The tax result depends upon whether an easement for, say, utilities affects all of the property or only a specific part of it. When only a specific part is affected, the measurement of the owner’s gain is the difference between the payment received for the sale of an easement and the basis (usually cost) of the property allocated to that part.

What happens to an easement when a property is sold?

Any payment received from a utility for permanent access easement is considered a sale of property, not treated as income or taxed in the year received. Instead, the basis of the property is decreased by the amount of the easement. This will affect the amount of annual depreciation and the capital gain subject to tax when you sell the property.

Does SDLT apply to the purchase of an easement?

Easement. The amount received for granting an easement is subtracted from the basis of the property. If only a specific part of the entire tract of property is affected by the easement, only the basis of that part is reduced by the amount received.

How does the IRS treat easement payments?

If you've owned the property for more than a year, you pay the long-term capital gains rate, which is often lower than conventional income-tax rates. To figure the gain, you have to figure the value of your land, then determine the value of the specific square footage taken by the easement.

Can I sell an easement on my property?

Feb 24, 2022 · Easements are treated as a recovery of the basis of the property first, with any excess proceeds treated as capital gain, which is taxed at a lower rate than ordinary income. The basis of property that offsets an easement is limited …

Is sale of an easement a capital gain?

Easements are treated as a recovery of the basis of the property first, with any excess proceeds treated as capital gain, which is taxed at a lower rate than ordinary income. The basis of property that offsets an easement is limited to the basis of the affected acres or square footage.Feb 24, 2022

How do you calculate basis for easement?

Sale of an easement at full fair market value. Under the conservation easement regulations, a portion of the basis of the farm must be allocated to the easement. Since the easement is worth 30% of the value of the entire farm, 30% of the farm's $100,000 basis, or $30,000, is allocated to the easement.

Is the sale of land considered a capital gain?

The IRS considers land to be a capital asset just like other types of real estate or shares of stock. As such, when you sell it, you will be liable for capital gains tax if the sale is profitable. Furthermore, if you depreciated land improvements, you will also need to pay depreciation recapture tax on them.May 21, 2019

Are Proceeds from eminent domain taxable?

Eminent domain involves the transfer of real estate title in exchange for the payment of compensation which the Internal Revenue Code (the “Code”) generally treats as an ordinary taxable sale of property.Mar 28, 2016

What is current capital gains tax rate 2020?

The tax rate on most net capital gain is no higher than 15% for most individuals. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $40,400 for single or $80,800 for married filing jointly or qualifying widow(er).Feb 3, 2022

What is the capital gains tax rate for 2021?

2021 Long-Term Capital Gains Tax RatesTax Rate0%15%SingleUp to $40,400$40,401 to $445,850Head of householdUp to $54,100$54,101 to $473,750Married filing jointlyUp to $80,800$80,801 to $501,600Married filing separatelyUp to $40,400$40,401 to $250,8001 more row•Feb 17, 2022

How do I avoid capital gains tax on land sale?

Exemptions from your Gains that Save Tax Section 54F (applicable in case its a long term capital asset)Purchase one house within 1 year before the date of transfer or 2 years after that.Construct one house within 3 years after the date of transfer.You do not sell this house within 3 years of purchase or construction.More items...•Jan 13, 2022

How do you calculate profit from sale of property?

Step 1: Add up the cost of selling your house, including all taxes and necessary fees, commissions, and outstanding mortgage balance if selling home property liens. Step 2: Subtract the entire house selling cost from the final purchase price. The answer will be your net proceeds.

Do I have to pay tax if I sell my land?

You have to pay tax at flat rate of 20% and cess of 4% on such tax if you do not wish to avail any avenue for exemption of long term capital gains.Jul 11, 2021

What is a 1033 tax exchange?

A 1033 exchange is a property investment practice that allows property owners to avoid tax liability on capital gain that occurs as a result of the forced loss of a property.Feb 18, 2019

Are condemnation proceeds taxable?

Compensation received for condemned property is taxable, just like the proceeds of any other type of real estate sale. Property owners should plan to face a tax liability for any taxable gain that occurred regarding the property.

Is gain on involuntary conversion taxable?

Gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. You report the gain or deduct the loss on your tax return for the year you realize it.Feb 14, 2022

Why is no allocation necessary?

Suppose, though, that no allocation is necessary because the entire property is affected or it’s impossible or impractical to make an allocation due to the nature of the easement or of the property. Then the sales proceeds simply reduce the total basis of the property.

What is the measurement of owner's gain?

When only a specific part is affected, the measurement of the owner’s gain is the difference between the payment received for the sale of an easement and the basis (usually cost) of the property allocated to that part.

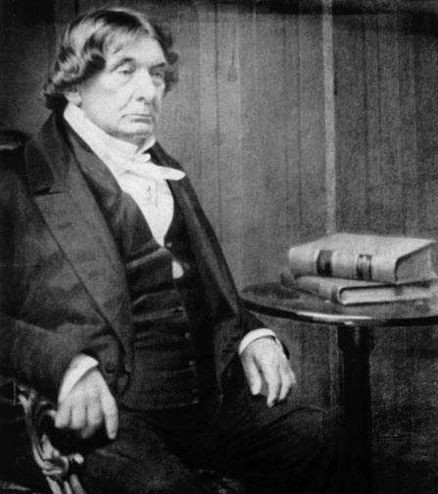

Who is Julian Block?

Attorney and author Julian Block is frequently quoted in the New York Times, Wall Street Journal, and the Washington Post. He has been cited as “a leading tax professional” ( New York Times ), an “accomplished writer on taxes... Read more from Julian Block.

What is tax treatment for an easement?

Tax Treatments for an Easement. An easement is a right wherein a property owner grants the use of all or part of his property without ceding ownership. Utility easements and conservation easements are the two most common. The IRS allows tax breaks for both, so it's vital to know the difference and be certain to use the correct forms ...

What is a historic easement?

Historical easements are a popular category of conservation easements. If your property is located in a registered historic district, you may grant an easement of the exterior of the building, often called a facade easement, to a governmental unit or a publicly funded organization dedicated to the preservation of the historical architecture in your area. Qualified easements must meet all of these requirements: The restriction must preserve the exterior of the building and prohibit any change that interferes with its historic characteristics; you and the organization must prove in writing that the organization's purpose is conservation and has the resources to enforce building restrictions; and you must include a written appraisal, photographs of the building's exterior and a list of restrictions on zoning, construction, etc., which the charitable organization intends to enforce.

What is conservation easement?

Conservation easements fall into several categories: preserving land for parks, recreation, natural habitat for wildlife; open space (including farm and ranch land); and preservation of historical structures. For tax purposes, conservation easements are treated as donations to the organization that oversees ...

What line do you report temporary access to your property?

If receive a payment for such access it is considered income, and should be reported on Form 1040, line 21 as other income. Advertisement.

Is a permanent access easement considered a sale?

Any payment received from a utility for permanent access easement is considered a sale of property, not treated as income or taxed in the year received. Instead, the basis of the property is decreased by the amount of the easement.

Do utility companies have to use your property?

Your utility companies may need to use a portion of your property for telephone poles and wires, storm drains, electrical power lines or gas pipes below the surface. The utility companies compensate the property owner for permanent access, including possible damage to property in the contract when the easement is granted.

What is a MACRS asset?

MACRS assets include buildings (and their structural components) and other tangible depreciable property placed in service after 1986 that is used in a trade or business or for the production of income . For more information on partial dispositions of MACRS property, see Treasury Regulations section 1.168 (i)-8 (d).

What is a 1231 transaction?

Section 1231 transactions are sales and exchanges of real or depreciable property held longer than 1 year and used in a trade or business. They also include certain involuntary conversions of business or investment property, including capital assets. See Section 1231 Gains and Losses in chapter 3 for more information.

What is the difference between a corporation and a partnership?

A corporation and a partnership if the same persons own more than 50% in value of the outstanding stock of the corporation and more than 50% of the capital interest or profits interest in the partnership.

What is a welfare fund?

An employer (or any person related to the employer under rules (1), (2), or (3)) and a welfare benefit fund (within the meaning of section 419 (e) of the Internal Revenue Code) that is controlled directly or indirectly by the employer (or any person related to the employer).

How long does a timber owner hold the timber?

You are the owner of the timber. You held the timber longer than 1 year before its disposal. You kept an economic interest in the timber. You have kept an economic interest in standing timber if, under the cutting contract, the expected return on your investment is conditioned on the cutting of the timber.

What is a like kind exchange?

An exchange of city property for farm property, or improved property for unimproved property, is a like-kind exchange. The exchange of real estate you own for a real estate lease that runs 30 years or longer is a like-kind exchange. However, not all exchanges of interests in real property qualify.

How much of a stock must you own to be in control of a corporation?

To be in control of a corporation, you or your group of transferors must own, immediately after the exchange, at least 80% of the total combined voting power of all classes of stock entitled to vote and at least 80% of the total number of shares of all other classes of stock of the corporation. .

What happens if money changes hands?

If money does change hands, it could be for a temporary easement -- access to a work site when someone's laying pipe -- or a permanent grant to use the property. If the government goes to court and forces you to accept an easement, the payments are taxable even though you objected to the deal.

What is permanent easement?

A permanent easement on your property is capital gains income. If you've owned the property for more than a year, you pay the long-term capital gains rate, which is often lower than conventional income-tax rates. To figure the gain, you have to figure the value of your land, then determine the value of the specific square footage taken by ...

When do you get a 1099 for an easement?

Whoever is paying for the easement will send you a Form 1099 at the end of the year. If you get a 1099-MISC for rental payments, you report the income on Schedule E. For a permanent easement, you get a 1099-S and use Schedule D to report capital gains.

Is an easement taxable?

It could be the water company running a pipe under your garden, the city using part of your yard for a sidewalk or someone taking a shortcut across your yard. If you get money for easement rights, it's usually taxable income.

Do you have to report capital loss on easement?

If your calculations on the value of the easement land show you have a capital loss, you don't have to report the income, but you should still keep records of the payments you received. A graduate of Oberlin College, Fraser Sherman began writing in 1981.

Can you write off a donation of easement?

If you donate the easement and it meets the federal requirements you can take a charitable donation tax write-off for the loss of land value. This also lowers the value of the land when figuring estate taxes and may reduce your property taxes.

How are easements obtained?

They are often obtained through eminent domain proceedings. Whether a transaction granting a person or entity the right to use property results in capital gain or ordinary income depends on whether it is treated as an easement ...

What happens if the owner of an easement retains no beneficial rights?

If the property owner granting the easement retains no beneficial rights, the property owner recognizes gain or loss. If the grantor retains significant beneficial rights, the property owner applies proceeds against basis in the tract and recognizes gain to the extent the proceeds exceed basis.

What is a temporary easement?

Construction operations usually require a temporary easement that exceeds the width of the permanent easement, to provide space for access, equipment, and material storage, or for boring sites. Designating such space as a temporary easement and allocating payments to its use will trigger rental income.

What is contingent reversion?

A contingent reversion in the event the easement is not used or is abandoned does not defeat easement status. 21. A reversionary event that necessarily or probably will occur, such as the passage of a term of years, is fatal to easement status.

What is surface rights?

Surface rights granted for oil and gas exploration are frequently deemed to be leases. Retaining certain reversionary rights can frustrate sale treatment. A reversion right causes the easement to revert to the original owner upon the occurrence or nonoccurrence of an event, condition, or fact.

What is retention of rights?

The retention of those rights connotes the sale of an easement rather than of the underlying tract. Transactions that are labeled as a sale of an easement are often intentionally or unintentionally structured as a lease of or license to use the land in question.

What is pipeline rights of way?

Pipeline rights of way usually take the form of perpetual easements. An easement is a real property interest that is subject to sale. A conveyance of a perpetual easement where the grantor retains no significant beneficial rights is considered a sale of the underlying tract of land. 5 Property owners commonly retain beneficial rights to use the subservient property, provided they do not interfere with the use of the easement. The retention of those rights connotes the sale of an easement rather than of the underlying tract.