Health Incentive Account (HIA) Financially reward employees for healthy actions. An HIA helps employees manage their health care spending and enables them to pay for health care through an employer-owned account. The account is funded after pre-defined health actions are completed by the employee, resulting in a healthier workforce.

Full Answer

What can I use my health care reimbursement account for?

You can use your Health Care Reimbursement Account to pay for health care expenses incurred by the following people (per the IRS rules effective 01/01/05) even if they are not covered by your employer's health plan: Your qualifying child* (including children up to age 26, whether married or unmarried)

What is a health care spending account (HCSA)?

The Health Care Spending Account (HCSA) is an employee benefit. It helps state employees pay for health-related expenses with tax-free dollars. This includes medical, hospital, laboratory, prescription drug, dental, vision, and hearing expenses that are not reimbursed by your insurance, or other benefit plans.

How do employees get rewarded for completing wellness programs?

Employees only get rewarded when they accomplish the actions or goals that your wellness program outlines. Because we offer all types of health accounts, you can work with a single vendor and offer an HIA along with other types of accounts, such as a health savings account (HSA).

How is the wellness account funded?

The account is funded after pre-defined health actions are completed by the employee, resulting in a healthier workforce. Employees only get rewarded when they accomplish the actions or goals that your wellness program outlines.

How do I account for employee health insurance?

Health insurance contributions by employees must be posted in a liability account. This data is also recorded in the ledger. Later, when you make the premium payment, record a debit to the liability account. Health insurance premiums are usually paid to the carriers each month.

How do I record employee paid health insurance?

One way to record the withholdings is to credit Health Insurance Expense for the $75 withheld from the employee. When the company pays the full cost of the health insurance plan it will debit the amount to Health Insurance Expense.

How do I account for employee benefits?

Journal Entries. When recording your employees' benefits in your payroll or general ledger, list the amounts you withheld from their paychecks for benefits under the respective accounts as credits. When recording wages paid, include fringe benefits paid to your employees, as a debit.

How do I record employee health insurance in Quickbooks?

Here's how:Click Employees at the top menu bar and choose Payroll Taxes and Liabilities.Tap Adjust Payroll Liabilities.Enter the Date and Effective Date.Under Adjustment is for, choose Company.Select the Health Insurance item and enter the Amount.Tick Accounts Affected and then OK.Hit OK.

Is health insurance part of payroll expense?

Benefit withholdings You may withhold amounts for the employee's share of insurance premiums or their retirement contributions, for example. Your share of the costs is a payroll expense. Generally, the only payroll expense for an independent contractor or freelancer is the dollar amount you pay for services.

What goes in box 12 dd on W-2?

Health Insurance Cost on W-2 - Code DD Many employers are required to report the cost of an employee's health care benefits in Box 12 of Form W-2, using Code DD to identify the amount. This amount is reported for informational purposes only and is NOT taxable.

Is employee benefits an expense or a liability?

The general principles for all short-term employee benefits As a liability, i.e. as accrued expenses, net of any amount already paid. However, if the amount paid exceeds the amount of benefits, entities recognise the excess as an asset.

Are employee benefits an expense?

You can generally deduct the cost of providing employee compensation and benefits as a business expense. If you have employees, you are undoubtedly aware that you can claim a business expense deduction for the wages and salaries that you pay them.

Is employee benefit expenses a direct expense?

Employee benefit expenses include both direct & indirect expenses. it refers the expenses related to the employees such wages, salaries, bonus, leave encashments, staff welfare expenses, etc.

How do I categorize health insurance expenses in Quickbooks?

Here's how:Sign in to your QBO account.Click the + New button, then select Expense.Select the vendor and your payment account from the drop-down.Go to the Category details section.Choose a medical expense account under the Category column.Enter the necessary information and the amount.Click Save and close.

How do I report health insurance on w2 in Quickbooks?

You'll need to create a Company Contribution payroll item to record the health insurance on your employee's W-2s. Select Employees, then Manage Payroll Items, and then select New Payroll Item. Select Custom Setup, then select Next. Select Company Contribution, then select Next.

Is health insurance an asset or liability?

This is often the case for health, life, hazard, automotive, liability and other forms of coverage required by a business. When a business policyholder pays the premium in advance, the total amount is shown as a current asset and is carried as an asset until the coverage is used.

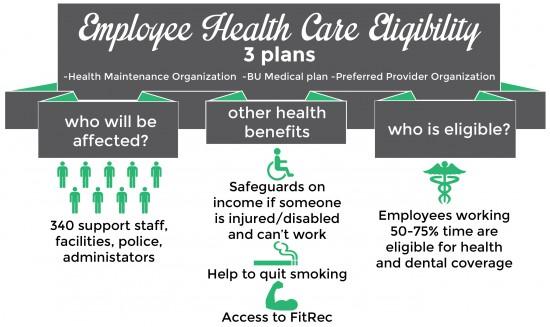

View a text only version of the infographic

Health savings and spending accounts help employees prepare for and manage health care costs, empowering them to become better health care consumers.

See how Optum Financial can help you build your strategy for improving employee health

Investments are not FDIC insured, are not bank issued or guaranteed by Optum Financial or its subsidiaries, including Optum Bank, and are subject to risk including fluctuations in value and the possible loss of the principal amount invested.

What is HIA account?

An HIA helps employees manage their health care spending and enables them to pay for health care through an employer-owned account. The account is funded after pre-defined health actions are completed by the employee, resulting in a healthier workforce. Request more information. Text. Text.

Do employees get rewarded for their health care?

Employees only get rewarded when they accomplish the actions or goals that your wellness program outlines. Because we offer all types of health accounts, you can work with a single vendor and offer an HIA along with other types of accounts, such as a health savings account (HSA).

What is a health care card?

The Health Care Card, administered through HealthEquity®, pays for many eligible health care expenses at the point of sale using funds from an employee's health care reimbursement account. That means less hassle and less paperwork. Please note: You can only use the Health Care Card in the plan year of the incurred expense.

How much can I contribute to Duke Health Care?

This $2,750 annual limit is a per person limit. If both you and your spouse are Duke employees, each of you may contribute up to $2,750 to a health care reimbursement account annually.

What is the app for receipts?

A mobile app called HealthEquity EZ Receip ts is available in the Apple and Google Play app stores. The app allows smartphone users to take pictures of receipts and upload them to assist with verification of purchases or submission of health care and dependent care reimbursement claims.

Can I get reimbursement for my spouse's HSA?

This means you may submit eligible expenses for reimbursement for these individuals. If your spouse is enrolled in a Health Savings Account (HSA), you are not eligible to participate in a Health Care Reimbursement Account.

Q1. What are the consequences to the employer if the employer does not establish a health insurance plan for its own employees, but reimburses those employees for premiums they pay for health insurance (either through a qualified health plan in the Marketplace or outside the Marketplace)?

Under IRS Notice 2013-54 PDF, such arrangements are described as employer payment plans. An employer payment plan, as the term is used in this notice, generally does not include an arrangement under which an employee may have an after-tax amount applied toward health coverage or take that amount in cash compensation.

Q3. Where can I get more information?

On Sept.

More Information

For more information the latest legal guidance on this topic, see the Employer Health Care Arrangement section on our ACA Tax Provisions for Employers page .

What are eligible expenses under HRA?

They include health insurance premiums, health insurance deductibles, coinsurance and copays, and other medical expenses. Eligible expenses must be incurred by the employee and their family and must take place within the HRA plan year.

How is HRA funded?

The HRA is 100 percent funded by the employer and the terms of these arrangements can provide first dollar medical coverage until the funds are exhausted or insurance coverage kicks in. The contribution amount per employee is set by the employer.

How long does an employee have to run out of HRA?

According to IRS rules, the employer owns the HRA. However, employees are entitled to a 90-day runout period after they leave the company during which they can catch up on reimbursement requests incurred during their employment.

What is a retiree HRA?

A Retiree HRA is an “excepted benefit,” which means it is excepted from the rules and regulations put in place by the Affordable Care Act, including the 60-day notice of material modification to the plan. Therefore, your company can make changes like a reduction in benefits without having to provide 60-day notice.

Is there a limit on HRA contributions?

For others, including the ICHRA, retiree HRA, and one-person stand-alone HRA, there are no contribution limits.

Can employees participate in an HRA?

Employees might need health insurance to participate in an HRA. The business owns the HRA. Only the business can put money into the HRA. HRA rollover depends on the type of HRA and the business's decision on whether to allow it. HRA funds don't earn interest. HRAs can reimburse anything in IRS Publication 502.

Is health care sharing ministry fee taxable?

Great question. Health care sharing ministry fees aren't considered eligible expenses for an HRA because these ministries don't provide health insurance. People belonging to a health care sharing ministry can still participate in some HRAs (like the QSEHRA), but they must do so on a taxable basis.

What is a medical check up?

A medical check-up is a physical examination carried out by a doctor or other health professional to determine your state of health. That means you can opt to go for an annual check-up ...

Is gym membership a legitimate business expense?

Regular workouts at the gym will definitely help to keep you healthy which is clearly also good news for the company. Unfortuna tely, you won’t get very far trying to claim gym or sports club membership as a legitimate business expense. If membership fees are paid for by the company, the employer will have to pay national insurance contributions ...

Can you claim back medical check ups?

You can claim back costs incurred for a single health-screening assessment and/or single medical check-up (see below) in any one tax year.

Can I claim a health check up and a health screening?

Health screening and check-ups. As stated above, you’re allowed to claim for a health-screening and a single medical check-up in the same tax year. HMRC defines health screenings as an assessment aimed at “identifying employees who might be at a particular risk of ill health”. The assessment could be in the form of a telephone interview ...

Can a company claim a private health insurance policy?

Private health insurance. As you benefit personally from any claims made on a private medical insurance policy, this is not something your company can claim against Corporation Tax. However, you may still decide to set up a policy via your company, as the true cost after tax may actually be less than paying personally.

Can I claim back medical expenses while working abroad?

Medical expenses while working abroad. If you’re a director or employee and are injured or need medical treatment while working outside the UK, you can claim back the cost of the treatment. It’s important to note that you can only claim back costs for your own treatment and not for any health-related costs incurred by a family member accompanying ...