How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

What is the yearly deductible for Medicare Part B?

- Social Security

- Railroad Retirement Board

- Office of Personnel Management

Is Medicare Part B worth the cost?

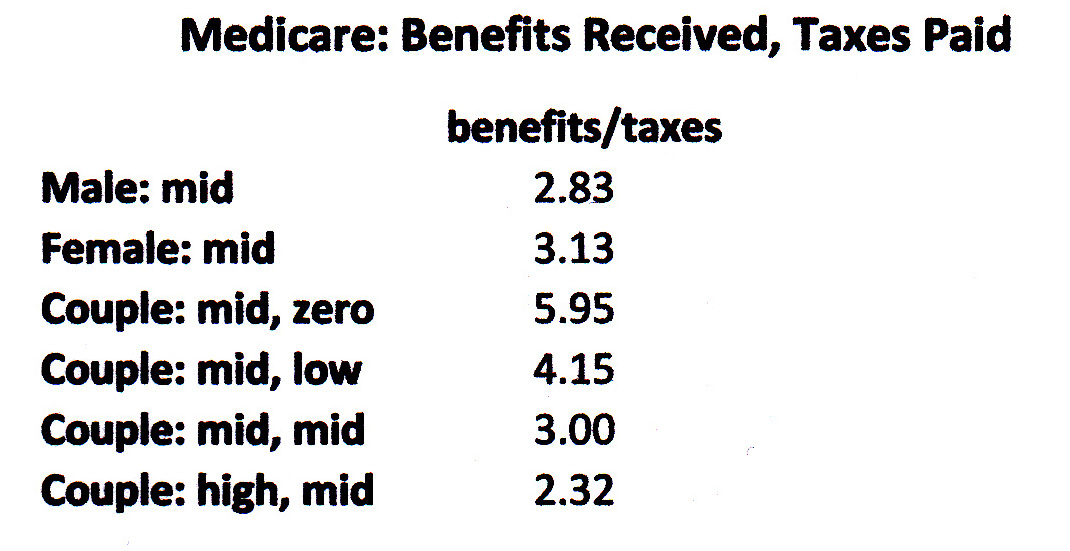

Yes is the short answer, but there are a few exceptions and details. Part B coverage (physician and outpatient coverage) is a good deal overall. The basic premium you pay only covers about one-fourth of the cost; the federal government pays the rest through general revenue.

How much is the premium for Medicare Part B?

More: Ask Rusty – Does Paying SS Tax Now Increase My Benefit? Although you must pay Medicare Part A and Part B premiums to the federal government to obtain a Medicare Advantage plan, all your healthcare services are handled by the private Medicare ...

How is Medicare Part B taxed?

As long as you use them for a qualified medical expense, which includes premiums for Medicare Parts A, B, C, and D, you don't have to pay taxes on the money.

Do Part B Medicare premiums reduce your Social Security income as far as income tax?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare tax deductible from federal tax?

Medicare expenses, including Medicare premiums, can be tax deductible. You can deduct all medical expenses that are more than 7.5 percent of your adjusted gross income.

Are Medicare premiums included in taxable income?

The IRS permits someone to deduct many medical expenses from their income tax return. This includes the premiums, coinsurance, copays, and deductibles associated with Medicare programs. A person may also deduct some healthcare expenses that Medicare does not cover.

Are Part B premiums tax-deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

At what age is Social Security no longer taxable?

There is no age at which you will no longer be taxed on Social Security payments.

Is Medicare Part B reimbursement taxable?

The Medicare Part B reimbursement payments are not taxable to the retiree.

Is Social Security taxed before or after Medicare is deducted?

Is Social Security Taxed Before Or After the Medicare Deduction? You may not pay federal income taxes on Social Security benefits if you have low-income. But for most, your Social Security benefits are taxable. That means you'll pay taxes before Medicare premiums are deducted.

What is modified adjusted gross income for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

What tax year is Medicare premiums based on?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

What insurance premiums are tax-deductible?

Health insurance premiums can count as a tax-deductible medical expense (along with other out-of-pocket medical expenses) if you itemize your deductions. You can only deduct medical expenses after they exceed 7.5% of your adjusted gross income.

What is Medicare Part B?

Medicare Part B picks up – to a large extent – where Medicare Part A leaves off. Part B coverage pays for a broad range of medically necessary serv...

Is there a premium for Part B?

Yes, and it tends to increase from year to year. For most enrollees, the 2022 Part B premium is $170.10/month. The fairly significant increase in P...

What is the Part B deductible?

Medicare enrollees who receive treatment during the year must also pay a Part B deductible, which is $233 in 2022 (up from $203 in 2021). After the...

How do I enroll in Part B?

If you are already receiving Social Security or Railroad Retirement benefits, you will be notified three months prior to your 65th birthday that yo...

Should I delay Part B enrollment?

If you have health insurance through your current employer, or through your spouse’s current employer, you may want to delay enrollment in Part B....

Can I reject Part B altogether?

Medicare Part B is optional. You can choose to skip it altogether and avoid the premiums. But that means you’re on the hook for the full cost of an...

What is medical expense deduction?

A tax deduction – like the well-known medical expense deduction – reduces the amount of money that you have to pay taxes on. Choosing to take the medical expense deduction gives you a write-off that will reduce, but not erase, the taxes that you owe.

What is AGI in taxes?

AGI is your total pre-tax income before certain non-itemized deductions such as health savings account spending. Depending on the circumstances, you may be better served by not deducting medical expenses. You may only want to deduct medical expenses in one year, and not another.

Is Medicare Part B tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense. Considering a Medicare Plan?

Can you deduct insurance premiums on your taxes?

Insurance premiums are among the many items that qualify for the medical expense deduction. Since it’s not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

Can you deduct medical expenses on taxes?

Follow the Rules to Deduct. However, you can only benefit from the medical expense deduction by following specific rules. You’ll need to file your taxes in a certain way, itemizing your deductions instead of choosing the standard deduction. Additionally, your medical expense deductions only begin to count after they surpass 10% ...

What is Medicare Part B?

Medicare Part B is an insurance plan that helps pay for doctor and medical service in exchange for a monthly premium.

What is the standard deduction for Medicare Part B?

As of 2020, the standard deduction is $12,400 for single people and $24,800 for married couples filing jointly . This may mean that it no longer makes sense for some people to claim Medicare Part B premiums and other medical expenses on their taxes, since they'll save more simply taking the standard deduction.

What is the medical deduction for $50,000?

Now, 7.5 percent of $50,000 is $3,750 and your total medical bill for the year exceeds that. You can deduct the amount you paid that’s more than 7.5 percent of your AGI so here, you could deduct $6,000 minus $3,750 , which is $2,250 .

How much of your adjusted gross income must be medical expenses?

To claim any medical expenses at all, your expenses must exceed 7.5 percent of your adjusted gross income. For example, suppose you had an AGI of $50,000 . The first step is to gather up all your medical receipts, insurance statements and summary notices, and add those together. Let's imagine your expenses come to $6,000 .

Can you deduct Medicare Part C and Part D?

Brought to you by Sapling. In addition to Medicare Part B, you might also pay monthly premiums for Medicare Part C, also known as Medicare Advantage, and Part D for prescription drug coverage. The IRS allows you to deduct any of your out-of-pocket medical expenses, including the premiums you paid for Part C and Part D.

Can you deduct medical expenses on taxes?

The amount of medical expenses you can deduct on your taxes, however, depends on your adjusted gross income. Any medical expense you pay for out of pocket because it's not covered by Medicare or falls under your Medicare annual deductible is included.

Are Medicare Premiums Tax Deductible?

The IRS offers two deductions: the standard deduction and itemized deductions, both of which reduce your taxable income. When you itemize your taxes, you opt to claim various actual deductible expenses, instead of just choosing the one-size-fits-all standard deduction. Only certain expenses, such as home mortgage interest, charitable contributions and medical expenses, qualify as itemized deductions. When you itemize, you enter all of your qualifying expenses in Schedule A on your Form 1040.

How much is the Part B premium?

Part B premiums are $148.50 per month. $148.50 multiplied by 12 months is $1,782. If a person has surgery, it would involve the Part A deductible of $1,484 for the hospital stay. The total amount for the Part B premium and Part A deductible is $3,266 (not including any other healthcare costs).

How much is medical expenses on taxes for 2021?

In 2021, the standard deduction is $12,550 for a person filing an individual return and $25,100 for a couple filing a joint return.

What is the alternative to Medicare?

The alternative to original Medicare is Part C, also known as Medicare Advantage . A person with this program pays a monthly Part B premium, in addition to their monthly Medicare Advantage plan premium. They may deduct both monthly premiums from their taxes. Some people who have original Medicare may have a Part D plan for prescription drug coverage.

What line on 1040 is AGI?

The IRS allows someone to deduct expenses that exceed 7.5% of their adjusted gross income (AGI), which is on line 7 of their 1040 tax form.

What is tax counseling for the elderly?

Tax Counseling for the Elderly (TCE) is a program that helps people aged 60 and older with tax preparation. A person can call 800-906-9887 to find a TCE office in their area. Volunteer Income Tax Assistance (VITA) provides tax help for people with disabilities or those with an income of $56,000 or less per year.

How much tax do you have to pay on unemployment?

They may have to pay income tax on up to 85% of their benefits if their total income is higher than $34,000.

Is Medicare deductible on taxes?

Share on Pinterest. While a person may need to pay income tax on Social Security benefits, Medicare premiums and out-of-pocket costs are tax deductible. Original Medicare comprises of Part A, hospital insurance, and Part B, medical insurance. Most people who have Part A do not pay premiums, but a person may deduct from their taxes ...

What does Medicare Part B cover?

Part B also covers preventive services, including diagnostic tests and a host of screenings.

What is the income limit for Medicare Part B?

Medicare Part B enrollees with income above $87,000 (single) / $174,000 (married) pay higher premiums than the rest of the Medicare population (this threshold was $85,000/$170,000 prior to 2020, but it was adjusted for inflation starting in 2020; it will be $88,000/$176,000 in 2021). The 2020 Part B premiums for high-income beneficiaries range ...

What is the Part B deductible?

Medicare enrollees who receive treatment during the year must also pay a Part B deductible, which is $233 in 2022 (up from $203 in 2021). After the deductible, enrollees also pay 20% of the Medicare-approved amount for care that’s covered under Part B.

How do I enroll in Part B?

If you are already receiving Social Security or Railroad Retirement benefits, you will be notified three months prior to your 65th birthday that you are about to become a Part A Medicare enrollee, and that Part B is an option. You’ll receive the Part B card at the same time as the Part A card.

Can I reject Part B altogether?

Medicare Part B is optional. You can choose to skip it altogether and avoid the premiums. But that means you’re on the hook for the full cost of any services that would otherwise be covered under Part B. For healthy enrollees, that might amount to the occasional office visit and nothing more. But if you end up needing extensive outpatient care — such as kidney dialysis, chemotherapy, radiation, physical therapy, etc. — your bills could add up quickly.

What income bracket did Medicare change?

The income levels for the various brackets changed in 2018, which means that people with unchanged income might have found themselves in a higher Part B premium bracket in 2018, and the adjustment resulted in more enrollees paying the highest premiums. The bracket changes only affected Medicare beneficiaries with income above $107,000 ($214,000 for a married couple), but the premium increases were substantial for people who were bumped into a higher bracket as a result of the changes.

How much did Medicare premiums cost in 2017?

But standard premiums in 2017 were $134/month for people who were new to Medicare, and for people who pay their Part B premium directly, rather than having it withheld from their Social Security check (either because they paid into a different retirement system in lieu of Social Security, or because they had not yet elected to take Social Security). This amounted to about 30% of Part B enrollees, although that includes low-income enrollees for whom state Medicaid programs pay the Part B premiums.

What does Medicare Part B cover?

Medicare Part B helps cover: services from doctors and other health care providers; outpatient care; home health care; durable medical equipment; and some preventive services. Part B is optional and may be deferred if the beneficiary or their spouse is still working and has health coverage through their employer.

What is Medicare?

Medicare is a form government provided health insurance for individuals 65 or older, or certain disabled individuals under the age 65. Medicare is funded by a payroll tax, premiums and surtaxes from beneficiaries, and general revenue. It provides health insurance for Americans aged 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration.

What are the various parts of Medicare?

Medicare Part A helps cover: inpatient care in hospitals; skilled nursing facility care; hospice care; and home health care.

Did Medicare change tax form?

The takeaway here is that there were no changes to the tax treatment of Medicare benefits or rules due to tax reform. While there are no changes to Medicare rules because of tax form, understanding how Medicare works can be helpful in understanding your overall financial picture.

Is Medicare Part B taxable?

That being said, social security benefits used to purchase Medicare Part B remain taxable. Part B premiums normally are not paid directly by the taxpayer but are withheld from his or her social security benefits.

Does Medicare have a claim number?

Until now, the Medicare claim number displayed on the enrollee’s Medicare card was his or her Social Security Number. That is about to change. To help prevent identity theft, the Centers for Medicare and Medicaid Services (CMS) will soon begin mailing new Medicare cards with new identifying numbers.

Who does the Social Security Administration provide health insurance to?

It provides health insurance for Americans aged 65 and older who have worked and paid into the system through the payroll tax. It also provides health insurance to younger people with some disability status as determined by the Social Security Administration.

What does Medicare Part B cover?

Medicare Part B helps cover medical services like doctors' services, outpatient care, and other medical services that Part A doesn't cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, ...

What is Part B insurance?

Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem. Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Medicare Part B?

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, you’ll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

Who Pays More for Medicare Part B?

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

How many people will pay Medicare premiums in 2029?

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

How much will Medicare cost in 2021?

The official estimate from the Medicare Trustees report is that the lowest possible monthly premium for Medicare Part B—$148.50 in 2021—could rise to more than $230 per person in 2029. If your income falls into a higher IRMAA tier, Medicare estimates your monthly premium in 2029 could cost you an additional $90 to $500.

What is the Medicare premium for 2021?

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

What line is Medicare Part B based on?

Medicare Part B premiums are calculated based on a person’s modified adjusted gross income (MAGI). For purposes of Part B premiums, your MAGI is the adjusted gross income you report on line 11 of your federal tax return, plus any tax-exempt interest income, such as municipal bonds (line 2a) earnings.

What happens when you enroll in Medicare Part B?

When you enroll in Medicare Part B, the federal government picks up the tab for most of your health care costs. Most, but not all.

What is the Maximum Cost of Medicare Part B?

This is often 20% of the Medicare-approved cost. Original Medicare does not have an out-of-pocket maximum , so there’s no limit to how much you could end up paying for Medicare Part B.

How does Medicare Part B work?

How it Works Premiums & Deductibles Coverage & Enrollment FAQs. Medicare Part B provides the medical portion of your Medicare coverage . Part B has costs, including a premium, deductible and coinsurance. Together, they make up the overall cost of Medicare Part B. But the costs aren’t the same for everyone.

What Is the Cost of Medicare Part B for 2022?

Have you ever asked a friend or family member: “How much does Medicare Part B cost?” If so, they probably responded with their monthly premium amount. This is the monthly cost of Medicare Part B when you have Original Medicare (Parts A and B). It’s income-based and changes each year. To illustrate, here’s how the 2022 Medicare Part B premium compares to the year prior:

What is a Medicare deductible?

Your deductible is the amount you must pay out-of-pocket before Medicare begins to pay its portion. After you’ve met your deductible each year, you then pay coinsurance for each Medicare-approved service you receive. Like the premium, the Part B deductible can change each year. Here’s the most recent deductible amount compared to the year prior:

What is Medicare premium?

A premium is a fee you pay to your insurance company for a health plan coverage. This is usually a monthly cost. A deductible is the amount you pay out of pocket before your insurance company covers its ...

How much is the penalty for not signing up for Medicare?

Your cost may go up even more if you don’t sign up for Medicare when you’re first eligible; Medicare Part B has a 10% penalty for every 12-month period you weren’t enrolled in Medicare but were eligible. You’ll pay this enrollment penalty as long as you’re enrolled in Part B.

Does Medicare Part B cover out-of-pocket costs?

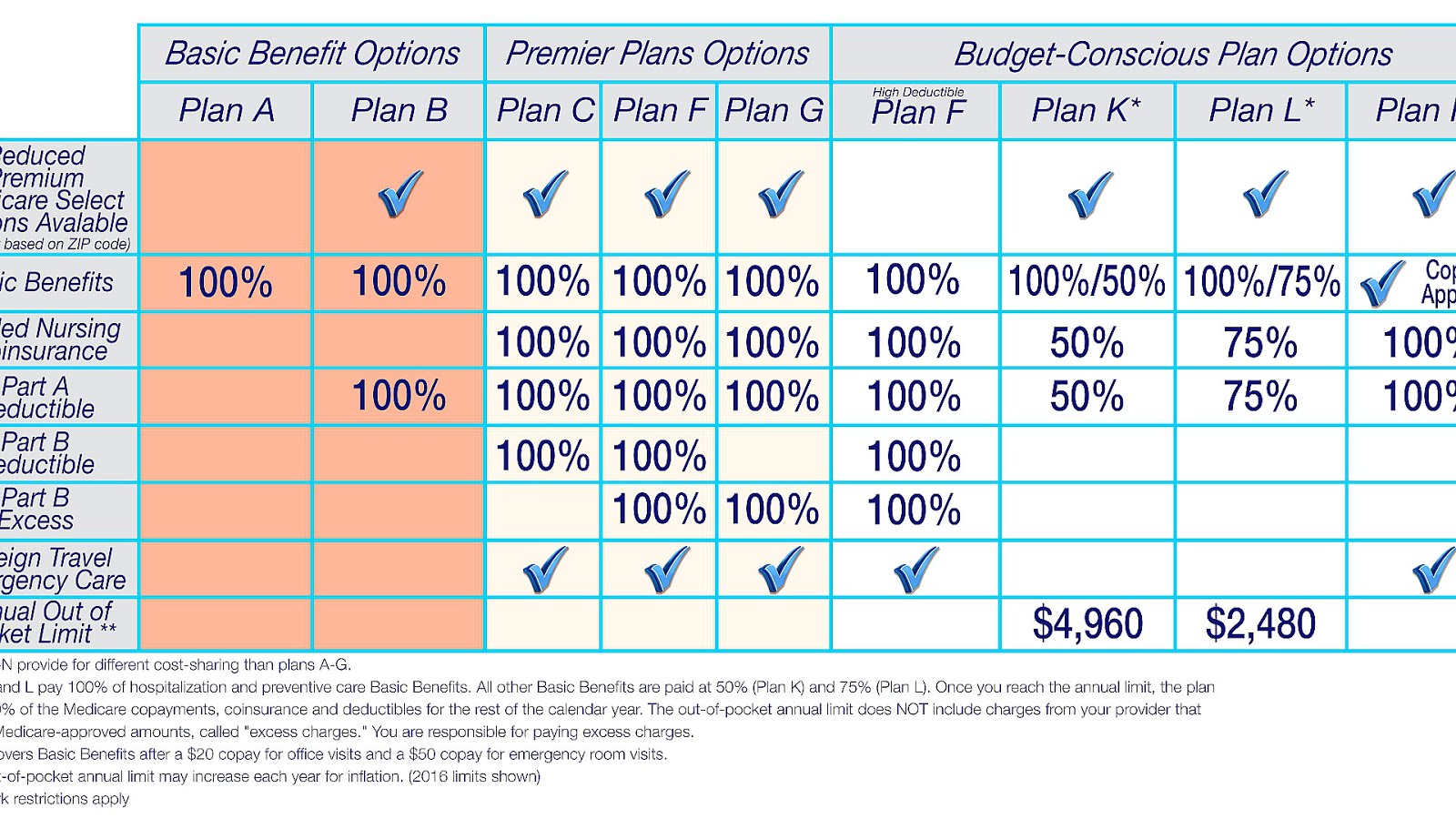

There are options for lowering the overall cost of Medicare Part B. Medicare Supplement Insurance (Medigap) has several policies that will help cover your Part B costs, including premiums, deductibles and out-of-pocket costs. Medicare Advantage (Part C) is Medicare coverage offered by private insurance companies and often has different costs for Part B coverage than Original Medicare.