For the particular year where the installment and the interest charge is supposed to be repaid, the part of the debt is classified as a Current Liability. The remaining portion of the debt, which is due after a period of 12 months, is still categorized as Non-Current Liability.

How are bad debts treated in accounting?

Mar 29, 2022 · Example of Accounting for Debt Issuance Costs. If $40,000 of costs are incurred to issue bonds that have a life of 10 years, the $40,000 should be capitalized and then charged to expense (amortized) at the rate of $4,000 per year for the next 10 years. The bonds are repaid two years early, so the company must charge the remaining $8,000 of debt issuance costs to …

What is the accounting treatment for debt issuance costs?

Mar 27, 2022 · They are as follows: Initial loan. When a loan is first taken out, debit the cash account and credit either the short-term debt account or... Interest payment. If there is no immediate loan repayment, with only interest being paid, then the entry is a debit to... Mixed payment. If a payment is being ...

How do you account for loan repayments in accounting?

Aug 03, 2020 · Loan Repayment – Principal and Interest. A business obtains a principal and interest loan of 500 at an annual interest rate of 6% to be repaid in 3 annual loan repayment installments of 187.05 at the end of each year. For this type of loan the cash payments (187.05) are the same each period throughout the term of the loan, and include an amount paid off the …

What is debt accounting?

Bad debts recovered: Bad debt recovery is the payment received that was previously written off against a company’s receivables. As the bad debt creates a loss for the company initially when recorded as bad debt, bad debt recovery generates income for …

How do you account for debt repayment?

Record Your Loan Payments When your business records a loan payment, you debit the loan account to remove the liability from your books and credit the cash account for the payments. For an amortized loan, repayments are made over time to cover interest expenses and the reduction of the principal loan.Mar 28, 2019

What is the accounting entry for debt forgiveness?

The increase to income is usually shown as a line-item such as “debt forgiveness” at the bottom of the profit and loss statement, below operating income. For example, if $5,000 in debt is forgiven, the entry would be to debt (decrease) debts payable for $5,000 and credit (increase) debt-forgiveness income for $5,000.

Is repaying debt an expense?

Your debt repayment is not an expense, it's an internal transfer. The only part that's an expense is the interest. The rest of the money was spent some time in the past, when you incurred the debt. The same principle applies when you put money into your savings account.Aug 21, 2007

What happens to balance sheet when debt is paid off?

Paying off accounts payable reduces assets and liabilities by the same, offsetting amount. Although both of these sections of the balance sheet change, stockholders' equity does not. In general, a business has a stronger overall financial position because it has the same amount of equity but less debt.

How do you report debt forgiveness on financial statements?

If a creditor does forgive your debt, you must report this debt as income on your tax returns. In addition, you must pay the income tax on the debt, since the creditor will be reporting a loss and taking a deduction. Look for a letter referred to as a 1099-C in the mail early in the year.Sep 26, 2017

Is debt forgiveness an income account?

In general, if you have cancellation of debt income because your debt is canceled, forgiven, or discharged for less than the amount you must pay, the amount of the canceled debt is taxable and you must report the canceled debt on your tax return for the year the cancellation occurs.Feb 18, 2022

How are loans treated in financial statements?

Loans, trade credits and deposits are valued at nominal value. Non-performing loans (i.e. that have not been serviced for some time) are included as a memorandum item to the balance sheet of the creditor but no impairment loss is recorded. - Nominal value and market equivalent value should be disclosed.

Why is debt repayment not in income statement?

Similarly, any repayment of the principal amount will not be an expense and therefore will not be reported on the income statement. The principal payment is recorded as a reduction of the liability Notes Payable or Loans Payable.

How does paying off debt affect income statement?

Debt financing includes principal, which must be repaid to lenders or bondholders, and interest. While debt does not dilute ownership, interest payments on debt reduce net income and cash flow. This reduction in net income also represents a tax benefit through the lower taxable income.

Is off-balance sheet accounting legal?

Off-balance sheet financing is a legitimate, legal accounting practice, as long as the rules surrounding it are followed.

What accounts do not appear on a balance sheet?

Off-balance sheet (OBS) assets are assets that don't appear on the balance sheet. OBS assets can be used to shelter financial statements from asset ownership and related debt. Common OBS assets include accounts receivable, leaseback agreements, and operating leases.

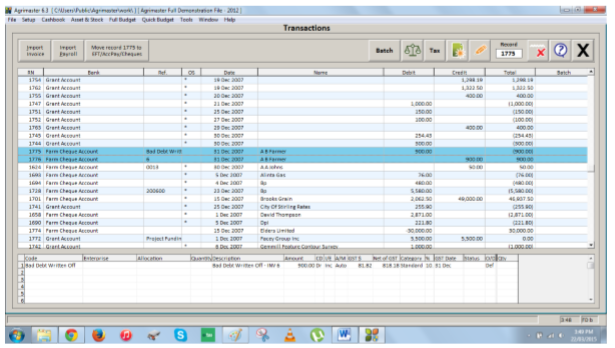

What's the accounting recording process for transactions?

The basic steps in the recording process are (1) analyze each transaction for its effects on the accounts, (2) enter the transaction information in a journal, and (3) transfer the journal information to the appropriate accounts in the ledger.

Loan Repayment Bookkeeping Journals

The following bookkeeping journals are needed to record the interest payment and the principal loan repayment each period.

Loan Repayment Journal Entry Explained

DebitIn each of these journals there are two debit entries. The debit to the interest expense records the accounting entry for interest on the loan...

Accounting Equation – Loan Repayment

The accounting equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities...

Popular Double Entry Bookkeeping Examples

Another double entry bookkeeping example for you to discover. 1. Drawings Accounting 2. Credit Card Sales Accounting 3. Using Personal Credit Card...

What is the first issue when accounting for debt?

There are several issues that the borrower must be aware of when accounting for debt. The initial issue is how to classify the debt in the accounting records. Here are the main areas to be concerned about: If the debt is payable within one year, record the debt in a short-term debt account. This is a liability account.

What is debt in finance?

Debt is defined as an amount owed for funds borrowed. The lender agrees to lend funds to the borrower upon a promise by the borrower to pay interest on the debt, usually with the interest to be paid at regular intervals.

What happens when you take out a loan?

When a loan is first taken out, debit the cash account and credit either the short-term debt account or long-term debt account, depending on the nature of the loan. Interest payment.

How often does a bank deduct interest on a line of credit?

In the case of a line of credit, the borrower is probably required to maintain its primary checking account with the lending bank, so the bank simply deducts the interest from the checking account once a month.

Is a line of credit a liability?

The typical line of credit is payable within one year, and so is classified as short-term debt. If the debt is payable in more than one year, record the debt in a long-term debt account. This is a liability account.

When did the FAS change the accounting of debt issuance costs?

Effective December 15 2015, FAS changed the accounting of debt issuance costs so that instead of capitalizing fees as an asset (deferred financing fee), the fees now directly reduce the carrying value of the loan at borrowing. Over the term of loan, the fees continue to get amortized and classified within interest expense just like before.

What is debt issuance cost?

When a company borrows money, either through a term loan or a bond, it usually incurs third party financing fees (called debt issuance costs). These are fees paid by the borrower to the bankers, lawyers and anyone else involved in arranging the financing.

What is the purpose of the FASB change?

The purpose of the change is part of a broader effort by FASB to simplify its accounting rules. The new rules now align with FASB’s own rules for debt discounts (OID) and premiums (OIP) as well as with IFRS treatment of debt issuance costs. Prior to the update, debt issuance costs were treated as an asset while debt discounts and premiums directly offset the associated liability:

What are the three ways that transaction fees need to be modeled?

Going forward, transaction professionals should take note that there are now three ways that fees will need to be modeled: Financing fees (term loans and bonds): Directly lower the carrying value of the debt. Financing fees (for revolvers): Capitalized and amortized. Transaction fees: Expensed as incurred.

Is the commitment fee capitalized?

That means that commitment fees continue to be capitalized and amortized as they have been in the past.

What is debit to loan account?

The debit to the loan account records the reduction in principal of the loan balance which is the cash repayment less the interest expense. Cash has been used to make the annual repayment to the lender on the due date in accordance with the loan agreement.

What is debit to interest expense?

The debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the beginning balance. The debit to the loan account records the reduction in principal of the loan balance which is the cash repayment less the interest expense.#N#accounting entry for interest on loan#N#Credit#N#Cash has been used to make the annual repayment to the lender on the due date in accordance with the loan agreement.

What is the equation for assets and liabilities?

The accounting equation, Assets = Liabilities + Owners Equity means that the total assets of the business are always equal to the total liabilities plus the equity of the business This is true at any time and applies to each transaction. For this transaction the accounting equation is shown in the following table.

What is bad debt recovery?

Bad debts recovered: Bad debt recovery is the payment received that was previously written off against a company’s receivables. As the bad debt creates a loss for the company initially when recorded as bad debt, bad debt recovery generates income for the company when they are recovered.

How to know if a company has bad debts recovered?

When a company supplies goods to a customer or another business on credit, the company has to recognize the same amount of receivables in their books as to the value of sold items.

What is receivable debt?

Receivables turn to bad debts: Initially, a company recognizes a receivable amount owed by a customer to the company as a loss called bad debts. When a company takes all the actions to make sure receivables are received in full. For example, they may take legal actions against the customer business if they don’t pay after official processes.

Does $200 from ABC affect receivables?

Even if the further $200 is recovered from ABC Company, it will not affect the receivables account because in either case, the receivables account is credited by the whole amount. Further $200 received will be treated the same as the $300 received from ABC Company.

What is a journal entry for loan payment?

Journal Entry for Loan Payment (Principal & Interest) Loans are a common means of seeking additional capital by the companies. They can be obtained from banks, NBFCs, private lenders, etc. A loan received becomes due to be paid as per the repayment schedule, it may be paid in instalments or all at once.

Is a short term loan a current liability?

The repayment of a secured or an unsecured loan depends on the payment schedule agreed upon between both the parties. A short-term loan is categorized as a current liability whereas the unpaid portion of a long-term loan is shown in the balance sheet as a liability and classified as a long-term liability.

Introduction to Financing Fees

Financing Fees Example

Revolver Commitment Fees Are Still Treated as A Capital Asset

Purpose of The Change

Implications For Modeling Transactions

Summary of Financing Fee Treatment

- Effective December 15 2015, FAS changed the accounting of debt issuance costs so that instead of capitalizing fees as an asset (deferred financing fee), the fees now directly reduce the carrying value of the loan at borrowing. Over the term of loan, the fees continue to get amortized and classified within interest expense just like before. The new ...