What to do when your insurance company denies your claim?

What to Do if Your Life Insurance Company Denies a Claim

- Contact the Insurer Sometimes, disputes over claims can be settled easily and with little to no effort by contacting your insurance company directly, explaining what happened, and asking for ...

- Contest the Rejection If you don’t get an answer or are not satisfied with their response, it’s time to go on the offensive! ...

- Engage with An Attorney

What to do when your health insurance claim is denied?

- Explain why your procedure or medication is necessary.

- Include evidence that supports your claim. ...

- Ask to expedite the appeal if you or your doctor feels that the denial of your claim could be life-threatening.

- Keep copies of everything you send to the insurance company for your records.

How to fight insurance denial?

How to fight insurance claim denial. Writing an appeal letter for your denied health insurance claim is a matter of sharing the proper information to have your case looked at as soon as possible. First, contact your insurer, inform them of the mistake you see and provide any necessary documentation.

Why your health insurance can be denied?

What Your Appeal Letter Should Include

- Opening Statement. State why you are writing and what service, treatment, or therapy was denied. Include the reason for the denial.

- Explain Your Health Condition. Outline your medical history and health problems. Explain why you need the treatment and why you believe it is medically necessary.

- Get a Doctor to Support You. You need a doctor's note. ...

Can insurance companies deny treatment?

Denial of Coverage for Out-Of-Network Treatments Under many Prefered Provider Organizations and almost all Health Maintenance Organizations and Exclusive Provider Organizations, insurance companies deny treatment as out-of-network if the treatment is not provided by an in-network healthcare provider.

Why would insurance deny a procedure?

Insurance companies deny procedures that they believe are more expensive or invasive than safer, cheaper, or more effective alternatives. It is possible that your insurer simply does not know about the procedure or that some other error has been committed, rather than a bad faith denial.

What are 5 reasons a claim might be denied for payment?

Here are some reasons for denied insurance claims:Your claim was filed too late. ... Lack of proper authorization. ... The insurance company lost the claim and it expired. ... Lack of medical necessity. ... Coverage exclusion or exhaustion. ... A pre-existing condition. ... Incorrect coding. ... Lack of progress.

What should you do if the insurance company denies a service?

If you are not satisfied with your health insurer's review process or decision, call the California Department of Insurance (CDI). You may be able to file a complaint with CDI or another government agency. If your policy is regulated by CDI, you can file a complaint at any time.

What are the 3 most common mistakes on a claim that will cause denials?

5 of the 10 most common medical coding and billing mistakes that cause claim denials areCoding is not specific enough. ... Claim is missing information. ... Claim not filed on time. ... Incorrect patient identifier information. ... Coding issues.

Do insurance companies dictate treatment?

The survey (PDF) of 600 doctors found that 89% said they no longer have adequate influence in the healthcare decisions for their patients. And 87% reported that health insurers interfere with their ability to prescribe individualized treatments.

What are two main reasons for denial claims?

Six common reasons for denied claimsTimely filing. Each payer defines its own time frame during which a claim must be submitted to be considered for payment. ... Invalid subscriber identification. ... Noncovered services. ... Bundled services. ... Incorrect use of modifiers. ... Data discrepancies.

How do denied medical claims work?

Six Tips for Handling Insurance Claim DenialsCarefully review all notifications regarding the claim. It sounds obvious, but it's one of the most important steps in claims processing. ... Be persistent. ... Don't delay. ... Get to know the appeals process. ... Maintain records on disputed claims. ... Remember that help is available.

How does rejection work in medical billing?

To successfully appeal denied claims, the billers must perform a root-cause analysis, take actions to correct the identifies issues, and file an appeal with the payer. To thrive, a healthcare organization must continuously address the front-end processes' problems to prevent denials from recurring in the future.

What is considered not medically necessary?

Most health plans will not pay for healthcare services that they deem to be not medically necessary. The most common example is a cosmetic procedure, such as the injection of medications, such as Botox, to decrease facial wrinkles or tummy-tuck surgery.

Why do insurance companies deny medications?

An insurance company may deny payment for a prescription, even when it was ordered by a licensed physician. This may be because they believe they do not have enough evidence to support the need for the medication.

How do you scare insurance adjusters?

The best way to scare insurance carriers or adjusters is to have an attorney by your side to fight for you. You should not settle for less.

How does insurance reduce costs?

Insurers are able to reduce medical costs by pre-negotiating reimbursement rates with hospitals and doctors, who are then listed as part of the insurer’s participating network. Patients usually face significant penalties for receiving treatment from an out-of-network provider or hospital, so even if the treatment is covered by the insurance plan, the patient has to pay more of the charges out of their own pocket. This can be especially problematic if your care requires treatment by multiple ancillary specialists who may not be within the network. Patients rarely learn in advance that the medical facility or specialist their in-network doctor recommends is not in the insurer’s network, thus leading to surprise charges after treatment.

What to do if you believe treatment is experimental?

If you believe the treatment that has been recommended by your doctor may be considered experimental, ask the doctor whether there have been issues obtaining insurance coverage for that treatment; and if so, how those issues have been resolved in the past. Most insurers have also compiled specific written policies or protocols for certain ...

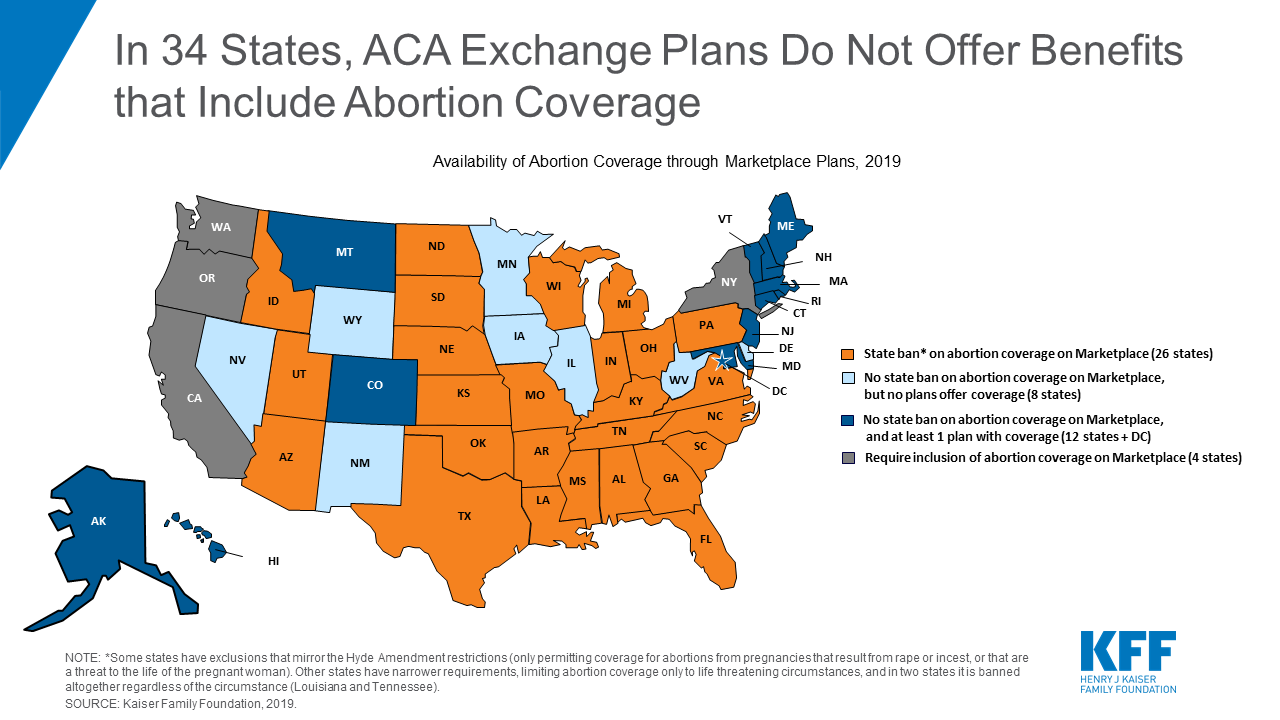

What does ACA mean for medical insurance?

Finally, many people have no understanding of what the Affordable Care Act (ACA) means with respect to medical coverage. Prior to the passage of that law, essential treatments like cancer care could be excluded from coverage or reimbursement would be markedly limited. The ACA mandates coverage for all essential benefits without annual or lifetime limits on the amount the insurer will reimburse. However, as a result of changes made to insurance coverage regulation during the Trump administration, many people have been hoodwinked into buying inferior coverage that is marketed as a “short-term” or “association” plans. Consumers should be extremely wary of the coverage they purchase if the price seems unbelievably low in comparison to other quotes they have received – it likely means the cheaper coverage is not comprehensive. However, if the medical insurance coverage is with recognized insurance company such as a Blue Cross plan, or through entities such as Aetna, Cigna, or Humana, unless the plan is explicitly marketed as a “short-term” plan, it will meet the requirements of the ACA.

Can cancer be denied?

Certain forms of cancer treatment may also be denied as not medically necessary. Although insurance companies steadfastly maintain that they do not practice medicine, they may question your doctor’s judgment and deem certain medications or therapies, even if FDA-approved, as unnecessary. Not surprisingly, such assessments usually fall heavily on more expensive drugs or treatments such as stem-cell transplants. The treating doctor needs to be able to offer a rationale explaining the medical necessity of prescribed treatment and explain why more invasive or expensive treatment is medically necessary and more effective than less expensive treatment.

What to do if your medical treatment is denied?

If your medical treatment is being denied, talk with your workers’ compensation attorney about how to get it approved.

How to beat medical denials in Georgia?

To beat medical treatment denials, you first need to know if the insurance company has a valid reason for denying treatment. To do that, you need to understand the law. Georgia’s workers’ compensation law on medical treatment has some basic rules: Your authorized treating physician (ATP) directs your medical treatment.

How long does it take for insurance to respond to a WC-205?

The insurance company has a deadline of 5 business days to respond. If there is no response, the treatment should be automatically approved. A Form WC-205 can help beat a medical treatment denial. Sending one should get the treatment approved or get an answer about why it is being denied.

Does insurance pay for unauthorized treatment?

The insurance company does not have to pay for “unauthorized treatment ”. “Unauthorized treatment” could be treatment provided by a doctor other than your authorized treatment physician or a referred physician.

Who directs your medical treatment?

Your authorized treating physician (ATP) directs your medical treatment. The insurance company should pay for the medical treatment ordered by the ATP. The insurance company should also pay for medical testing ordered by the ATP. Your authorized treating physician may refer you to other doctors for specialized care.

Can a doctor call and fax an insurance claim?

No answer at all – The doctors office has called, faxed, and emailed but cannot get a response from the insurance company. The insurance company should pay for the medical treatment for your injury. That rule is fundamental to Georgia workers’ compensation law.

Why do insurance companies deny claims?

Here are some of the other common reasons that health insurers deny claims: Procedure is not medically necessary. Not covered by the policy. Untimely claim. Procedure is experimental. Lack of prior authorization or referral. Inaccurate physician coding. Incomplete or inaccurate insurance information.

Can insurance companies cancel policies?

In addition, many large health insurers have been accused of illegally canceling, retroactively, policies of people whose conditions are expensive to treat, leaving them to pay for crippling medical bills while they face fatal health conditions such as cancer.

Why does my insurance not approve my request?

Reasons that your insurance may not approve a request or deny payment: Services are deemed not medically necessary. Services are no longer appropriate in a specific health care setting or level of care. The effectiveness of the medical treatment has not been proven. You are not eligible for the benefit requested under your health plan.

How to appeal a health insurance claim?

Your insurer must provide to you in writing: 1 Information on your right to file an appeal 2 The specific reason your claim or coverage request was denied 3 Detailed instructions on submission requirements 4 Key deadlines to submit your appeal 5 The availability of a Consumer Assistance program, if available in your state

Is the effectiveness of the medical treatment proven?

The effectiveness of the medical treatment has not been proven. You are not eligible for the benefit requested under your health plan. Services are considered experimental or investigational for your condition. The claim was not filed in a timely manner.

Does prior authorization guarantee payment?

It is important to remember, that prior authorization does not guarantee payment of the claim. There are multiple levels of appeal. Even if the first appeal is denied, you have additional levels of appeals that will be outlined in your denial documents.

Why did health insurance companies keep their old plans?

Some health insurance providers kept their old plans for the rest of the year after Obamacare went into effect, so that people’s plans wouldn’t just be changed out from underneath their noses. This continued many exclusions even after the ACA went into effect.

Why would companies refuse to pay for anything from diabetes testing strips to chemotherapy?

Companies would refuse to pay for anything from diabetes testing strips to chemotherapy, because it was allowed. Since the Affordable Care Act, plans are now required to cover one drug in each category of the U.S. Pharmacopeia, or compendium of drug information.

Can health insurance companies refuse to cover a car accident?

Health Coverage. Before the Affordable Care Act went into effect in 2014, health insurance companies were legally allowed to exclude and/or refuse to cover whatever they wanted in their plans. It didn’t matter if it was a flu shot or in-patient hospital care after a car accident, whatever was in the contract was what both parties agreed to, ...

Can you add prescription drug coverage to ACA?

Luckily, prescription drug coverage is one of 10 essential health benefits that are required by the ACA. What this means is that insurers are no longer legally allowed to add on a prescription drug benefit plan to a healthcare plan at an additional price.

Can insurance companies charge you more?

Now, they cannot charge you more or deny coverage to you based on pre-existing conditions or your current health.

Do you have to have a brand name to be covered by a health plan?

While brand names are not required to be covered, the cost of a generic or alternate brand must be provided for. In addition to this, patients and doctors can now also request and be granted access to clinically appropriate drugs that are not covered by individual health plans.

Can insurance companies refuse to pay for medication?

In conclusion, since the Affordable Care Act, health insurance companies can no longer refuse to pay for necessary medication when there is no alternative. If there is only one drug in a category, it’s covered, and if there are several, at least one is required to be covered.