Answer: Yes, Medicare covers a wide range of mental health services. Medicare Part A (Hospital Insurance) covers inpatient mental health care services you get in a hospital. Part A covers your room, meals, nursing care, and other related services and supplies.

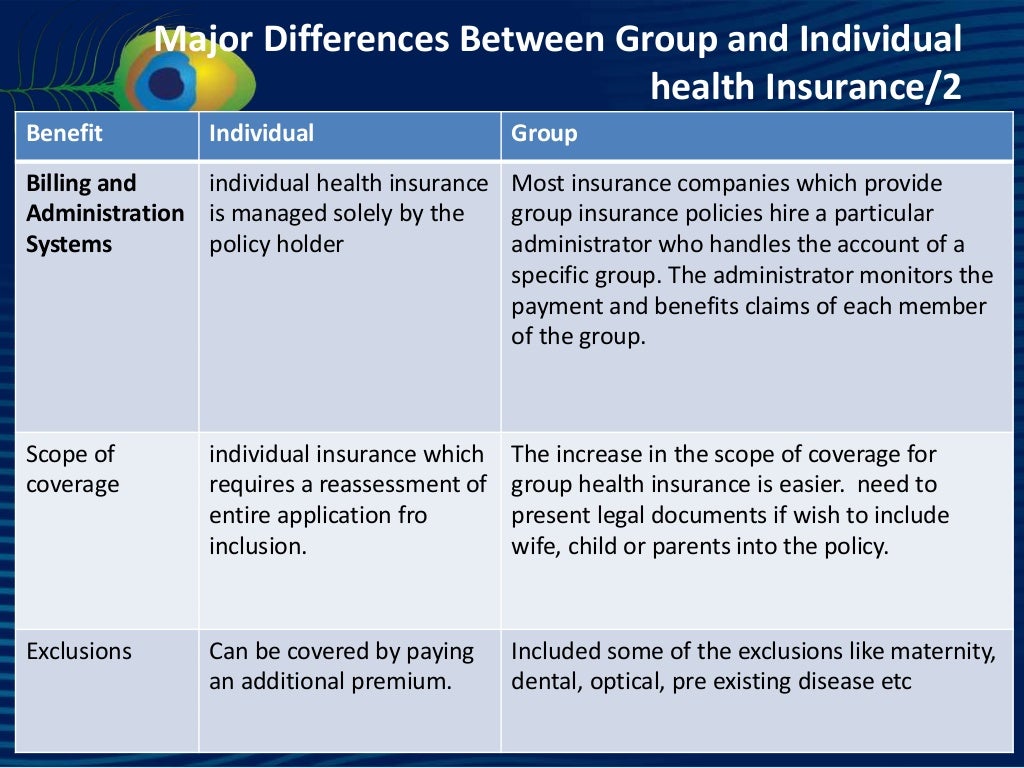

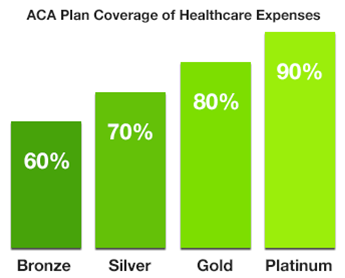

What is the difference between metal tiers in health insurance?

The difference between metal tiers is how insurance companies split costs with consumers. Cost sharing is a necessary part of health insurance, because it helps both you and your insurer to afford the high cost of medical care. Each tier has an average cost split associated with it.

What are the metal tiers under Obamacare?

Obamacare required plans to begin categorizing themselves according to pre-set actuarial values: 60%, 70%, 80%, and 90%. This was part of the creation of the metal tiers and simply makes it easier for consumers to compare plans.

Does health insurance cover mental health out-of-network costs?

If your health insurance covers some or all of the cost of going out of network for a physical health problem, it has to do the same for a mental health problem. There are some exceptions. For instance, the law doesn't apply to companies with 50 or fewer workers.

How much will my health insurance pay for medical bills?

So if you have coinsurance of 20%, which is common, then you will pay 20% of each medical bill after you hit your deductible (until you hit your out-of-pocket limit) and then your insurance will pay the other 80%. As with all the other costs we’ve mentioned, Bronze plans usually require you to pay the most.

Do You Have Insurance Questions About Mental Health Or Addiction Services?

Help is available, if you have: 1. Been denied coverage 2. Reached a limit on your plan (such as copayments, deductibles, yearly visits, etc.) 3. H...

Q: Do Insurance Plans Have to Cover Mental Health Benefits?

Answer: As of 2014, most individual and small group health insurance plans, including plans sold on the Marketplace are required to cover mental he...

Q: Does Medicaid Cover Mental Health Or Substance Use Disorder Services?

Answer: All state Medicaid programs provide some mental health services and some offer substance use disorder services to beneficiaries, and Childr...

Q: Does Medicare Cover Mental Health Or Substance Use Disorder Services?

Answer: Yes, Medicare covers a wide range of mental health services.Medicare Part A (Hospital Insurance) covers inpatient mental health care servic...

Q. What Can I Do If I Think I Need Mental Health Or Substance Use Disorder Services For Myself Or Family Members?

Here are three steps you can take right now: 1. Learn more about how you, your friends, and your family can obtain health insurance coverage provid...

Q: What Is The Health Insurance Marketplace?

The Health Insurance Marketplace is designed to make buying health coverage easier and more affordable. The Marketplace allows individuals to compa...

How to compare health insurance plans?

You can compare plans on HealthCare.gov or, if you’re insured through your employer, by asking your human resources representative.

How many employees does an employer sponsored health plan have?

Any employer-sponsored health plan for companies with 50 or more employees. It does not apply to companies with less than 50 employees.

What is Medicare Part A?

Medicare Part A (Hospital Insurance): Covers inpatient mental healthcare services (your room, meals, nursing care, etc.) provided in a hospital

Can insurance companies manage mental health?

But that doesn’t mean an insurance company can’t still try to manage your care to reduce their costs. A healthcare plan may state that after a set number of mental health appointments (12, 15, 20, etc.) with a psychologist, the insurer will evaluate your case to determine whether additional treatment is “medically necessary” according to their criteria. This is allowed under the parity law as long as the insurer applies the same standards for determining medical care.

Does Medicaid cover mental health?

Most Medicaid programs. Requirements may vary from program to program, however, all state Medicaid programs provide some mental health and substance use disorder services. Check with your state’s plan for specifics available in your area or visit Medicaid.gov for information about Medicaid and mental health and substance use disorder services.

Does health insurance cover mental health?

Unlike coverage for dental or vision needs, there currently aren’t health insurance options that single out mental healthcare. When available, mental health coverage is within the framework of a medical health insurance policy. If you’re shopping for new health insurance and want to only consider plans that also provide mental health coverage, visit HealthCare.gov to compare plans and find one with the coverage you’re seeking.

Does parity require medical coverage?

The federal parity law does not require healthcare plans to provide mental health benefits. However, when an insurance plan provides mental health coverage, the law requires those benefits be equal to (or better than) medical and surgical coverage.

What are some examples of equal treatment limits?

For example, benefits must have equal treatment limits, such as: Number of days you can stay in the hospital. How often you get treatment. Also, the amount you pay on your own needs to be the same for similar categories of physical and mental health services. For instance:

Does insurance cover menatal care?

Insurance Coverage for Mental Health Care. Insurance coverage for menatal health problems is changing -- for the better. In the past, your insurance might have paid 80% of the cost of seeing your primary care doctor but only 50% of the cost for seeing a psychologist. But a law that took place in 2010 changed the rules.

Does mental health insurance have to be equal to physical health?

Under the law, if a private insurance plan provides coverage for mental health and substance use services, the plan's coverage must be equal to physical health services. For example, benefits must have equal treatment limits, such as: Number of days you can stay in the hospital.

Does health insurance cover mental health?

If your health insurance covers some or all of the cost of going out of network for a physical health problem, it has to do the same for a mental health problem.

Is it illegal for insurance companies to deny you coverage for mental health conditions?

The Affordable Care Act also makes it illegal for insurance companies to deny you coverage for pre-existing conditions, including a mental health condition.

How much does a mental health copay cost?

You’ll want to review the cost of copays for mental health visits when choosing a plan. Copays are often between $20 and $50. However, that’s not as important as the cost of premiums and deductibles.

What is deductible in health insurance?

Health plans that have lower premiums often have higher deductibles. A deductible is what you pay for health care services before your health insurer begins picking up a portion of the costs.

How to compare health insurance plans?

However, health plans can vary. If you’re concerned about mental health coverage, here’s what you want to review when comparing health plans: 1 Check out a plan’s provider network to see the mental health options in your area. If you’re receiving mental health care, make sure your providers are in the plan’s network or you’ll have to pay more or all of the care costs. 2 See if the health plan covers your prescriptions and how much you’ll have to pay. 3 Look into health plan costs, such as copays, deductibles, coinsurance and out-of-pocket costs. These costs will help you compare health plans.

What is short term health insurance?

Short-term health plans have low premiums but much higher out-of-pocket costs than regular health insurance. These plans also have coverage caps, so you wind up paying all of the health care costs once you reach the limit. Insurers that offer short-term plans have more leeway than a standard health insurance plan.

Does health insurance cover mental health?

Health insurance covers mental health visits , just like it handles primary care provider visits. The ACA requires that insurers accept you regardless of pre-existing conditions. Previously, a health plan in the individual market could deny you or charge much higher rates if you had pre-existing conditions. The ACA changed that.

Does ACA cover mental health?

The ACA changed that. In addition to mental health and substance abuse care, health insurance covers: Similar to physical health care, you’ll want to stay within the plan’s provider network when possible. Staying in the plan’s provider network will keep down costs.

Can insurance companies limit mental health visits?

The law also disallows insurers from putting annual limits on mental health visits. Insurers can’t place absolute coverage restrictions, but they can review your situation after a certain number of mental health appointments and decide whether to approve future visits.

Which is the best mental health insurance?

Overall, our top pick is United Healthcare for best overall mental health insurance. With their impressive network and easily accessible support for mental health issues, plus a range of treatment options for substance abuse disorders, they are an excellent choice.

How many people didn't receive treatment for their mental health condition in the previous year?

Even more worrying is that 56% of those adults didn't receive any treatment for their condition in the previous year. 1. Receiving appropriate care and support when you have a mental health issue is pivotal to recovery but can be expensive. This roundup will help you understand your mental health insurance options.

What states does Cigna cover?

If you are considering a Cigna health insurance plan, you'll need to live in one of the following states: Arizona, California, Colorado, Connecticut, Florida, Georgia, Maryland, Missouri, North Carolina, South Carolina, Tennessee, or Texas.

Why choose United Healthcare?

Why We Chose It: United Healthcare is our top overall choice for mental health coverage thanks to their impressive network and reputation coupled with 24/7 support for mental health issues, treatment options for substance abuse disorders, and excellent online resources.

Does Aetna have short term insurance?

No short-term health insurance options. No individual health plans. Aetna's history dates back to 1853, and they now provide around 39 million people with Medicare Advantage plans, group insurance, and prescription drug coverage. One drawback with Aetna is that you can't buy individual health plans from them.

Is mental health insurance included in health insurance?

Generally, insurance for mental health is included within an overall health insurance policy; there are no specifically tailored insurance policies for mental health coverage. However, many health plans include some level of coverage for mental health following the Affordable Care Act. 6 .

Is mental health insurance expensive?

Receiving appropriate care and support when you have a mental health issue is pivotal to recovery but can be expensive. This roundup will help you understand your mental health insurance options. Our analysis compared factors like company reputation, price, coverage, availability, and limitations of some of the best mental health insurance options before deciding on our top four. Continue reading to find out what the top picks are for mental health insurance.

How much do you have to pay out of pocket for health insurance?

Depending on your plan’s deductible, for instance, you may have to pay $500, or even $5,000, out of pocket before your insurance company will pay any claims.

What to do if your health insurance does not accept your mental health insurance?

If your health plan covers out of network providers for mental health services and you are seeing a mental health provider who does not accept your insurance, complete your insurance claim form and submit it along with the mental health provider’s invoice to get reimbursed. If you are unsure about your health plan’s claim procedures for out of network providers, contact your insurance company.

What is parity in health insurance?

The federal parity law generally applies to the following types of health insurance: 1 Employer-sponsored health coverage, for companies with 50 or more employees 2 Coverage purchased through health insurance exchanges that were created under the health care reform law also known as the Affordable Care Act or “Obamacare” 3 Children’s Health Insurance Program (CHIP) 4 Most Medicaid programs. (Requirements may vary from program to program. Contact your state Medicaid director if you are not sure whether the federal parity law applies to your Medicaid program.)

What percent of Americans are unfamiliar with the mental health law?

In fact, a 2014 APA survey found that more than 90 percent of Americans were unfamiliar with the mental health parity law. This guide helps you learn what you need to know about mental health coverage under the mental health parity law.

How to check if your insurance uses a network?

Typically, patients are required to pay more out-of-pocket costs when visiting an out-of-network provider. Call your insurance company or visit the company’s website for a list of in-network providers.

How to reach out to insurance company?

To reach out to your insurance company, check for a customer service number on the back of your insurance card. If you obtained your insurance through an insurance exchange, you may be able to get help from your state insurance commissioner.

Can insurance companies charge for office visits?

For example, an insurance company can’t charge a $40 copay for office visits to a mental health professional such as a psychologist if it only charges a $20 copay for most medical /surgical office visits.

How much does online therapy cost?

Furthermore, you may be able to subscribe to online therapy providers and pay a set fee per month for unlimited access to a therapist, which could provide a higher level of treatment at a lower cost than paying for individual appointments with an in-person therapist. For example, Talkspace costs $65 to $99 a week if you get billed monthly — or $52 to $79 per week if you choose to pay for three or six months in advance. Online therapy might not be the right fit for everyone, but it’s always worth considering.

How much does it cost to get a therapist for depression?

Even with insurance, the copay for a therapy session can range from just a few dollars to $50 or more .

Is health insurance confusing?

There’s no other way to put it: Health insurance plans are confusing. For young people navigating them for the first time on their own, it can be difficult to figure out what’s actually covered and what’s not — especially when it comes to mental health.

Is mental health expensive?

Mental health care that’s expensive to the point of being inaccessible has been an issue for a long time, but it has taken on new urgency during the Covid-19 pandemic. Last year, almost 80% of people aged 18 to 24 and more than 75% of people aged 25 to 34 who took an anxiety or depression screen scored with moderate to severe symptoms.

Is telemedicine better than therapy?

Compared to other forms of health care, therapy is ideally suited to telemedicine. After all, speaking to someone on Zoom (or chat, text, email, or phone) is the closest we can get right now to conversing in the same room. And according to multiple studies, it is just as effective as in-person treatment. There are numerous great options for “remote” mental health care available that are more convenient and less expensive.

Does insurance cover mental health?

Though federal laws require insurance companies to cover mental and physical health issues equally, deep disparities persist between the two. In fact, 42% of people struggle to cover high costs related to mental health.

How long does Part A pay for mental health?

If you're in a psychiatric hospital (instead of a general hospital), Part A only pays for up to 190 days of inpatient psychiatric hospital services during your lifetime.

How much is Medicare coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). In Original Medicare, these are additional days that Medicare will pay for when you're in a hospital for more than 90 days.

What is Medicare Part A?

Mental health care (inpatient) Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers mental health care services you get in a hospital that require you to be admitted as an inpatient.

What is coinsurance for a day?

Coinsurance is usually a percentage (for example, 20%). per day of each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

When does the benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins.

How much is original Medicare deductible?

Your costs in Original Medicare. $1,484. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. for each. benefit period.

Can you have multiple benefit periods in a general hospital?

for mental health services you get from doctors and other providers while you're a hospital inpatient. Note. There's no limit to the number of benefit periods you can have when you get mental health care in a general hospital. You can also have multiple benefit periods when you get care in a psychiatric hospital.

Which metal tiers require the most out of pocket expenses?

The four metal tiers, from the plan that requires the most out-of-pocket expenses to the least, are Bronze, Silver, Gold, and Platinum

What are the four tiers of health insurance?

The four tiers of health insurance plans available on the market are named after metals — bronze, silver, gold, platinum — and so they are referred to as the metal tiers (or “metal levels”). The tiers differ based on how the cost of health care services are split between you and your insurer. Bronze plans generally have ...

What is the Obamacare tier?

Those who cannot afford a plan in one of the metal tiers have multiple options, such as premium subsidies. The Affordable Care Act (ACA), also known as Obamacare, standardized the health benefits that all individual and small-group plans must cover. In the process, Obamacare also made it easier to compare health insurance plans by dividing them ...

What are the actuarial values for Obamacare?

Obamacare required plans to begin categorizing themselves according to pre-set actuarial values: 60%, 70%, 80%, and 90%. This was part of the creation of the metal tiers and simply makes it easier for consumers to compare plans.

How many levels of health insurance are there?

Health insurance plans on the marketplace are divided into four levels, named after metals, based on how much of your total costs the insurance company will pay on average. By. Derek Silva.

What is the benefit of subsidy insurance?

A health insurance subsidy can help low-income individuals and families to afford insurance coverage that would otherwise be too expensive. Your household income needs to fall between 100% and 400% of the federal poverty level in order to qualify. Some subsidies only apply to plans in the Silver metal tier, but they give you a lower monthly premium, deductible, coinsurance, copays, and out-of-pocket maximum.

What are the four metal tiers?

The four metal tiers, from the plan that requires the most out-of-pocket expenses to the least, are Bronze, Silver, Gold, and Platinum. The tiers aren’t related to the quality of medical care, and all plans cover the same essential benefits. Those who cannot afford a plan in one of the metal tiers have multiple options, such as premium subsidies.

Does health insurance cover the majority of bills?

As with most things in life, “you get what you pay for,” and that rings true with health insurance. More expensive plans cover the majority of bills, leaving you with the lowest out-of-pocket costs, while less expensive plans have a lower percentage of bills covered by insurance. Of course, it’s not that cut-and-dry. Perhaps the most important question to ask yourself is, “How often are we going to need doctors/medical care?”

Is health insurance confusing?

Health insurance can be confusing and frustrating. We want to fix that, and we need talented people to help us fully realize our long-term vision.