who wrote Venture Deals?

One book that has greatly helped my own understanding of Startup fundraising mechanics is Venture Deals, a book written by co-authors Brad Feld and Jason Mendelson. I highly recommend early-stage founders read that book as it gives a great overview of startup fundraising mechanics.

Is a convertible note a liability?

Convertible Notes are loans – so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt’s maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Main Advantage of Convertible Notes

Terms of Convertible Notes

Practical Example

More Resources

- In essence, issuing convertible notes does not compel the issuer and investors to come up with a value of the company (future company) at the time when they might not be able to properly perform valuation, i.e., when the company is just an idea that needs implementation. A valuation will be typically conducted during the Series A financing round, g...