How do you know if your insurance covers therapy?

- Register and log on to your insurance account online. Your health insurance plan’s website should contain information...

- Call your insurance provider. If you need additional information, call the toll-free number on the back of your...

- Check with your company’s HR department. If you’re insured through employment and need...

How do I know if my insurance covers therapy?

Jun 25, 2017 · How Do I Know If My Insurance Will Cover Treatment? Every insurance plan has its own rules for coverage of substance use and mental health treatment. Instead of having you and/or your loved one call your insurance company, which can be very confusing at times, Good Heart Recovery will call your health insurance plan for you to determine your level of coverage …

How can I find out what my insurance plan covers?

There is perhaps no more direct way to find out what your insurance company pays for than by contacting them and getting a comprehensive idea of your coverage options. You can also consult AllTreatment’s database of treatment centers to find out which facilities accept your insurance. They can also help you find supplemental coverage if you find that you are …

What should I look for in a health insurance coverage agreement?

Your Summary of Benefits and Coverage: Sign in to your online account through your insurance company, and look for a link to your plan’s Summary of Benefits and Coverage, sometimes called an SBC. This is a standard document that all plans are required to have. It lists the services the plan covers and how much (see a sample SBC).

What should I do if I already have an insurance plan?

Feb 10, 2022 · How Do I Know If My Insurance Covers Therapy? When you’re asking, “Does my insurance cover therapy,” you want a quick and clear answer. If it is still unclear if your therapist takes your insurance, here are some actions to take: Ask your insurance provider in person or via phone call or contact form. The answer may also be on their website.

What is insurance assessment?

Your insurance assessment will be a standard part of the screening process to help you or your loved one make an informed decision regarding where to seek care. Insurance verification takes very little time and is a critical part of the admissions process.

What is in network treatment?

In-network treatment providers have existing agreements with your insurance company and can provide care at a much lower rate. Your health insurance can be a game-changing element in ensuring you get the care you need to overcome addiction and rebuild your life. Talk to your insurance company or prospective treatment provider to find out ...

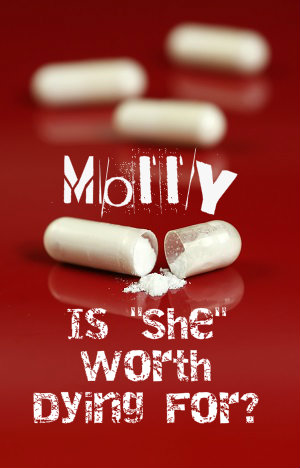

Why is it so hard to get treatment for substance use disorder?

Despite escalating rates of drug- and alcohol-related fatality, many substance use disorder (SUD) sufferers find it incredibly difficult to get quality treatment because of the costs that are often involved with the process. Subsequently, reforms have been made to insurance that have mandated increased coverage for the disease of addiction.

Does insurance cover detox?

Most insurance plans will cover detoxification to help patients address the immediate medical issues and withdrawal symptoms associated with substance abuse. Limitations to coverage may include level of care, duration of treatment, coverage to certain therapies, and more.

How to help your doctor with insurance?

By understanding your insurance coverage, you can help your doctor recommend medical care that is covered in your plan. Take the time to read your insurance policy. It’s better to know what your insurance company will pay for before you receive a service, get tested, or fill a prescription.

What is health insurance?

Health Insurance: Understanding What It Covers. Your health insurance policy is an agreement between you and your insurance company. The policy lists a package of medical benefits such as tests, drugs, and treatment services. The insurance company agrees to cover the cost of certain benefits listed in your policy.

What is preventive care?

Preventive services can detect disease or help prevent illness or other health problems. The types of preventive services you need depend on your gender, age, medical history, and family history. All plans from the Health Insurance Marketplace must cover the following without charging a copayment:

What is a rehabilitative device?

Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills). Laboratory services. Preventive and wellness services and chronic disease management.

How many essential health benefits does the ACA cover?

It will also cover at least 10 essential health benefits required by the Affordable Care Act (ACA). All private health insurance plans offered in federally facilitated marketplaces will offer the following 10 essential health benefits (EHBs):

What happens if your insurance denies your claim?

If your insurance company denies your claim, you have the right to appeal (challenge) the decision. Before you decide to appeal, know your insurance company’s appeal process. This should be discussed in your plan handbook. Also, ask your doctor for his or her opinion.

What is medical benefit?

A medical benefit is something that your insurance plan has agreed to cover. In some cases, your doctor might decide that you need medical care that is not covered by your insurance policy. Insurance companies determine what tests, drugs and services they will cover.

What does it mean when a doctor is covered by insurance?

If a service is covered, it means your health plan will pay for some or all of the cost. In most cases, your doctor also needs to be on the list of doctors that take your insurance, called a network. How much your health plan pays for depends on what type of care you use and where you get it.

What is SBC insurance?

Your Summary of Benefits and Coverage: Log onto your online account through your insurance company, and look for a link to your plan’s Summary of Benefits and Coverage, sometimes called an SBC. This is a standard document that all plans are required to have. It lists the services the plan covers and how much (see a sample SBC).

Do all health plans have a list of prescriptions?

All plans have a list of the prescriptions they cover. Search the list to make sure the prescriptions you need are included . Some plans also offer a calculator tool to help you find the lowest prices on prescriptions from specific pharmacies or in different quantities.

What to do if your health insurance does not accept your mental health insurance?

If your health plan covers out of network providers for mental health services and you are seeing a mental health provider who does not accept your insurance, complete your insurance claim form and submit it along with the mental health provider’s invoice to get reimbursed. If you are unsure about your health plan’s claim procedures for out of network providers, contact your insurance company.

How much do you have to pay out of pocket for health insurance?

Depending on your plan’s deductible, for instance, you may have to pay $500, or even $5,000, out of pocket before your insurance company will pay any claims.

What is a copay for mental health?

Ask about copayments. A copay is a charge that your insurance company requires you to pay out of pocket for a specific service. For instance, you may have a $20 copay for each office visit. In the past, copays for mental health visits may have been greater than those for most medical visits.

What is parity law?

The parity law prevents insurers from putting a firm annual limit on the number of mental health sessions that are covered. However, insurance companies can still manage your care. Your plan may say, for example, that after 10 or 20 appointments with a psychologist, they will evaluate your case to determine whether additional treatment is “medically necessary” according to their criteria. This kind of management is generally permissible under the parity law if the company uses the same standards for determining mental health coverage as they use to decide what medical services to cover. But if the company terminates or reduces care much sooner than your psychologist thinks is appropriate, that could indicate a possible violation of the parity law.

What is parity in health insurance?

The federal parity law generally applies to the following types of health insurance: 1 Employer-sponsored health coverage, for companies with 50 or more employees 2 Coverage purchased through health insurance exchanges that were created under the health care reform law also known as the Affordable Care Act or “Obamacare” 3 Children’s Health Insurance Program (CHIP) 4 Most Medicaid programs. (Requirements may vary from program to program. Contact your state Medicaid director if you are not sure whether the federal parity law applies to your Medicaid program.)

What percent of Americans are unfamiliar with the mental health law?

In fact, a 2014 APA survey found that more than 90 percent of Americans were unfamiliar with the mental health parity law. This guide helps you learn what you need to know about mental health coverage under the mental health parity law.

What to ask when scheduling an appointment with a mental health provider?

When you call to schedule an appointment with a mental health provider, ask if he or she accepts your insurance. Also ask whether he or she will bill your insurance company directly and you just provide a copayment, or if you have to pay in full and then submit the claim to your insurance company for reimbursement.

What to do if you don't have insurance?

If you don’t have your coverage documents or don’t understand them, you may want to call the customer service department. They will be able to explain your coverage in plain, simple language and will be able to answer your questions about a specific service.

What to do if your insurance doesn't pay for a medical bill?

Finally, if your health insurance company refuses to pay for a medical service or doesn’t pay as much as you think they should pay, you can appeal and ask them to reconsider the decision. The law requires them to tell you why they didn’t cover the service.

How much money do you have to pay out of your own pocket?

The amount of money you must pay out of your own pocket before your health insurance plan kicks in. For example, if your deductible is $1,000, you’ll have to pay for all your medical services until you’ve paid a total of $1,000. Nowadays, many plans have high deductibles--$3,000, $5,000, $7,000 or more. For some services, the deductible does not ...

What is summary of benefits and coverage?

Federal law requires that insurance companies and job-based plans provide you with a “Summary of Benefits and Coverage” written in plain, easy-to-understand, everyday language. This also includes a standard glossary explaining terms used in health insurance and medical care. This is a high-level summary.

What is the best place to start?

The best place to start is your health plan’s “coverage documents” – the legal contracts that spell out what is covered and what is not. There are two documents: a short and simple summary and a longer and more detailed coverage agreement. You’ll receive these documents when you shop for or purchase health insurance. You can usually find them online, but you can also request printed copies from your insurance company. You can also request these documents in languages other than English.

What is cost share insurance?

Most plans have “cost shares” – things like deductibles, co-pays and co-insurance (more about these terms below). The amount you must pay for medical care varies from plan to plan. Generally, the lower your monthly bill for your policy (called the premium), the higher your cost shares will be.

How much does a flat fee cost?

This is usually a relatively small amount, such as $20 to $30 for an office visit or $100 for an emergency room visit. A third cost you may have to pay is “co-insurance.”. This is a percentage of the cost of the service, for example 20% or 30%.

What happens if you don't have ACA coverage?

If they don’t, the employer can be subject to a penalty under the ACA’s employer mandate, but about 5% of large employers still opt to offer scanty plans that don’t comply with this regulation and would offer little in the way of coverage for intensive COVID-19 treatment.

How is health insurance regulated?

Those plans are regulated by a combination of state and federal rules, depending on the size of the group and whether it’s self-insured or fully-insured. And about 6% of Americans buy their own health insurance in the individual market, where both state and federal rules apply.

How much can a non-grandfathered health plan pay in 2021?

Under the ACA, all non-grandfathered, non- grandmothered health plans must have in-network out-of-pocket maximums that don’t exceed $8,550 for a single individual in 2021 (this limit doesn’t apply to plans that aren’t regulated by the ACA, such as short-term health plans). So for most patients who need COVID treatment in 2021, ...

What is the unemployment benefit for 2021?

If you’re receiving unemployment compensation at any point in 2021, you’re likely eligible for a $0 premium Silver plan in your state’s marketplace . This plan will come with robust cost-sharing reductions, which means your out-of-pocket exposure will be far lower than it would be on most other health plans.

Does insurance require prior authorization for testing?

And although H.R.6201 prohibits insurance plans from requiring prior authorization for testing, insurers are still allowed to impose their normal prior authorization rules for other services, including COVID-19 treatment, unless a state otherwise prohibits it on state-regulated plans.

Is intensive care an ACA benefit?

Inpatient care, including intensive care, is an essential health benefit for all ACA-compliant individual and small group health plans (but states define exactly what’s covered for each essential health benefit , so the specifics do vary from one state to another).

Can an employer waive cost sharing?

It’s important to understand, however, that if an insurer is acting as an administrator for a self-insured employer-sponsored plan, the employer would have to agree to waive the cost-sharing, as it’s the employer’s money (as opposed to the insurance company’s money) that pays the claims.