Per accounting principles and standards, gains acquired by an entity are only recorded and recognized in the accounting period that they occur in. A potential gain contingency can be recorded and disclosed in the notes to the financial statements.

What is a gain contingency?

A gain contingency is an uncertain situation that will be resolved in the future, possibly resulting in a gain. The accounting standards do not allow the recognition of a gain contingency prior to settlement of the underlying event.

What is the appropriate accounting for a contingency?

When deciding upon the appropriate accounting for a contingency, the basic concept is that you should only record a loss that is probable, and for which the amount of the loss can be reasonably estimated.

When is a loss contingency recognized under GAAP?

U.S. GAAP in this area was established in 1975 when FASB issued its Statement Number Five, “Accounting for Contingencies.” This pronouncement requires the recognition of a loss contingency if the amount of loss can be reasonably estimated. When both of these criteria are met, the expected impact of the loss contingency is recorded.

What is the accounting for contingent losses?

The accounting for a contingency is essentially to recognize only those losses that are probable and for which a loss amount can be reasonably estimated. Examples of contingent loss situations are:

How do you record a gain contingency?

Gain contingencies will never be recorded (accrued), however, if they are reasonably likely to occur, they should be reported in the notes to the financial statements.

How are gain contingencies reported in the financial statements?

Gain Contingencies in Financial Statements Since the precise amount of a potential gain from a gain contingency is unknown, it is not recorded in accounting. However, it may be disclosed in the notes of a financial statement if the amount of gain is expected to be significant.

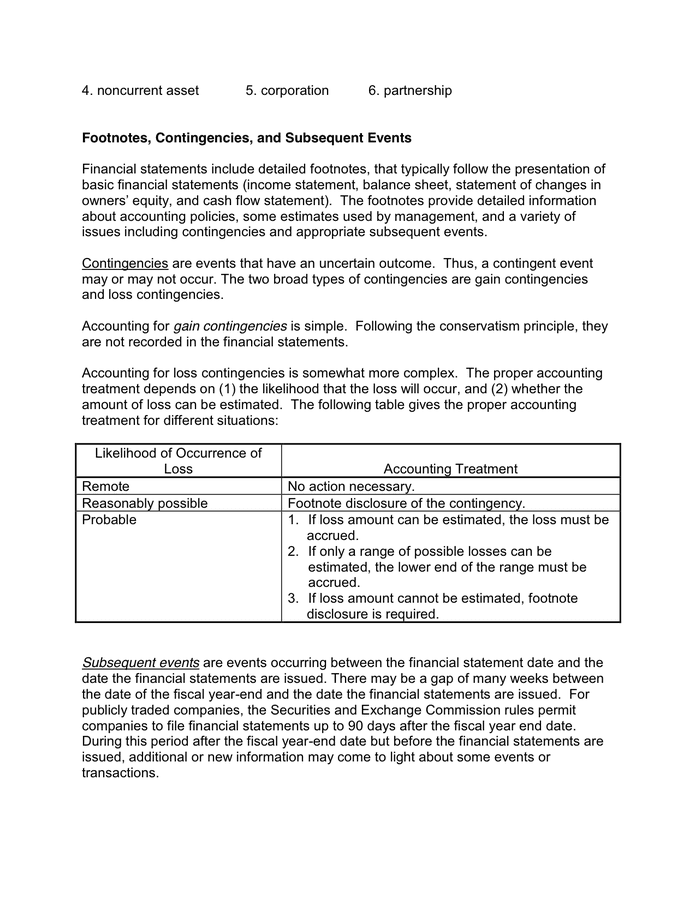

What are the accounting treatments for loss contingencies and gain contingencies?

The proper accounting treatment for loss contingencies is based on two factors: (1) the likelihood of the loss occurring and (2) the ability to estimate the amount of the loss.

Should a contingent gain be recorded?

Unlike a loss contingency, a gain contingency is usually not reflected in the financial statements and should not be recorded in the financial statements before the contingency is realized.

What is a gain contingency is it accrued and recorded in the financial statements explain?

What is a gain contingency? Is it accrued and recorded in the financial statements? explain. Q13-8 ANSWER: A gain contingency relates to an existing condition, situation or set of circumstances involving uncertainty that will be resolved when one or more future events occur or fail to occur.

Is contingent liability recorded in accounting records?

Key Takeaways. A contingent liability is a potential liability that may occur in the future, such as pending lawsuits or honoring product warranties. If the liability is likely to occur and the amount can be reasonably estimated, the liability should be recorded in the accounting records of a firm.

What are contingent gains?

A contingent gain is a potential increase in assets that has not yet occurred. A contingent gain is not recognized in the financial statements until the transaction has been settled.

How do you record a contingent loss?

A loss contingency that is probable or possible but the amount cannot be estimated means the amount cannot be recorded in the company's accounts or reported as liability on the balance sheet. Instead, the contingent liability will be disclosed in the notes to the financial statements.

How do you record a loss contingency?

Assuming that the loss contingency is “probable” and can be reasonably estimated, then a journal entry should be recorded to accrue the liability. The journal entry would be to debit legal expense and credit to record the legal liability.

Why are contingent gains not Recognised?

According to the accounting standards, a business does not recognize a contingent asset even if the associated contingent gain is probable. A contingent asset becomes a realized (and therefore recordable) asset when the realization of income associated with it is virtually certain.

What is the proper treatment of contingent asset?

Which is the proper treatment of contingent asset? a. It is probable that an outflow of resources embodying economic benefits will be required to settle the obligation.

How is contingent liability shown in balance sheet?

A contingent liability is recorded first as an expense in the Profit & Loss Account and then on the liabilities side in the Balance sheet.

What are contingencies in accounting?

Entities often make commitments that are future obligations that do not yet qualify as liabilities that must be reported. For accounting purposes, they are only described in the notes to financial statements. Contingencies are potential liabilities that might result because of a past event. The likelihood of loss or the actual amount of the loss is still uncertain. Loss contingencies are recognized when their likelihood is probable and this loss is subject to a reasonable estimation. Reasonably possible losses are only described in the notes and remote contingencies can be omitted entirely from financial statements. Estimations of such losses often prove to be incorrect and normally are simply fixed in the period discovered. However, if fraud, either purposely or through gross negligence, has occurred, amounts reported in prior years are restated. Contingent gains are only reported to decision makers through disclosure within the notes to the financial statements.

What is a probable loss?

“Probable” is described in Statement Number Five as likely to occur and “remote” is a situation where the chance of occurrence is slight.

Is an accountant a fortune teller?

The accountant is not a fortune teller who can predict the future. For example, assume Wysocki Corporation commits an act that is detrimental to the environment so that the federal government files a lawsuit for damages. The original action against the environment is the past event that creates the contingency.

Is the timing used in the recognition of gains the same as the timing used in the recognition of losses?

Answer: As a result of the conservatism inherent in financial accounting, the timing used in the recognition of gains does not follow the same rules applied to losses. Losses are anticipated when they become probable; that is a fundamental rule of financial accounting.

Does the $900,000 loss change in year one?

Restating the Year One loss to $900,000 does not allow them to undo and change the decisions that were made in the past. Consequently, no change is made in the $800,000 figure reported for Year One; the additional $100,000 loss is recognized in Year Two.

Do you report contingent gains on financial statements?

Contingent gains are only reported to decision makers through disclosure within the notes to the financial statements.

Why should a contingency not be reflected in financial statements?

A contingency that might result in a gain usually should not be reflected in the financial statements because to do so might be to recognize revenue before its realization. A realized gain is one where cash (or other assets, such as claims to cash) has been received without expectation of repayment. A gain is realizable when assets are readily ...

When is a gain realizable?

A gain is realizable when assets are readily convertible to known amounts of cash or claims to cash. We believe the recognition of a gain is appropriate at the earlier of when the gain is realizable or realized.

When is ASC 606 effective?

This publication reflects guidance that is effective for public business entities for annual reporting periods beginning on or after January 1, 2019, including the guidance in ASC 606, ASC 842, and ASC 326 on revenue, leases, and credit losses, respectively.

Does ASC 450 change?

Although the guidance in ASC 450 has not changed significantly for decades, the application of the existing framework remains challenging at times because an entity may be required to use significant judgment in applying this guidance (e.g., legal interpretations are likely to be needed).

Is ASC 460 still challenging?

Similarly, although the guidance in ASC 460 has not changed significantly for two decades, it may remain challenging to apply given the complexity of determining whether a guarantee is within the scope of ASC 460 as well as how guarantees should be accounted for in periods after their initial recognition and measurement.

What is contingency in business?

On the other hand, a contingency is an obligation of a company, which is dependent on the occurrence or non-occurrence of a future event. A contingency may not result in an outflow of funds for an entity.

What is a commitment and contingency?

What are Commitments and Contingencies? In accounting and finance, Commitments and Contingencies can be defined as follows: A commitment is a promise made by a company to external stakeholders. Stakeholder In business, a stakeholder is any individual, group, or party that has an interest in an organization and the outcomes of its actions.

Why are all commitments and contingencies recorded in the footnotes?

Generally, all commitments and contingencies are to be recorded in the footnotes to allow for compliance with relevant accounting principles and disclosure obligations.

When are commitments recorded in GAAP?

Following the Generally Accepted Accounting Principles#N#GAAP GAAP, Generally Accepted Accounting Principles, is a recognized set of rules and procedures that govern corporate accounting and financial#N#, commitments are recorded when they occur, while contingencies (should they relate to a liability or future fund outflow) are at a minimum disclosed in the notes to the Statement of Financial Position (Balance Sheet) in the financial statements of a business. If the contingency is probable (>75% likely to occur) and the amount is reasonably estimable, it should be recorded in the financial statements.

What is the difference between a commitment and a contingency?

A commitment is a promise made by a company to external stakeholders and/or parties resulting from legal or contractual requirements. On the other hand, a contingency is an obligation of a company, which is dependent on the occurrence or non-occurrence of a future event . A loss contingency refers to a charge or expense to an entity ...

What is accounting standard?

Accounting Standard An accounting standard is a standardized guiding principle that determines the policies and practices of financial accounting. Accounting standards not only.

Is contingency guaranteed?

Contingencies are not guaranteed, and they heavily rely on the occurrence or lack thereof, of uncertain future events. A commitment by an entity must be fulfilled, regardless of external events, while contingencies may or may not result in liability for the respective entity.

What are contingent liabilities?

Contingent liabilities, liabilities that depend on the outcome of an uncertain event, must pass two thresholds before they can be reported in financial statements. First, it must be possible to estimate the value of the contingent liability.

What are the three categories of contingent liabilities?

There are three GAAP-specified categories of contingent liabilities: probable, possible, and remote. Probable contingencies are likely to occur and can be reasonably estimated. Possible contingencies do not have a more-likely-than-not chance of being realized but are not necessarily considered unlikely either. ...

How many thresholds are required for contingent liabilities?

Contingent liabilities must pass two thresholds before they can be reported in financial statements: it must be possible to estimate the value of the contingent liability, and the liability must have greater than a 50% chance of being realized.

Should a company consult experts before making decisions?

Company management should consult experts or research prior accounting cases before making determinations. In the event of an audit, the company must be able to explain and defend its contingent accounting decisions. Any probable contingency needs to be reflected in the financial statements—no exceptions.

Is contingent loss reflected on the balance sheet?

If the contingent loss is remote, meaning it has less than a 50% chance of occurring, the liability should not be reflected on the balance sheet. Any contingent liabilities that are questionable before their value can be determined should be disclosed in the footnotes to the financial statements.