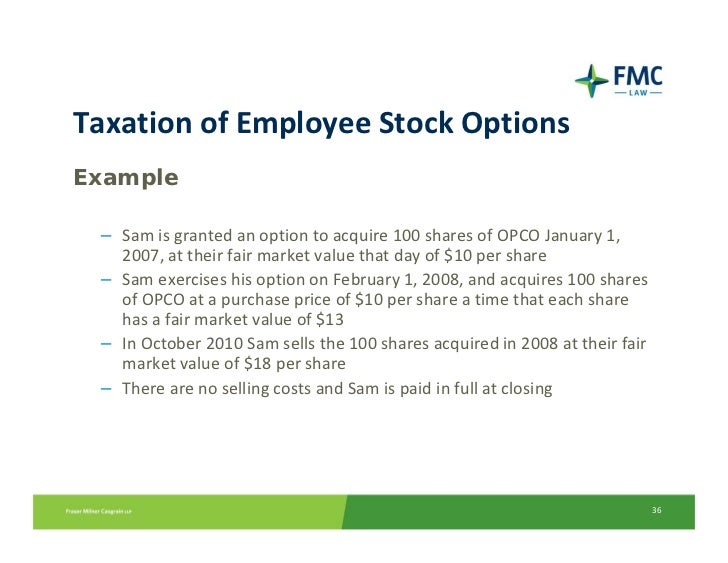

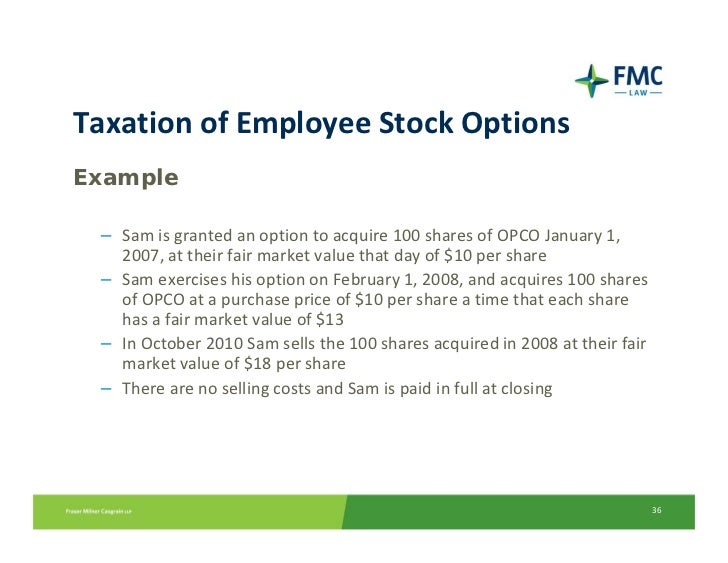

- Exercising Options. When call options are exercised, the premium paid for the option is included in the cost basis of the stock purchase.

- Pure Options Plays. Both long and short options for the purposes of pure options positions receive similar tax treatments.

- Covered Calls. Covered calls are slightly more complex than simply going long or short a call. ...

- Qualified vs. Unqualified Treatment. When writing ITM covered calls, the investor must first determine if the call is qualified or unqualified, as the latter of the two can have negative ...

- Protective Puts. Protective puts are a little more straightforward, though barely just. ...

- Wash Sale Rule. According to the IRS, losses of one security cannot be carried over towards the purchase of another "substantially identical" security within a 30-day time span.

- Straddles. Finally, we conclude with the tax treatment of straddles. Tax losses on straddles are only recognized to the extent that they offset the gains on the opposite position.

- The Bottom Line. Taxes on options are incredibly complex, but it is imperative that investors build a strong familiarity with the rules governing these derivative instruments.

How do you pay taxes on stock options?

What Is the Tax Rate on Stock Options?

- Types of Stock Options. The two basic types of stock options are non-qualified stock options (NQSOs) and incentive stock options (ISOs).

- Taxes for Non-Qualified Stock Options. Exercising your non-qualified stock options triggers a tax. ...

- Taxes for Incentive Stock Options. ...

- When to Exercise Stock Options. ...

- Bottom Line. ...

- Tax Tips. ...

What are the tax implications of exercising options?

What to Consider Before Exercising Your Stock Options This December

- STATUTORY VS. NONSTATUTORY STOCK OPTIONS. ...

- TAX IMPLICATIONS OF EXERCISING STOCK OPTIONS. While some companies may withhold tax when options are exercised (and not all do, so it’s important to find out); it is not a ...

- FACTORS IN DETERMINING WHEN TO EXERCISE OPTIONS. ...

Is exercise of stock options taxable?

The New Shares will also trade on the TSX Venture Exchange. Following Admission, Cornish Metals' Issued and Outstanding share capital will consist of 277,320,157 shares. The Company does not hold any shares in treasury.

How to report stock options on your tax return?

Usually, taxable Non-qualified Stock Option transactions fall into four possible categories:

- You exercise your option to purchase the shares and you hold onto the shares.

- You exercise your option to purchase the shares, and then you sell the shares the same day.

- You exercise the option to purchase the shares, then you sell them within a year or less after the day you purchased them.

How are employee stock options taxed when exercised?

Key Takeaways With NSOs, you pay ordinary income taxes when you exercise the options, and capital gains taxes when you sell the shares. With ISOs, you only pay taxes when you sell the shares, either ordinary income or capital gains, depending on how long you held the shares first.

How do I report stock options to exercise on my tax return?

Open market options When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an option—or the stock you acquired by exercising the option—you must report the profit or loss on Schedule D of your Form 1040.

How do you avoid taxes when exercising stock options?

15 Ways to Reduce Stock Option TaxesExercise early and File an 83(b) Election.Exercise and Hold for Long Term Capital Gains.Exercise Just Enough Options Each Year to Avoid AMT.Exercise ISOs In January to Maximize Your Float Before Paying AMT.Get Refund Credit for AMT Previously Paid on ISOs.More items...

What are the tax implications of stock options?

You'll pay capital gains tax on any increase between the stock price when you sell and the stock price when you exercised. In this example, you'd pay capital gains tax on $5 per share (the $10 sale price minus $5, which was the price of the stock when you exercised).

Are options taxed as capital gains?

Internal Revenue Code section 1256 requires options contracts on futures, commodities, currencies and broad-based equity indices to be taxed at a 60/40 split between the long and short term capital gains rates.

What happens when option is exercised?

Exercising your options To exercise an option means to take action on the right to buy or sell the underlying position in an options contract at the predetermined strike price, at or before expiration. The order to exercise your options depends on the position you have.

Does exercising an option trigger capital gains?

Exercising nonqualified stock options is a taxable event. At exercise, the compensation element, or difference between the FMV at exercise and the strike price is taxable as ordinary income and subject to payroll tax. Any subsequent gain is a capital gain depending on the holding period (either short or long-term).

What is nonstatutory stock option?

If your employer grants you a nonstatutory stock option, the amount of income to include and the time to include it depends on whether the fair market value of the option can be readily determined.

What is a 427 stock option?

427 Stock Options. If you receive an option to buy stock as payment for your services, you may have income when you receive the option, when you exercise the option, or when you dispose of the option or stock received when you exercise the option. There are two types of stock options:

What happens if you don't meet special holding period requirements?

However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income. Add these amounts, which are treated as wages, to the basis of the stock in determining the gain or loss on the stock's disposition.

Is an option without a fair market value taxable?

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option. You have taxable income or deductible loss when you sell ...

What are the two types of taxes you need to keep in mind when exercising stock options?

3. Required ISO holding periods to receive tax benefits. 4. Common times people exercise stock options. Ordinary income tax vs. capital gains tax. There are two types of taxes you need to keep in mind when exercising options: ordinary income tax and capital gains tax.

When do you have to exercise stock options?

As discussed in Part 1, most companies require you to exercise your vested stock options within a set window of time after leaving the company. This window, called a post-termination exercise (PTE) period, is usually around 90 days.

How long do you have to exercise stock options after leaving a company?

This window, called a post-termination exercise (PTE) period, is usually around 90 days.

How long do you have to file an IPO with the IRS?

You only have 30 days to file this with the IRS, and there are no exceptions. IPOs and acquisitions. The third common time to exercise your stock options is upon an exit, such as an IPO or acquisition. This is the least risky time to exercise because you know the stock is liquid.

What is the gain on selling a stock when the price is $10?

If you sell the stock when the stock price is $10, your theoretical gain is $9 per share—the $10 stock price minus your $1 strike price: The spread (the difference between the stock price when you exercised and your strike price) will be taxed as ordinary income.

What is the theoretical gain of a stock if the stock price is $5?

If you decide to exercise when the stock price is $5, your theoretical gain is $4 per share. That’s the $5 stock price minus your $1 strike price:

What happens to theoretical gain when the stock price is lower?

In our continuing example, your theoretical gain is zero when the stock price is $1 or lower—because your strike price is $1, you would pay $1 to get $1 in return. As the stock price grows higher than $1, your option payout increases.

How long do you have to exercise stock options after leaving a company?

At that moment, your employer will offer you a post-termination exercise (PTE) period, or a limited timeframe of up to three months to exercise your options.

What happens to stock options when a company is acquired?

Company Acquisition: If your company gets acquired, your stock options may be compensated or converted into shares of the acquiring company. You might be able to exercise your options during or after the acquisition deal.

What is incentive stock option?

Incentive stock options are similar to NQSOs but they include a special tax provision, discussed below, which makes them more attractive for employees. Executives or other high-ranking officials at a company are more likely to receive ISOs.

What is an early exercise?

Taking an early exercise means that you can also benefit from paying less taxes on gains. You will need to file tax form 83(b). Initial Public Offering (IPO): When company shares are taken public, you can exercise and sell your stock on the market.

How long do you have to exercise your options?

At that moment, your employer will offer you a post-termination exercise (PTE) period, or a limited timeframe of up to three months to exercise your options. Early Exercise:Usually, options vest gradually over a period of time. But some employees can buy company stock right after accepting an option grant.

What happens if you don't hold stock for a year?

But keep in mind that if you do not hold on to your stock for at least one year, your gains will be taxed at a higher rate as ordinary income. Company Acquisition: If your company gets acquired, your stock options may be compensated or converted into shares of the acquiring company.

Is stock profit a capital gain?

Any profit counts as a capital gain. Stocks sold within a year are subject to income tax. If you wait at least a year, they are subject to the lower long-term capital gains rate. Taxes for Incentive Stock Options. Incentive stock options, on the other hand, are much more tax-friendly for employees.

What happens to put options when they are exercised?

If a put is exercised and the buyer owned the underlying securities, the put's premium and commissions are added to the cost basis of the shares . This sum is then subtracted from the shares' selling price. The position's elapsed time begins from when the shares were originally purchased to when the put was exercised (i.e., when the shares were sold).

How much is Taylor's put option?

In this case, Taylor would be taxed on a $700 short-term capital gain ($50 - $40 strike - $3 premium paid x 100 shares).

What is the cost basis of a call option?

When call options are exercised, the premium paid for the option is included in the cost basis of the stock purchase. Take for example an investor who buys a call option for Company ABC with a $20 strike price and June 2020 expiry. The investor buys the option for $1, or $100 total as each contract represents 100 shares. The stock trades at $22 upon expiry and the investor exercises the option. The cost basis for the entire purchase is $2,100. That's $20 x 100 shares, plus the $100 premium, or $2,100.

What happens if Taylor takes a loss on a call?

Similarly, if Taylor were to take a loss on an option (call or put) and buy a similar option of the same stock, the loss from the first option would be disallowed, and the loss would be added to the premium of the second option.

How much capital gain will Taylor make if the call is exercised?

Say they bought shares in January of 2020 for $37, Taylor will realize a short-term capital gain of $13.95 ($50 - $36.05 or the price they paid minus call premium received).

When does Taylor buy XYZ?

Taylor purchases an October 2020 put option on Company XYZ with a $50 strike in May 2020 for $3. If they subsequently sell back the option when Company XYZ drops to $40 in September 2020, they would be taxed on short-term capital gains (May to September) or $10 minus the put's premium and associated commissions.

When are gains and losses calculated?

Gains and losses are calculated when the positions are closed or when they expire unexercised. In the case of call or put writes, all options that expire unexercised are considered short-term gains. 3 Below is an example that covers some basic scenarios.

When you exercise stock options, do you have to be aware of the exercise?

When you have employee stock options, there are three special occasions you need to be aware of: the date your company granted you the options, when you exercised them, and how long you hold the shares you receive on exercise before you sell them. These moments play an important role in your tax calculation.

Why is it important to have a tax strategy when exercising NSOs?

It's important to have a tax strategy when exercising NSOs because you'll be hit with a tax twice, and it can get a bit complicated.

What is an incentive stock option?

Incentive stock options (ISOs), also known as statutory stock options, are granted under a stock purchase plan. However, nonqualified stock options (NSOs) are granted without a specific type of plan and are often referred to as nonstatutory stock options. As we'll see below, NSOs don't qualify for the same tax benefits that ISOs receive.

What are the two types of stock options?

There are two main types of stock options that you could receive as part of your compensation gift: incentive stock options and nonqualified stock options. The main difference between these two is how they are treated for tax purposes when you exercise the options. Incentive stock options (ISOs), also known as statutory stock options, ...

How long do you have to hold ISOs to sell?

You may be able to unlock favorable long-term capital gains tax rates (a top rate of 20%) if you hold ISOs for at least two years from the date the options are granted and longer than one year from the exercise date before you sell; otherwise, you give up the right to exclusive tax benefits and risk being stuck with ordinary income taxes that could be as high as 37%.

Can you tap into stock options?

Simply put, you cannot tap into your stock option benefits until you've been at your company for a certain period of time. After you are vested, then you can exercise the options at any time before they expire.

Can employees buy stock at a discount?

Often, employees are able to buy the company stock at a discount, providing a great opportunity to accumulate wealth if the stock performs well. But the other piece of the puzzle is trying to grasp how taxes for employee stock options work. It could easily become a nightmare if you've never dealt with stock options before.

How Incentive Stock Options Are Taxed: The Basics

If you've been offered stock options as part of your compensation package, you probably have a lot of questions about if, when and how to exercise them. Stock options can be a powerful investment tool because they allow you to purchase stock in your company at a discounted rate.

What Are ISOs?

Incentive stock options–also known as qualified stock options (QSOs)–are typically given to highly valued employees as part of their compensation package. A company can only offer ISOs to its employees, and there are limits to how many can be offered.

What Are the Benefits of ISOs?

Like NSOs, ISOs provide you with an opportunity to purchase shares of stock at a reduced price. Let’s say your company gives you the option to purchase 2,000 shares of stock at an exercise price of $10 per share, but the market value of those shares is $50. That means you can buy $100,000 worth of stock for only $20,000.

How Are ISOs Taxed?

ISOs are reported for tax purposes at two different times, when exercised and when sold. How they are taxed when they are sold depends on whether the sale meets the criteria for a qualifying disposition or is considered disqualified.

What Are the Risks Associated With ISOs?

The biggest risk with ISOs is time–which also happens to be the greatest benefit. Bear with us.

What Should I Do With My ISOs?

That’s a question that only you can answer. A strategic approach that considers factors like your cash flow, tax implications and overall portfolio diversification will give you the best chance of seeing the benefit of ISOs.

Jim Wiley

Jim has more than 35 years of experience in the financial services industry, including years spent with Morgan Stanley. Throughout his career Jim has helped clients with life planning, coaching them on how to help achieve their vision by leveraging their financial resources and focusing on work-life balance.