Do medical bills match the cost of treatment?

Estimates for medical procedures don’t always match what people are eventually charged. Getty Images Experts say medical bills are many times much higher than original estimates for surgery, treatments, and other procedures. A new law that took effect Jan. 1 requires healthcare providers to be transparent on their prices.

How long does it take for a patient to receive a bill?

Then, once a bill is sent to the insurer, health care providers have to wait for payment before billing a patient for the balance. It's not unusual for it to take several months before a patient receives a bill, and providers often have until the statute of limitations runs out to collect on an outstanding debt.

How many Americans don’t understand their medical bills?

Notably, 41% of Americans do not understand their medical bills. 1 Below are some tips and resources to help you understand your health insurance bill, billing errors, and how to check or negotiate your medical bill when your health insurance bills are confusing.

What do you need to know about your medical bill?

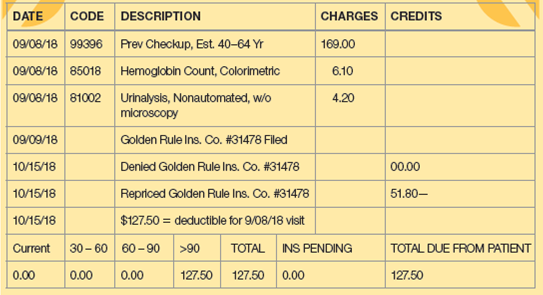

If you have questions regarding your bills and balance, you need to provide this number when contacting your healthcare provider’s billing office. Account numbers are also typically used when you pay for a bill online. Service Date: Your bill includes a column listing the dates you received each medical service.

What percentage of medical bills are wrong?

80%Upwards of 80% of Medical Bills Contain Errors According to Pat Palmer, CEO and founder of Medical Billing Advocates of America, his organization finds errors on three out of four medical bills they review.

How do you negotiate out of medical bills?

If you're negotiating a balance bill from an out-of-network provider, call your insurance company and ask for the market rate (e.g., what they would have paid an in-network provider) for that service....Use your research about the market rate as leverage.Offer to pay cash, if you can. ... Ask to set up a payment plan.More items...

Should I negotiate medical bills?

You will always get lower interest rates when you negotiate directly with the health care provider." In many cases, hospital and clinic bills are actually interest free.

How are hospital charges calculated?

Multiplying each hospital's overall cost-to-charge ratio by total charges provides an estimate of the hospital's costs. The cost-to-charge ratio can be used to estimate the cost of some specific procedures or to compare hospital costs between different facilities in the same local area or in other areas of the country.

Do medical bills affect your credit?

Most healthcare providers do not report to the three nationwide credit bureaus (Equifax, Experian and TransUnion), which means most medical debt is not typically included on credit reports and does not generally factor into credit scores.

Can medical debt be forgiven?

How does medical bill debt forgiveness work? If you owe money to a hospital or healthcare provider, you may qualify for medical bill debt forgiveness. Eligibility is typically based on income, family size, and other factors. Ask about debt forgiveness even if you think your income is too high to qualify.

How can I negotiate a lower doctor bill?

How to negotiate medical billsTry negotiating before treatment.Shop around to find cheaper providers before your service.Understand what your insurance covers ─ and what it doesn't.Request an itemized bill and check for errors.Seek payment assistance programs.Offer to pay upfront for a discount.Enroll in a payment plan.More items...•

Why are medical bills so expensive?

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Who is responsible for hospital bills after death?

In most cases, the deceased person's estate is responsible for paying any debt left behind, including medical bills. If there's not enough money in the estate, family members still generally aren't responsible for covering a loved one's medical debt after death — although there are some exceptions.

Why are my doctor visits so expensive?

A. A facility fee is an additional charge that some medical practices can add to the cost of each doctor visit. The additional charge usually comes as a surprise because, unlike an exam or a test or treatment, the facility fee is not tied directly to hands-on care.

How much is a hospital stay per day?

Total health care spending in America went over $4 trillion in 2020 and more than 30% of that – or about $1.24 trillion – was spent on hospital services. Hospital costs averaged $2,607 per day throughout the U.S., with California ($3,726 per day) just edging out Oregon ($3,271) for most expensive.

What is percent of billed charges?

A. While not as prevalent as it was in the past, the percent-of-charges method is a reimbursement approach commonly used by non-governmental payers to compensate hospitals and other facilities. The formula is simple. The total charges reported on the claim are multiplied by the contracted percentage.

How much do providers mischarge?

He says providers usually mischarge for up to 2 percent of their total amount billed every year.

What did Trump propose to do about healthcare prices?

In July, President Trump proposed that hospitals be required to post prices they’ve negotiated with insurers online. A month earlier, he signed an executive order aimed at giving Americans more information about their healthcare costs.

How to avoid billing snafus?

Jain says the best way for people to avoid billing snafus is to negotiate an “all-inclusive bundled price with a provider ahead of the procedure,” which is how his company operates.

How many providers does Scott see?

Scott sees the mistakes every day, as his business is fixing those errors for more than 200 providers nationwide before they get to patients.

What is CMS transparency?

The CMS (Centers for Medicare and Medicaid Services) hospital transparency rule is a new federal mandate that went into effect Jan. 1, requiring providers to post price lists online.

How much did Barry Pack pay upfront for knee replacement?

He believed the $4,000 he paid upfront was the end of his share.

Why was Tyler G. hospitalized?

Tyler G. was hospitalized earlier this year for severe depression.

How many Americans do not understand their medical bills?

Notably, 41% of Americans do not understand their medical bills.

How to check medical bills?

You can check your medical bills yourself using the tools we provided above. Start by trying to check the billing codes and fees being charged. Then, make a call to your health insurance provider and ask them to explain the EOB. You can also make calls to the medical service provider.

How much medical billing error is there?

Equifax did a study on medical billing and found that hospital bills totaling $10,000 or more had on average $1300 of medical billing errors on them. According to Derek Fitteron, CEO of Medical Cost Advocate, experts say that 80% of medical bills may contain errors. 3

What is EOB in medical billing?

Understanding the Explanation of Benefits (EOB) An explanation of benefits is a summary of the costs that your medical provider billed your insurance for and what they did with the claim. The EOB is not a bill; it explains how the costs of your medical care (the medical bill) will be split between you and your insurer. 2 .

What are some examples of mistakes that might happen with coding on your medical bill?

Here are some examples of mistakes that might happen with coding on your medical bill which would cause a denial of coverage, but it is due to a mistake: Bundling errors. Often there are codes for a group of services or supplies that get bundled together. If the wrong code is used, or if a code is used outside of the bundle code, ...

Can you make a call to a medical billing service?

You can also make calls to the medical service provider. More hospitals and doctors' offices are working hard to help their patients understand their medical billing, and depending on the care facility, they may have people in the accounting and finance department willing to help you.

Can you make a call to a medical provider?

You can also make calls to the medical service provider. More hospitals and doctors' offices are working hard to help their patients understand their medical billing and depending on the care facility; they may have people in the accounting and finance department who will be willing to help you.

What is a claim to a doctor?

Path to improved wellness. After you visit your doctor, your doctor’s office submits a bill (also called a claim) to your insurance company. A claim lists the services your doctor provided to you. The insurance company uses the information in the claim to pay your doctor for those services. When the insurance company pays your doctor, it might send ...

Who does the lab send a claim to?

The lab will send a claim for the test to Mrs. Jones’s insurance company. The lab will also send a bill to Mrs. Jones. After the insurance company pays the lab, Mrs. Jones may need to pay the lab any remaining balance.

Do all insurance companies send EOBs?

Keep in mind that not all insurance companies send EOBs, and not all doctors’ offices send statements. You may receive one or the other or both.

Does the 'General Overview' apply to everyone?

This information provides a general overview and may not apply to everyone. Talk to your family doctor to find out if this information applies to you and to get more information on this subject.

Is an EOB a bill?

An EOB is not a bill. Your doctor’s office might send you a statement. A statement shows how much your doctor’s office billed your insurance company for the services you received. If you receive a statement before your insurance company pays your doctor, you do not need to pay the amounts listed at that time.

What is the standard system for hospital fees?

There is no standard system that determines what a hospital charges for a particular service or procedure. Many factors figure into hospital pricing, including an individual’s health circumstances, the cost of lab tests, X-rays, surgical procedures, operating room and post-surgical costs, medications, and doctors’ and specialists’ fees.

How much does Medicare spend on medical expenses?

In 2019, Medicare spent about $799.4-billion on benefit expenses for 61-million individuals who were age 65 or older or disabled, according to the U.S. Department of Health and Human Services. Inpatient hospital services accounted for 29% of that amount ($231.8-billion).

How to reduce surgery cost?

Reduce Surgery Costs — Become a master negotiator. But first, pare down the cost of everything. Research where the procedure will cost the least amount of money — from anesthesia to the surgeon to the hospital to the pharmacy — much like how everything needs to be in-network for insurance. How do you do this? Call everyone who is providing the care and explain your situation. Ask for the best rate offered to insurance companies. By being pleasant (but persistent), you can whittle thousands of dollars off your bill. People in billing will often help, whether it’s pointing you toward programs for people with financial difficulties or providing inside information (such as the savings from using a surgery center instead of a hospital).

How much does Medicare pay for hospital care?

Overall, Medicare payments account for nearly 20% of all hospital care costs. In 2019, Medicaid paid about $138.7billion for acute-care services, such as hospital care, physician services and prescription drugs. Its share of hospital admissions is about 20%, for whom it pays about 89% of all hospital costs.

What type of insurance pays most of the expenses?

In the best-case scenario, the patient will have primary insurance to pay most of the expenses, along with a secondary form of insurance that pays the remaining expenses.

What is a payment plan for surgery?

Payment Plans — They are commonly offered when surgery is routinely paid for by the patient instead of an insurance company. Sometimes, it’s a formal agreement for monthly payments. It could be a loan that involves the hospital or surgeon in the financial arrangements. Especially in the case of an unplanned or emergency surgery, hospitals are usually happy to establish a payment plan with willing patients. Monthly payments are more attractive than NO payments. And they should keep the debt from appearing on your credit report as a negative account.

What is international surgery?

International Surgery — Seeking healthcare outside of the United States — a practice sometimes known as “medical tourism,’’ has become a recent trend. In some cases, the procedures cost 75% less. Sometimes, foreign surgeons promote and advertise themselves. But let the buyer beware.

How many medical bills contain errors?

The nonprofit Patient Advocate Foundation estimates that about half of all medical bills contain incorrect charges, wrongly denied claims or surprise fees. “They may charge you for the wrong service or charge you twice for the same service or say you had an ibuprofen when you didn’t,” says Caitlin Donovan, spokesperson for the organization. Spotting an error can save you thousands of dollars, she adds. “That’s why it’s so important to scrutinize your bill.”

What is an adjustment on a doctor's bill?

If your bill includes an “adjustment” or a “plan discount,” that’s the difference between the full fee a doctor or facility charges for a service and the rate negotiated by your insurance company.

What to do if your bill does not include a detailed list of charges?

If your bill does not include a detailed list of charges, call the doctor's or hospital's billing office and ask for an itemized invoice. That's the only way to make sure you're being charged just for services you received.

What does "insurance payment" mean?

The “insurance payment” or “plan payment” shows what portion of the charges your insurance company has paid. If no payments appear here, your plan may not yet have paid what it owes — check with your insurer before paying the amount listed as due. If your bill does not include a detailed list of charges, call the doctor's or hospital's billing ...

What is an EOB in Medicare?

Every medical procedure or visit will show up on an explanation of benefits (EOB) from your insurance company or a Medicare Summary Notice (MSN). These list the services performed, what the doctor or hospital charged, what your insurance company or Medicare paid, and what you owe. Make sure the dates and codes on that statement match the bills you receive from medical providers.

How many digits are in a medical procedure code?

Every medical procedure has a corresponding five-digit code. These numerical systems, called Current Procedural Terminology (CPT) for insurance and the Healthcare Common Procedure Coding System (HCPCS) for Medicare, determine how much your provider will be paid.

Do medical bills include a total due?

In addition, many medical providers don’t include an itemized list of charges when they first bill you, especially for a hospital visit. Instead they lump all the charges together in what's called a “summary” bill, with a “total due” at the bottom. And some initial statements don’t factor in payments from Medicare or your insurance company, which could give you the impression that you owe more than you do.

How much did the John Muir hospital bill for the third bill?

How much did the the hospital (John Muir hospital) bill for this extended hospitalization? Over $367 thousand! That’s enough money to buy a very decent house most anywhere in the U.S.

How much is a routine test charged by insurance?

Anyone getting routine tests or a diagnostic workup from a hospital is likely to be charged five to ten times what an insurance company would pay for it (five to ten times what the service is really worth). So people are completely dependent on their health insurance for even small medical costs.

How much stamp did they use to send 8 cent debt?

As you look at this letter, remember: This 8 cent debt was SOLD to a collection agency, and they used a 44 cent stamp to send it.

Do hospitals pay their bills the same way?

But the hospitals do all their bills the same way, no matter who the payer is . So the best way for them to get paid is to put anything that might be reimbursed by any payer on every bill. An insurance company will happily ignore the things it doesn’t intend to pay, but will never add anything the hospital leaves out.

Is there a penalty for billing too much?

In other words, there is no penalty for billing too much for a service, but if the hospital doesn’t bill enough, it short changes itself . The only potential penalty would be for billing for a service not provided or a diagnosis not justified. Now let’s look at what all this means.

Do people depend on insurance for medical expenses?

So people are completely dependent on their health insurance for even small medical costs. In what other industry would you do this? Would you use your car insurance to buy windshield wiper fluid or replace a burned-out headlight? Would you use your homeowners insurance to replace a screen? In medicine, people are routinely billed several hundred dollars for trivial tests that shouldn’t cost more than a car headlight, just because they don’t have insurance, or the insurance company denied coverage for that test.

Is hospital time expensive?

Spending time in the hospital is very expensive. Rather than giving you an itemized list of everything that might go into a hospital stay, I’ll talk about something that should be almost as good: bills from a hospital, complete with final payments. That should give us a pretty good idea of the value of hospital services, since insurance companies have access to all the costs and specialize in being able to offer the minimum amount any institution is likely to accept.

How long does it take for a health insurance bill to be paid?

It's not unusual for it to take several months before a patient receives a bill, and providers often have until the statute of limitations runs out to collect on an outstanding debt.

How Old Is the Bill?

It could take longer than you think for a medical bill to arrive in your mailbox. "The longer that a provider waits, the more likely they can just bill your insurer," Vivero says. By waiting, your deductible is more likely to be met, meaning the insurance company will pay the entire amount and a provider won't have the hassle of collecting payment from the patient.

Do I Recognize All the Charges?

Once you have an itemized bill, review everything listed to ensure it matches your records or recollection of the care you received. "Patients should not accept anything that is either wrong or they don't understand," Otto says.

Are the Dates and Providers Correct?

Beyond looking at the charges themselves, double-check the dates and providers listed. "A hospital will charge you for every time someone pops their head into your room," says Sharona Hoffman, professor of law and bioethics at Case Western Reserve University in Cleveland, Ohio.

Are There Red Flags Indicating This Is a Medical Billing Scam?

Most billing problems are the result of human error. "Oftentimes, we're victims of honest mistakes," Vivero says. However, you do need to watch for medical billing scams.

Did I Get Billed for an Out-of-Network Provider?

Surprise billing, or balance billing, occurs when a patient believes they are getting care from an in-network provider, but the health care professional or facility is actually out-of-network. For instance, a person might be admitted to an in-network hospital, but a specialist providing services is not part of the network. As a result, an insurer may decline to cover some or all of their charges.

What to do if your insurance bill is higher than expected?

If a bill is higher than expected, confirm your insurer has been billed correctly. "Sometimes, the bill is literally wrong, (and) that might be a problem with insurance," Otto says. Compare your itemized statement to the Explanation of Benefits provided by your insurer to confirm they were billed for the same services.

How many medical bills contain erroneous charges?

Nearly 80% of medical bills contain erroneous charges, according to Becker Hospital Review. "Billing errors are common, and they are rarely in your favor," Latham says. You can check the billing codes against the three systems used in the health care industry.

What to do if medical bills go to collections?

You can negotiate with a creditor for a low-interest or interest-free payment plan with affordable monthly installments. Again, do not pay a creditor with a high-interest credit card just to get out from underneath the debt.

What to do if your medical bill is reduced?

Your next step is to negotiate a payment plan. Ask for a payment plan directly with the provider. "If you have medical bills you can't afford," Latham says, "don't put them on your credit card.

How long does it take for a hospital to report nonpayment?

Don't worry: The three major credit reporting agencies don't report nonpayment on medical bill information for 180 days, and hospitals are unlikely to immediately sic a creditor on you anyway. Plus, medical debt is treated differently than other types of debt. Yes, you should make a plan to negotiate sooner rather than later, but you can take a deep breath.

How to cut your medical bill in half?

Reach out to your health care provider's billing office. You can usually find this number right on your medical bill. "Ask if you qualify for charity care or financial assistance programs," suggests Latham. "Just asking for this can often cut your debt in half. It is worth noting that all nonprofit hospitals are legally required to have these programs, and many for-profit hospitals have them also."

What to do if you find an error on your health insurance bill?

If you find an error, call your health care provider and ask them to recode and re-bill your insurance company.

What to do if your hospital bill isn't reduced?

If your bill isn't reduced, and you cannot afford the amount due, ask about the hospital's or clinic's appeals process. Then file an appeal.

What to do if you can't afford medical bills?

If you don’t think you can afford your medical bills and you're facing overwhelming debt, consider looking into debt relief for your medical bills.

How long does it take for a medical bill to show up on your credit report?

As far as your credit reports are concerned, here's a bit of good news: There is a waiting period of 180 days before an unpaid medical bill will show on your credit reports. Also, medical accounts in collections that are paid later by health insurers will be removed from your reports.

What to ask when comparing a payment plan?

Tip: Ask if there are billing charges or any other fees associated with the payment plan, so you can assess the affordability.

What to do if you have an extended stay in the hospital?

If you've had an extended stay in the hospital or an intensive procedure, you’re probably facing a mountain of medical bills. You can hire a medical bill advocate to negotiate on your behalf. Advocates are experts in medical billing who know how to read health care bills and understand common costs for procedures.

What is a medical loan?

Personal loans. A medical loan for healthcare expenses can help you consolidate medical expenses or pay for emergency or planned procedures. Getting a personal loan may be best after you’ve exhausted other options, such as a payment plan or medical credit card.

Can a medical bill collector buy pennies?

For medical bills in collections , know that debt collectors generally buy debts for pennies on the dollar. That gives you some good leverage to negotiate. If you think you can haggle with your provider, you may be able to take the work of a medical bill advocate into your own hands.

Can you dedicate a medical card to a medical bill?

Tip: Dedicate the card only to medical bills if you do go this route. Otherwise it’ll be harder to keep records of the expenses for tax deductions or a medical savings account.