How do you determine creditable coverage?

creditable coverage determination. A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS guidelines.

How do I find out if my prescription drug coverage is creditable?

Medicare Part D requires employers to disclose to CMS and to Medicare Part D-eligible individuals whether their prescription drug coverage is creditable. There is no employer fee or penalty for offering prescription drug coverage that is non-creditable. Ask the health insurance carrier (for insured coverage)

Is a group health plan's prescription drug coverage creditable?

A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS guidelines.

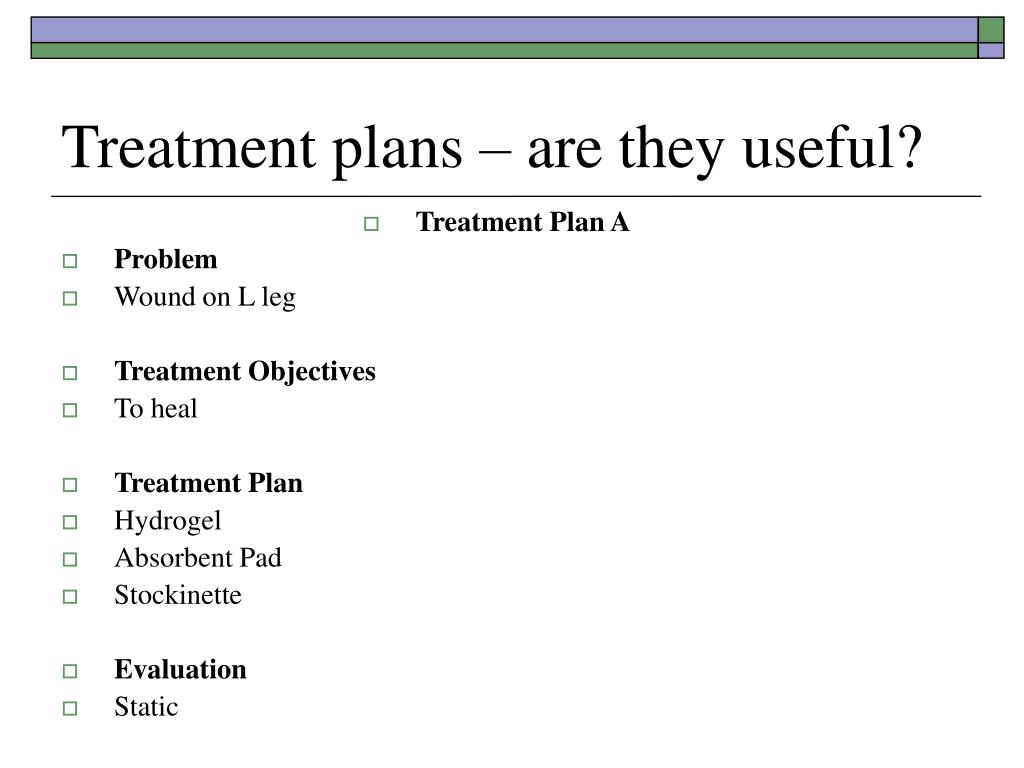

How often do you have to update a treatment plan?

Treatment Plan Updates Due When clinically indicated; At a minimum of once every 20 days of service to the individual patient. Required Signatures The client and the treatment team (consists of a treatment team leader, a psychiatrist when the treatment team leader is not a psychiatrist and other appropriate staff).

What is creditable coverage?

The Medicare Modernization Act (MMA) requires entities (whose policies include prescription drug coverage) to notify Medicare eligible policyholders whether their prescription drug coverage is creditable coverage, which means that the coverage is expected to pay on average as much as the standard Medicare prescription drug ...

How long does it take to complete a CMS 2nd disclosure?

The Disclosure should be completed annually no later than 60 days from the beginning of a plan year (contract year, renewal year), within 30 days after termination ...

How long does Medicare have to be in effect to be late?

The MMA imposes a late enrollment penalty on individuals who do not maintain creditable coverage for a period of 63 days or longer following their initial enrollment period for the Medicare prescription drug benefit.

What is creditable coverage?

creditable coverage determination. A group health plan’s prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS guidelines.

What is a prescription drug plan?

1. It provides coverage for brand and generic prescriptions; 2. It provides reasonable access to retail providers; 3. It is designed to pay, on average, at least 60 percent of participants’ prescription drug expenses; and.

How much is the maximum annual benefit for prescription drug coverage?

The prescription drug coverage has no maximum annual benefit or a maximum annual benefit of at least $25,000 ; or. The prescription drug coverage has an actuarial expectation that the amount payable by the plan will be at least $2,000 annually per Medicare-eligible individual.

What is combined lifetime benefit?

A combined lifetime benefit maximum* for all benefits under the plan. *The Affordable Care Act (ACA) prohibits health plans from imposing lifetime and annual limits on the dollar value of essential health benefits. An integrated plan’s prescription drug coverage will be deemed creditable if it satisfies all of the following criteria: 1.

Do employers have to ask their insurance company if they have made a determination about whether the plan is credit answer

As a first step, employers with insured prescription drug plans should ask their carriers whether they have made a determination about whether the plan’s coverage is creditabl. For self-insured plans, or where the carrier for an insured plan has not made a determination about whether the plan is creditable, employers may use a simplified ...

Do employers have to disclose Medicare Part D coverage?

Employers with group health plans that provide prescription drug coverage to individuals who are eligible for Medicare Part D must comply with certain disclosure requirements. Employers must inform these individuals and CMS whether their prescription drug coverage is “creditable,” meaning at least as good as Medicare Part D coverage. These disclosures must be made on an annual basis and at certain other designated times.

Is prescription drug coverage creditable?

Prescription drug coverage that does not meet this standard is called “non-creditable.”. There are a few different ways for employers to determine whether their prescription drug coverage is creditable. Employers with insured plans should ask their health insurance carriers if they have made this determination for the insured product.

Who is the MD of SADS?

The SADS Foundation just released a COVID-19 Vaccine statement that recommends that all individuals with SADS conditions receive a vaccination. Michael J. Ackerman, MD, PhD, director of the Long QT Syndrome Clinic and professor of medicine,…

Why are some medicines being recalled?

Recent warnings that certain manufacturing lots of several very important medicines have been recalled because the have been found to contain higher than acceptable levels of chemicals known to cause cancer in animals.

How to start a treatment plan?

Every good treatment plan starts with a clear goal (or set of goals). Identify what your client would like to work on and write it down. Don't be scared of limiting your work, you can always adjust these as time goes on. However, it's helpful to write down and discuss what your client's purpose is for starting therapy.

Is treatment plan more meaningful than term paper?

Without their feedback, your treatment plan is no more meaningful than a term paper with a bunch of words on it. Remember, your documentation serves you and the client, not the other way around! This is an ongoing conversation to have throughout treatment.

Is therapy hard work?

Therapy is often hard work but can have amazing results. However, success is 100% dependent on the client's motivation and willingness to engage in the process. 3. Support. Another aspect of treatment planning that is so often forgotten in private practice settings is the client's support system.

What is the initial treatment plan due?

Initial Treatment Plan Due Ongoing clinical documentation is to reflect “continued evaluation over an extended period of time beyond the initial emergency psychiatric evaluation to further evaluate for the most appropriate level of care.”

What is CBH compliance?

CBH Compliance has been tasked with ensuring that our providers adhere to documentation standards presented in state regulations, bulletins, CBH contractual documents, etc. Complying with rules and regulations related to treatment planning remains a significant concern and accounts for a large portion of overpayments identified in compliance audits.

What are the final rules for HRAs?

Specifically, the final rules allow HRAs and other account-based group health plans to be integrated with individual health insurance coverage or Medicare , if certain conditions are satisfied (an individual coverage HRA). The final rules also set forth conditions under which certain HRAs and other account-based group health plans will be recognized as limited excepted benefits (an excepted benefit HRA).

What is the safe harbor for HRA?

The proposed regulations under Code section 4980H that were issued on September 30, 2019 provide safe harbors for determining whether an offer of an individual coverage HRA pursuant to the June 2019 final rules is an offer of minimum value, affordable coverage for purposes of the employer shared responsibility provisions. These regulations are proposed to apply for periods beginning after December 31, 2019. Under the proposed regulations, which may be relied upon for periods during any plan year of an individual coverage HRA beginning before the date that is six months following the publication of any final regulations, an individual coverage HRA that is considered affordable under the applicable safe harbor (s) provides minimum value. Proposed Treas. Reg. § 54.4980H-5 (f) (3).

Can HRAs be integrated with Medicare?

Specifically, the final rules allow HRAs and other account-based group health plans to be integrated with individual health insurance coverage or Medicare, if certain conditions are satisfied (an individual coverage HRA). The final rules also set forth conditions under which certain HRAs and other account-based group health plans will be recognized ...