How often can I use the home sale tax exclusion?

Mar 03, 2017 · Home sale exclusion requirements The full exclusion amount is $500,000 for married taxpayers filing jointly and $250,000 for everyone else. In order to qualify for it, …

What are the requirements for a home sale exclusion?

What is the full exclusion amount for federal income tax?

What are the advantages of exclusionary rule?

Learn how you might still qualify for this incredibly valuable deduction even if you don't meet all the requirements

Please answer a few questions to help us match you with attorneys in your area.

Free Case Evaluation

Please answer a few questions to help us match you with attorneys in your area.

How often can you use the $250,000/500,000 exclusion?

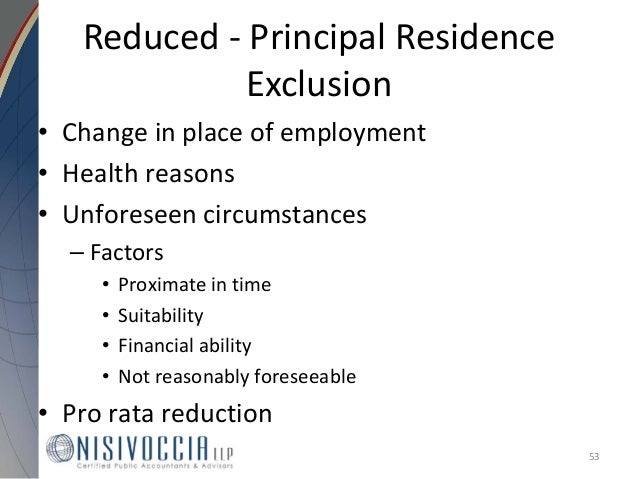

However, to qualify for the tax exclusion, you must own and occupy the home as your principal residence for at least two years out of the five years before you sell it. Moreover, you can use the exclusion only once every two years. For details, see " The $250,000/$500,000 Home Sale Tax Exclusion .". Unfortunately, it's not always possible ...

How long is a partial home sale exclusion?

A partial home sale tax exclusion is ordinarily limited to the percentage of the two years up to the date of the sale that you owned and occupied the home as your principal residence.

Do not sell personal information?

Do Not Sell My Personal Information. The best tax break for homeowners is the home sale tax exclusion. If you qualify, you don't have to pay any income tax on up to $250,000 of the gain from the sale of your principal residence if you're single, or up to $500,000 if you're married and file a joint return.

What are the reasons for moving?

The IRS has established several unforeseen circumstances safe harbors. If you move for one of these reasons, you will automatically qualify for a partial tax exclusion: 1 a death in the family 2 losing your job and qualifying for unemployment 3 not being able to afford the house anymore because of a change in employment or marital status 4 a natural disaster that destroys your house, or 5 you or your spouse have twins or another multiple birth.

He Is Violent, Homicidal, or Suicidal

One of the most important things we need to establish in this blog post is that we are trained and experienced in a very specific type of teenage therapy. But, a lot of people hear the word “therapist” and assume it’s a catch-all title for a person who can treat any and every type of mental illness or distress.

He Requires Medical Detox or Intensive Maintenance

Although we are an inpatient facility here at Kaizen Academy, we focus much more on mental health than physical health. Many inpatient programs are medical in nature, with a fair share of nurses, doctors, and medical beds always nearby.

He Excessively and Extensively Runs Away

You sure don’t need us to tell you that it can be exceedingly difficult to help a teenager to correct their bad habits. How do you do it? Push them too hard, and they resent you. Leave them to their own devices, and they self-destruct.

What is the exclusionary rule?

1. It is a rule that has no effect on the innocent. The exclusionary rule is a legal concept that is designed to shield someone who would normally be convicted of a crime because of their actions. Although there may be more searches and seizures of the general population, those who are innocent will still be innocent.

What are the disadvantages of the exclusionary rule?

The disadvantage of the exclusionary rule is that it can allow people who are clearly guilty to be freed on a legal technicality. It places the burden of providing a clear chain of evidence on law enforcement officials that includes a reasonable cause for taking actions. Here are some of the other key points to consider in this conversation about ...

Which amendment protects against illegal searches?

It is a rule that is based on the Fourth Amendment, which protects individuals from illegal searches and/or seizures. In some cases, the Fifth Amendment may also apply, which states that a person cannot be compelled to be a witness against themselves in a criminal proceeding. Under the process of the exclusionary rule, ...

What happens if you are accused of wrongdoing?

Even if a person is accused of wrongdoing, their actions must be examined before they are subjected to a search. Although this requires additional steps in the chain of evidence, the time, effort, and monetary investment that is needed is minimal.

Why is the exclusionary rule important?

The exclusionary rule supports this concept because people, even if charged with a crime, are still assumed to be innocent. Reporting on a person’s conduct can cause society to pre-judge individuals, but one of the core concepts in the U.S. justice system is to receive a fair trial. The exclusionary rule promotes fairness. 5.

How much does a police officer make an hour?

The average salary of a U.S. police officer is about $58,240, or about $28 per hour. At 7.65 million hours of work, that’s $214.2 million in administrative spending for the exclusionary rule. The goal of any justice system should be to provide an outcome that is fair for all parties involved.

What is the goal of the justice system?

The goal of any justice system should be to provide an outcome that is fair for all parties involved. These exclusionary rule pros and cons are one way the United States attempts to create that outcome.

How much does it cost to treat a house?

Treatment for the entire home ranges from $1,200 to $2,500 or more and often requires tenting the house. Prices may be set as a flat rate or by size, around $5 to $20 per linear foot.

How much does heat treatment cost?

Heat treatment averages about $800 to $2,500, or around $10 per linear foot. Homeowners may prefer this because it is chemical-free, organic pest control. It can work for the entire house or for localized activity in a dining room, basement or attic.

What is Termidor termite?

Termidor is a popular brand of term iticide that controls subterranean, drywood and dampwood termites. It is available only to licensed professionals. Homeowners should consult a Termidor Certified Professional in their area for pricing.

How much does termite bait cost?

Termite bait systems cost around $8 to $12 per linear foot. Pros may charge more for the placement of additional baits after initial installation. This form of treatment often costs more than chemical application because it is less precise and may require more visits.

How to control termites in a house?

Enclose the home in a tent to control internal temperature. Force hot air inside until it reaches 150 degrees Fahrenheit. Monitor the home's structural wood temperature until it reaches 120 degrees Fahrenheit, to eliminate termite colonies and activity.

How to get rid of termites in a tent?

Monitor the home's structural wood temperature until it reaches 120 degrees Fahrenheit, to eliminate termite colonies and activity. Take down the tent and allow homeowners to return after the inside temperature returns to normal.

How much does it cost to spray termite repellent?

Applying repellent to prevent termites from developing a colony may cost as much as a regular treatment, or $225 to $2,500. Which method the professional uses depends on when they visit the construction site to apply the treatment. Spraying repellent on soil prior to the installation of the foundation may take less time.

What percentage of your income can you deduct for dental and medical expenses?

You can deduct only the amount of eligible medical and dental expenses that is more than 7.5 percent of your adjusted gross income. As part of your medical expenses, you can include amounts you paid for special equipment installed in a home, or for improvements, if their main purpose was medical care for you, your spouse, or a dependent.

What percentage of your adjusted gross income can you deduct for accessibility modifications?

You can deduct only the amount of eligible medical and dental expenses that is more than 7.5 percent of your adjusted gross income.

What can you include in medical expenses?

As part of your medical expenses, you can include amounts you paid for special equipment installed in a home, or for improvements, if their main purpose was medical care for you, your spouse, or a dependent.

What is the IRS 502?

IRS Publication 502 indicates that “amounts paid by a renter to buy and install special plumbing fixtures in a rented house for a person with a disability, mainly for medical reasons, are medical expenses.”.