Get written authorization. Under federal law, doctors cannot tell you anything about an employee's medical treatment without the employee's permission. This means if you either must have the employee take the certification form to their doctor, or have them complete and sign an authorization form.

Full Answer

What is an employer status?

Employment status is the kind of work that an employee and an employer agree to when a work contract is signed and agreed upon. It sets the basic parameters of what type of employee the employee is being hired to be.

What are the benefits of employee status reporting?

Employee status reporting leads to more discussions and more bright ideas. For many employees (especially the Millennials), it's important to show what they have done. Employees want to know that their manager cares about them enough to pay attention to their work and employee status reporting gives you a chance to prove that you care.

Are employee status reports a waste of time?

An employee status report may seem like a waste of time for many employees but it's vital for running an effective team. Status reporting has many perks for both managers and employees. For managers knowing what everyone's doing is vital. But it also gives employees a sense of what's going on.

What are the different types of employment statuses?

These statuses include labels like full-time, part-time, or seasonal worker. It is important to understand employment status so that companies are compliant, employees understand job expectations and HR professionals can attract the best talent through your recruiting efforts.

How the status of an employee is determined?

Remuneration would be another factor to be considered in determining employee status. Generally, an employee would receive a fixed salary or fixed amount, paid on the same day each month or each week, irrespective of the employees output or level of competency.

What are the different types of employee status?

There are three different types of employment status:Employee.Worker.Self-employed.

What is the employment status?

An employment status refers to the rights and protections that employees are entitled to at work. The employment status determines the responsibilities that an employer owes to the employee. Whenever an employer hires new personnel, it is up to them to decide what type of employment status they are hiring under.

Which of the following is considered to be the leading test to determine employee status?

I.A. Determination of Employment Status and Common Law Test The primary method used to determine whether an employee-employer relationship exists is the "common law" test.

What are the 4 types of employees?

Types of employees:Full-Time Employees.Part-Time Employees.Seasonal Employees.Temporary Employees.

What are the 5 types of employees?

Companies may have as many as five or six types of employees working for them at once....The most common employee classifications include:Part-time employees.Full-time employees.Seasonal employees.Temporary employees.Leased employees.

Why is it important to determine employment status?

Employment status determines which employment rights apply to the individual concerned. The definitions of 'employee' and 'worker' differ slightly from one area of legislation to another, but generally workers have fewer rights than employees. However, if rights apply to a worker they usually also apply to an employee.

What are the three IRS factors that help to determine whether a worker is an employee or an independent contractor?

AB 5 requires the application of the “ABC test” to determine if workers in California are employees or independent contractors for purposes of the Labor Code, the Unemployment Insurance Code, and the Industrial Welfare Commission (IWC) wage orders.

What are the 2 tests in determining the existence of employer/employee relationship?

To ascertain the existence of an employer-employee relationship jurisprudence has invariably adhered to the four-fold test, to wit: (1) the selection and engagement of the employee; (2) the payment of wages; (3) the power of dismissal; and (4) the power to control the employee's conduct, or the so-called "control test. ...

What does the IRS require to determine if a person is truly acting as an independent contractor?

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.

What is the difference between a contract for service and a contract for employment?

There is a legal difference between a contract of employment (known as a 'contract of service') and a contract for service. A contract of employment applies to an employee-employer relationship. A contract for service applies in the case of an independent or self-employed contractor. A worker's employment status is not a matter of choice.

Do you have to be exposed to personal financial risk in carrying out the work?

they are not exposed to personal financial risk in carrying out the work. they do not assume any responsibility for investment and management in the business. they cannot profit from the management, scheduling or performance of the work. you set the work hours. they carry out work for you or your business only.

Is employment status a matter of choice?

A worker's employment status is not a matter of choice. It depends on the terms and conditions of the job. Usually it is clear whether an individual is employed or self-employed. If it is not obvious, the checklists below will help in deciding this. When looking at the criteria, you must consider the working conditions and the employment as a whole.

What is an effective employee status report?

An effective employee status reporting system is maybe one of the hardest systems to implement in a team. An employee status report may seem like a waste of time for many employees but it's vital for running an effective team.

How can feedback help employees?

Feedback from managers (either praise or encouragement) can go a long way to make employees feel better about the work they're doing. Increasing Collaboration.

Can you manage remote workers without status reporting?

Without status reporting, managing remote workers is simply not possible .

What are the three categories of exempt jobs?

There are three typical categories of exempt job duties: executive, professional, and administrative.

What is salary basis test?

What is the salary basis test? The salary basis test is used to make sure an employee is paid a predetermined and fixed salary that is not subject to reduction due to variations in the quality or quantity of work. It is used to ensure that the employee meets a minimum specified amount to qualify for the exemption.

How much do you have to be paid to qualify for the exemption?

According to the U.S. Department of Labor (DOL), in order to qualify for exemption, employees generally must be paid no less than $455 per week on a salary basis.

Is the salary basis test exempt?

An employee who meets the criteria of the salary level test and the salary basis test is exempt only if they also perform exempt job duties. The primary job duties test must meet all the requirements of Department of Labor regulations.

How to claim employee retention credit?

An eligible employer's ability to claim the Employee Retention Credit is impacted by other credit and relief provisions as follows: 1 If an employer receives a Small Business Interruption Loan under the Paycheck Protection Program, authorized under the CARES Act, then the employer is not eligible for the Employee Retention Credit. 2 Wages for this credit do not include wages for which the employer received a tax credit for paid sick and family leave under the Families First Coronavirus Response Act. 3 Wages counted for this credit can't be counted for the credit for paid family and medical leave under section 45S of the Internal Revenue Code. 4 Employees are not counted for this credit if the employer is allowed a Work Opportunity Tax Credit under section 51 of the Internal Revenue Code for the employee.

When is the employee retention credit due?

The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to employees after March 12, 2020, and before January 1, 2021.

What is the form 941 for employee retention?

In order to claim the new Employee Retention Credit, eligible employers will report their total qualified wages and the related health insurance costs for each quarter on their quarterly employment tax returns, which will be Form 941 for most employers, beginning with the second quarter. The credit is taken against the employer's share ...

Employee Status Report

Employee Status Report is Option 1 on the Funds Control System - Salaries and Benefits screen. This option provides a complete employee payroll status report by pay period showing earnings and Government contribution totals processed through CAS Central Accounting System .

To Select This Option

Type 1 or ESR at the Enter Report Code prompt on the Funds Control System - Salaries and Benefits screen.

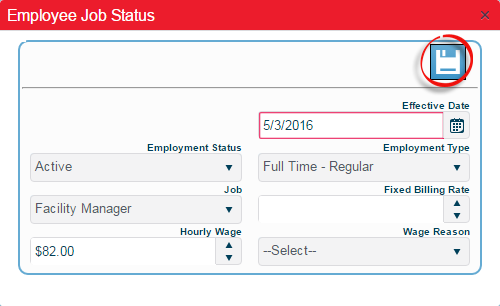

What is an employee status code?

An Employee Status Code defines whether the employee is currently working for the company and whether or not benefits and payments should be processed for the employee.

What is the status code for payroll?

An employee's Employee Status code (EmployeeStatusCd), which is seen on the Employment tab within the Employee Master (PER_EMPLOYMENT), identifies an employee's payroll processing status as "Process" or "Suspend". An easy way to see this through the online system is to look at the Employment tab.

What is the to list in payroll?

The "To" list in the Employee Message Center hides employees who lack an active payroll processing status, based on the employee's Employment Status. Typically, such employees are terminated, on a non-paid leave of absence, or are retired; however, this depends on the setup of the applicable Employee Status Code.

What does "Terminated Employee" mean in ESS?

On the Employee Status Code, having the "Terminated Employee" option selected effectively blocks users from being able to log into ESS with any role except ONBOARD, which would not be assigned to a terminated or retired employee.

Can an employee be terminated on leave of absence?

For instance, an employee may have been terminated, or an employee may be on a leave of absence. Where the Accrue Benefits checkbox is selected for the Employee Status Code, benefits continue to accrue. In addition, employees' assigned employment statuses are used to produce the Employee Turnover Report.

Can you enter time in payroll if you are suspended?

A message line indicates, " [The employee] is suspended from payroll processing. Time cannot be entered."