AK, FL, NV, NH, SD, TN, TX, WA, and WY have no state capital gains tax. AL, AR, DE, HI, IN, IA, KY, MD, MO, MT, NJ, NM, NY, ND, OR, OH, PA, SC, and WI either allow taxpayer to deduct their federal taxes from state taxable income, have local income taxes, or have special tax treatment of capital gains income.

Should states eliminate capital gains tax preferences?

Capital gains, which go overwhelmingly to the wealthiest households, receive special tax preferences, such as a partial exemption, in a number of states. States with such preferences should eliminate them. States also have several options to boost capital gains revenue to support investments that benefit the state as a whole.

Which states offer capital gains tax breaks for in-state investments?

(See Table 2.) In addition, a handful of states (including Colorado, Idaho, Louisiana, and Oklahoma) provide breaks only for capital gains on investments in in-state businesses, and a few states target preferences to investments in specific industries, like farming in Iowa and Wisconsin. [3] Capital gains are generated by wealth.

What is the tax treatment of capital gains?

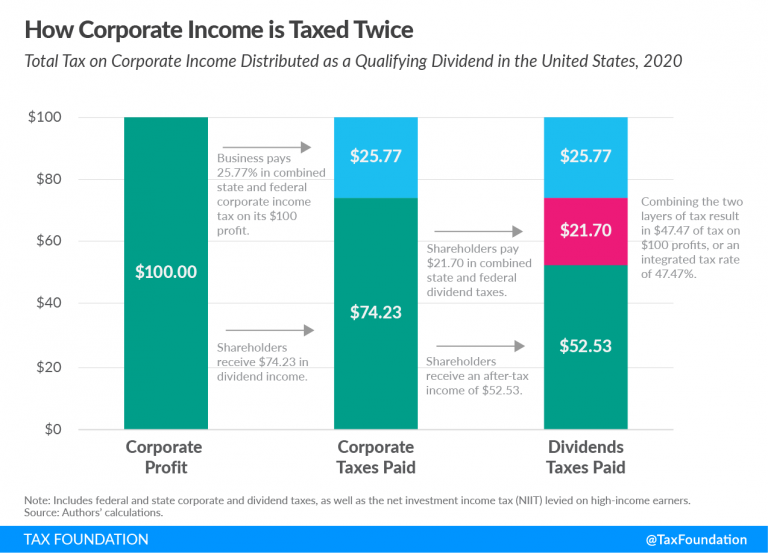

The tax treatment of capital income, such as from capital gains, is often viewed as tax-advantaged. However, capital gains taxes place a double-tax on corporate income, and taxpayers have often paid income taxes on the money that they invest.

Which states tax capital gains less than ordinary income?

While most states tax income from investments and income from work at the same rate, nine states — Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin — tax all long-term capital gains less than ordinary income. These tax breaks take different forms.

Are there any states that do not tax capital gains?

The states with no additional state tax on capital gains are: Alaska, Florida, New Hampshire, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. These are the same states that do not tax personal income on wages, although they might tax interest and dividends from investments, depending on the state.

How do states treat capital gains?

Most states tax capital gains as income. In states that do this, the state income tax applies to both long- and short-term capital gains. Keep in mind that if your state taxes capital gains as income, you'll add your capital gains to your other ordinary income, which may put you in a higher tax bracket.

What states charge capital gains tax?

While most states tax income from investments and income from work at the same rate, nine states — Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin — tax all long-term capital gains less than ordinary income. These tax breaks take different forms.

Can capital gains be taxed by two states?

As a California resident, you are taxable on any income, no matter where you earn it. Therefore, no matter what state you have property in, you would have to report the gain to California.

Does California tax capital gains?

California doesn't differ in the capital gains tax depending on how long you hold the asset, unlike the federal rate. Since capital gains in California are taxed as ordinary income, everyone is taxed at the normal income brackets. As previously mentioned, these tax brackets are between 1% and 13.3%.

Does Florida tax capital gains?

The State of Florida does not have an income tax for individuals, and therefore, no capital gains tax for individuals.

What is the most tax-friendly state for retirees?

Delaware1. Delaware. Congratulations, Delaware – you're the most tax-friendly state for retirees! With no sales tax, low property taxes, and no death taxes, it's easy to see why Delaware is a tax haven for retirees.

How do I avoid paying capital gains tax?

How to Minimize or Avoid Capital Gains TaxInvest for the long term. ... Take advantage of tax-deferred retirement plans. ... Use capital losses to offset gains. ... Watch your holding periods. ... Pick your cost basis.

How do I avoid capital gains tax in Texas?

How do I avoid capital gains tax in Texas?Hold on to assets for longer than a year. The taxes for long-term capital gains tend to be far less than that of short-term capital gains. ... Make use of tax-advantaged accounts. ... Look into tax-loss harvesting. ... Consider hiring a fiduciary financial advisor.

How do you avoid double state tax?

Home states also have the right to collect income taxes on residents, but states usually make an effort to avoid double taxation. Some 17 states have reciprocity agreements to prevent taxing people's income twice, and others allow a tax credit to fully offset tax paid to the state where income was generated.

Do you owe state taxes on capital gains?

Simply put, California taxes all capital gains as regular income. It does not recognize the distinction between short-term and long-term capital gains. This means your capital gains taxes will run between 1% up to 13.3%, depending on your overall income and corresponding California tax bracket.

How can I reduce capital gains tax on property sale?

Invest for the long term. ... Take advantage of tax-deferred retirement plans. ... Use capital losses to offset gains. ... Pick your cost basis. ... Invest for the long term. ... Take advantage of tax-deferred retirement plans. ... Use capital losses to offset gains. ... Pick your cost basis.

Does Realized offer legal advice?

Realized does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Can you deduct federal taxes from your state income?

States either allow a taxpayer to deduct their federal taxes from your state taxable income, have local income taxes, or have special tax treatment of capital gains income.

How much are capital gains taxes?

The federal government taxes long-term capital gains at the rates of 0%, 15% and 20%, depending on filing status and income. And short-term capital gains are taxed as ordinary income. Some states will also tax capital gains. A financial advisorcould help you figure out your tax liability and create a tax plan to maximize your investments. Let’s break down how capital gains are taxed by state in 2021.

What is the tax rate for capital gains in 2021?

Based on filing status and taxable income, long-term capital gains for tax year 2021 will be taxed at 0%, 15% and 20%. Short-term gains are taxed as ordinary income.

What is the maximum tax rate for capital gains?

Taxes capital gains as income and the rate reaches a maximum of 9.85%.

What is the federal tax rate for capital gains?

The top federal tax rate is 20 percent. In addition, taxpayers with AGI over $200,000 ($250,000 married filing jointly) are subject to the 3.8 percent Net Investment Income Tax. Long-term capital gains are also subject to state and local income taxes. Combined, taxpayers can expect to face a marginal rate as high as 33 percent depending on their state of residency.

Which states have no income tax?

The lowest rate of 25 percent is shared among the nine states with no personal income tax (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming).

How much tax do you pay on investment income?

At the state level, taxes on investment income vary anywhere from 0 to 13.3 percent.

Why should we look no further than our state's treatment of capital gains?

Lawmakers who want to address the current fiscal crisis head-on while also getting rid of unnecessary tax breaks should look no further than their state’s treatment of capital gains because the secret’s out: they are costly, inequitable, and ineffective.

Which states have long term capital gains tax?

Nine states (Arizona, Arkansas, Hawaii, Montana, New Mexico, North Dakota, South Carolina, Vermont, and Wisconsin) go further and provide their own income tax ...

What are the reforms to defer capital gains taxes?

Proactive reforms include: Eliminating or scaling back tax deferral for unrealized capital gains, which allows taxpayers to defer income tax on gains until assets are sold; Ending step-up in basis, which, when combined with deferral, allows a large portion of capital gains income to go untaxed;

What percentage of Americans reported capital gains in 2017?

Only 9 percent of Americans reported net capital gains income on their federal tax returns in 2017. The very wealthiest 0.1 percent of Americans—taxpayers with AGI over $2 million—received more than half, or 54 percent, of all capital gains income. Capital gains are primarily received by white households.

Should state lawmakers be afraid of capital gains tax?

State lawmakers concerned with short-and long-term budget projections shouldn’t be afraid to scrutinize the usefulness of capital gains tax breaks, especially with potential cuts to vital public services being a real possibility.

Is state tax regressive?

Moreover, a majority of state tax structures are regressive, meaning low- and moderate-income families pay a greater share of their income in taxes than wealthy families do, and these tax breaks only make the problem worse.

What is the federal tax rate on capital gains?

[4] This means long-term capital gains in the United States can face up to a top marginal rate of 37.1 percent .

What is capital gain?

Capital gains, or losses, refer to the increase, or decrease, in the value of a capital asset between the time it’s purchased and the time it’s sold. Capital assets generally include everything a person owns and uses for personal purposes, pleasure, or investment, including stocks, bonds, homes, cars, jewelry, and art. [2] The purchase price of a capital asset is typically referred to as the asset’s basis. When the asset is sold at a price higher than its basis, it results in a capital gain; when the asset is sold for less than its basis, it results in a capital loss.

Why is step up basis important?

However, step-up in basis also prevents the double taxation that would occur if heirs owed both capital gains taxes and estate taxes on the same asset. Ending step-up in basis without also making reforms to the capital gains tax would increase the cost of capital and subject these returns to saving to multiple layers of tax. [10]

Why are capital gains taxes bad?

Capital gains taxes can be especially harmful for entrepreneurs, and because they reduce the return to saving, they encourage immediate consumption over saving. Lawmakers should consider all layers of taxes that apply to capital gains, and other types of saving and investment income, when evaluating their tax treatment.

Why do capital gains tax layers distort the choice between immediate consumption and saving?

When multiple layers of tax apply to the same dollar, as is the case with capital gains, it distorts the choice between immediate consumption and saving, skewing it towards immediate consumption because the multiple layers reduce after-tax return to saving.

What is the NIIT tax?

However, the thresholds for the 3.8 percent net investment income tax (NIIT), an additional tax that applies to long-term capital gains, are not. Additionally, the NIIT also applies to short-term capital gains.

What is the purchase price of a capital asset?

The purchase price of a capital asset is typically referred to as the asset’s basis. When the asset is sold at a price higher than its basis, it results in a capital gain; when the asset is sold for less than its basis, it results in a capital loss.

Which state has the highest capital gains tax?

Wyoming. At the other end of the spectrum, California has the highest capital gains tax rate at a whopping 13.3%. That means there is more than a 50% difference between taking a large capital gain in California and in any of the nine states with no capital gains tax.

How to avoid capital gains tax?

The only surefire way to avoid capital gains taxes is not to sell your investments. If you do foresee yourself having capital gains, however, a little planning can go a long way. If you have a lot of time, the government offers various tax-advantaged accounts, such as individual retirement accounts and 401 (k)s.

What is the long term capital gains tax rate?

Tax Bracket. Long-Term Capital Gains Rate. 10%-15%. 0%.

Why is California a windfall state?

Because it is the technology capital of the world and has the highest capital gains tax rate of any state, California can experience a windfall when technology companies go public. Revenue from the capital gains tax for the 2012-2013 budget year -- the year Facebook went public -- contributed 10.5% of the state's general tax revenue. Now, the state could reap big tax rewards if Yahoo! (NASDAQ: YHOO) decides to sell its stake in Alibaba ( NYSE:BABA), which has been a big topic of conversation among Yahoo! investors after Barron's and then Starboard Capital raised the issue.

How much is the net investment income tax?

Then there's the net investment income tax. Single taxpayers who make more than $200,000 a year, or $250,000 if they are married and filing jointly, pay an additional 3.8% on investment income based on a simple formula. If this applies to you, you can find out more on the net investment income tax in this article.

Do capital gains taxes depend on your state?

Your state capital gains tax rate will depend not only on your tax bracket but also whether your state allows deductions for federal capital gains taxes or has other special rules. However, some states keep it extremely simple.

What is the capital gains tax rate for 2020?

In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%).

What is the long term capital gains tax rate?

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15% or 20% depending on your taxable income and filing status. They are generally lower than short-term capital gains tax rates.

How much does TaxAct save?

TaxAct is a solid budget pick, and NerdWallet users can save 25% on federal and state filing costs.

What is the money you make on the sale of a property called?

The money you make on the sale of any of these items is your capital gain. Money you lose is a capital loss. Our capital gains tax calculator can help you estimate your gains.

How much can you deduct from your taxes if you have capital losses?

The difference between your capital gains and your capital losses is called your “net capital gain.” If your losses exceed your gains, you can deduct the difference on your tax return, up to $3,000 per year ($1,500 for those married filing separately).

How long do you have to own a home to qualify for capital gains?

To qualify, you must have owned your home and used it as your main residence for at least two years in the five-year period before you sell it. You also must not have excluded another home from capital gains in the two-year period before the home sale. If you meet those rules, you can exclude up to $250,000 in gains from a home sale if you’re single and up to $500,000 if you’re married filing jointly. (Learn more here about how capital gains on home sales work.)

Is capital gains taxed?

Capital gains are the profits from the sale of an asset — shares of stock, a piece of land, a business — and generally are considered taxable income. How much these gains are taxed depends a lot on how long you held the asset before selling.