When stock dividends are declared, the amount is debited equivalent to the amount generated by multiplying the current stock price by the shares outstanding by the dividend percentage. Once stock dividends are paid for, the amount is subsequently reduced from the Retained Earnings and increased in the Common Stock account.

Full Answer

How are dividends treated in accounting?

The Accounting Treatment of Dividends. As your company grows and earns a profit, you have the choice of either reinvesting the profits back into your company or distributing them to your shareholders in the form of a dividend. Most of the time, businesses and business owners aren’t required to issue dividends.

How much does a stock dividend reduce a stock price?

A 2% stock dividend paid on shares trading at $200 only drops the price to $196, a reduction that could easily be the result of normal trading. However, a 35% stock dividend drops the price down to $130 per share, which is pretty hard to miss.

How are dividends paid out in the stock market?

How Dividends Are Paid Out. Dividends are usually paid in the form of a dividend check, but they may also be paid in additional shares of stock. The standard practice for payment of dividends is a check that is usually mailed to stockholders a few days after the ex-dividend date, the date on which the stock starts trading without...

When to expect a stock dividend payment?

When to expect a stock dividend payment. If a dividend is declared, shareholders are notified via press release, and the information is usually reported through major stock quoting services for easy reference. At the time of declaration, a record date is set, meaning all shareholders on record on that date are entitled to the dividend payment.

What happens to stock price when dividend is paid?

After the declaration of a stock dividend, the stock's price often increases. However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share, and the stock price is reduced accordingly.

What is the correct treatment of a stock dividend?

A business typically issues a stock dividend when it does not have sufficient cash to pay out a normal dividend, and so resorts to a "paper" distribution of additional shares to shareholders. A stock dividend is never treated as a liability of the issuer, since the issuance does not reduce assets.

How do you calculate stock price after dividend?

To figure the new average price after a stock dividend, convert the percentage of the stock dividend to a decimal by dividing by 100. Then, add it to 1. Finally, divide the initial stock price by the result to find the new stock price.

What is the correct treatment of a share dividend issued in mid year?

The stock dividend should be weighted by the length of time that the additional number of shares are outstanding during the period.

What is the journal entry for dividend paid?

Cash dividends are paid out of the company's retained earnings, so the journal entry would be a debit to retained earnings and a credit to dividend payable.

Does stock price drop on ex-dividend date?

Ex-Dividend Values On the ex-dividend date, the share price drops by the amount of dividend to be paid. This price drop actually maintains the investment value of the stock. Consider a stock with a share price of $50 the day before going ex-dividend with a $1 dividend to be paid.

Do dividends go down when stock price goes down?

Since dividends are not a function of stock price, market fluctuations and stock price fluctuations on their own do not affect a company's dividend payments.

Should I sell stock before or after dividend?

You must have acquired your shares before the ex-dividend date in order to receive a dividend. If you acquired your shares on or after the ex-dividend date, the previous owner will receive the dividend. Sell your shares on or after the Ex-Dividend Date and you'll receive the dividend.

What is stock dividend?

A stock dividend, a method used by companies to distribute wealth to shareholders, is a dividend payment made in the form of shares rather than cash. Stock dividends are primarily issued in lieu of cash dividends when the company is low on liquid cash on hand. The board of directors. Board of Directors A board of directors is a panel ...

How does a dividend affect a company's stock?

Maintaining an “investable” price range. As noted above, a stock dividend increases the number of shares while also decreasing the share price. By lowering the share price through a stock dividend, a company’s stock may be more “affordable” to the public.

Why do companies issue dividends instead of cash?

Issuing a stock dividend instead of a cash dividend may signal that the company is using its cash to invest in risky projects. The practice can cast doubt on the company’s management and subsequently depress its stock price.

Why does the price per share decrease?

Although it increases the number of shares outstanding for a company , the price per share must decrease accordingly. An understanding that the market capitalization of a company remains the same explains why share price must decrease if more shares are issued.

Is a stock dividend taxed?

No tax considerations exist for issuing a stock dividend. For this reason, shareholders typically believe that a stock dividend is superior to a cash dividend – a cash dividend is treated as income in the year received and is, therefore, taxed.

Does dividend affect the value of a stock?

The key takeaway from our example is that a stock dividend does not affect the total value of the shares that each shareholder holds in the company. As the number of shares increases, the price per share decreases accordingly because the market capitalization must remain the same.

Can a company pay dividends in lieu of a cash dividend?

A company that does not have enough cash may choose to pay a stock dividend in lieu of a cash dividend. In other words, a cash dividend allows a company to maintain its current cash position. 2. Tax considerations for a stock dividend. No tax considerations exist for issuing a stock dividend.

How long do you have to hold a stock to get dividends?

Although most corporate dividends are "qualified" and taxed at a special rate, you have to hold a stock for 61 days or more to earn that status. This means your first couple of dividends will be taxed at your ordinary income tax rate.

How long after the record date is the dividend paid?

The payout date can be days, weeks or even months after the record date. This is the date that the dividend is actually paid out to shareholders.

Why are payout dates important?

On the record and payout dates, there are no price adjustments made by the stock exchanges. Those dates are mainly administrative markers that don't affect the value of the stock. From an investment perspective, the important date is the ex-dividend date, as that is the date that determines whether you are entitled to a dividend or not. Payout dates are important to investors, as that is the day they actually receive their money. However, it doesn't affect the value of the company on the open market.

What are the factors that affect stock prices?

Numerous factors affect stock prices. Supply and demand plays a major role in the rise and fall of stock prices. Fear and greed are also driving factors. Something else plays a role when a company pays a dividend, however.

Can a stock be bid up on the ex-dividend date?

However, the market is guided by many other forces. If a stock is deemed to be undervalued by investors, the stock price may be bid up, even on the ex-dividend date. Similarly, if investor perception of the value of a stock on any given day sours, the stock may sell off much more than the simple drop due to the dividend.

Do dividends have to be recorded on the books?

Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. Payouts are only made to shareholders that are recorded on the books of the issuing company. A person must be on record as a shareholder by what's known as the record date in order to receive a dividend.

How are dividends paid?

A dividend is the distribution of some of a company's earnings to a class of its shareholders. Dividends are usually paid in the form of a dividend check. However, they may also be paid in additional shares of stock. The standard practice for the payment of dividends is a check that is mailed to stockholders ...

What happens if you pay dividends?

If dividends are paid, a company will declare the amount of the dividend, and all holders of the stock (by the ex-date) will be paid accordingly on the subsequent payment date. Investors who receive dividends may decide to keep them as cash or reinvest them in order to accumulate more shares.

What is dividend reinvestment plan?

A dividend reinvestment plan (DRIP) offers a number of advantages to investors. If the investor prefers to simply add to their current equity holdings with any additional funds from dividend payments, automatic dividend reinvestment simplifies this process (as opposed to receiving the dividend payment in cash and then using the cash to purchase additional shares). Company-operated DRIPs are usually commission-free, since they bypass using a broker. This feature is particularly appealing to small investors since commission fees are proportionately larger for smaller purchases of stock.

What is dividend distribution?

A dividend is the distribution of some of a company's earnings to a class of its shareholders. If a company elects to distribute dividends, usually, both the date and the amount is determined on a quarterly basis, after a company finalizes its income statement and the board of directors meets to review the company's financials.

What is the ex-date on a stock?

The day preceding the record date is called the ex-date, or the date the stock begins trading ex-dividend. This means that a buyer on ex-date is purchasing shares that are not entitled to receive the most recent dividend payment. The payment date is usually about one month after the record date.

Do all companies pay dividends?

Dividends are a way for companies to distribute profits to shareholders, but not all companies pay dividends. Some companies decide to retain their earnings to re-invest for growth opportunities instead. If dividends are paid, a company will declare the amount of the dividend, and all holders of the stock ...

Is dividend reinvestment taxable?

This practice is known as dividend reinvestment; it is commonly offered as a dividend reinvestment plan ( DRIP) option by individual companies and mutual funds. Dividends are always considered taxable income by the Internal Revenue System (IRS) (regardless of the form in which they are paid).

What is dividend payment?

In simple words, it is a form of dividend payment where the companies return a profit to their investors by giving them additional shares of the company instead of a cash dividend. This makes them own a higher number of shares in that company. The decision to issue this dividend is made by the board of directors of that company.

What is stock dividend?

Stock Dividend is the dividend declared from the profits of the company which is discharged by the company by issuing additional shares to the shareholders of the company rather than paying such amount in cash and generally company opts for stock dividend payout when there is a shortage of cash in the company.

What is a small dividend payout?

before dividend, this can be small or large. When the total number of shares issued is less than twenty-five percent of the entire value of shares that were outstanding before dividend, it is called a small dividend payout. On the other hand, if the total number of shares issued is more than twenty-five percent of the entire value ...

Do dividends have to be taxed?

In most countries, there are no tax consequences on the investor or shareholder as a repercussion of stock dividend payout. This is unlike the cash dividend payouts made to shareholders, which are subject to taxation.

Can a company pay dividends if it doesn't have cash?

Whenever the company doesn’t have enough cash to pay dividends to its shareholders, it can pay in terms of shares. Thus, effectively costing nothing in return to the company. Since there aren’t any tax considerations, it is beneficial for the investors as well to receive this dividend. A cash dividend.

What is dividend payable?

The Dividends Payable account records the amount your company owes to its shareholders. It’s the liability. In the general ledger hierarchy, it usually nestles under current liabilities. On the date of declaration, credit the dividend payable account.

What happens to retained earnings after a dividend payment?

After your date or record, your liabilities will increase and your retained earnings will decrease. Then after the payment, both your cash account and your liability will be reduced. The end result across both entries will be an overall reduction in retained earnings and cash for the amount of the dividend.

What is the final entry required to record issuing a cash dividend?

The final entry required to record issuing a cash dividend is to document the entry on the date the company pays out the cash dividend. This transaction signifies money that is leaving your company: so we’ll credit or reduce your company’s cash account and debit your dividends payable account.

Do you have to issue dividends to shareholders?

As your company grows and earns a profit, you have the choice of either reinvesting the profits back into your company or distributing them to your shareholders in the form of a dividend. Most of the time, businesses and business owners aren’t required to issue dividends. Preferred shareholders can be an exception.

Do dividends affect your financial statements?

Impacts to your financial statements. As you would expect, dividends shouldn’t impact the operating activities of your company. That means declaring, paying, and recording dividends won’t change anything on your income statement or profit and loss statement.

Do preferred shareholders have to record dividends?

Preferred shareholders can be an exception. With that said, many companies earn enough cash to regularly provide shareholders with dividends. Whether you issue dividends monthly or choose to only issue dividends following a strong fiscal period, you’ll need to record the transaction. This article will explain the accounting treatment of dividends.

What is dividend payout?

A dividend is simply a percentage of the profits a company makes that’s paid out to shareholders. Some companies pay out 100% of earnings to investors while others pay less. And some companies don’t offer any type of dividend payout at all. Dividends can be paid in cash or in shares of stock.

What happens if you buy stock on a dividend date?

If you buy shares of dividend stock on or after this date, then you won’t be able to get the next dividend payment. Instead, the seller of those shares would collect those dividends. Finally, you have the payment date.

Why is it important to have a higher dividend yield?

A higher dividend yield could make a stock look more attractive, but it’s important to consider how sustainable it is over time. Dividend per share refers to how much a company distributes in dividends for each of its shares of outstanding stock.

How do dividends work?

How Dividend Payouts Work. If you buy into a dividend-paying stock you might automatically assume that you’ll receive the next dividend payment. But there are some key dates companies use to determine who gets a dividend payment. First, there’s the declaration date.

What is a one time dividend?

This is a one-time payment you receive in addition to regular dividend payouts. Companies may choose to offer a special dividend following a stronger than usual earnings period. Before dividends can be paid out, the payments have to be approved by the company’s board of directors. Once this happens, the company will announce when ...

How often do companies pay dividends?

Generally, companies can pay out stock dividends quarterly though some may do so monthly or annually. In terms of when dividends are paid out and who’s eligible to receive them, there are several key dates to know. Many investors have found that working with a financial advisor was a major part of their success.

When do dividends hit your account?

The actual date dividends hit your investment account once they’re paid out can depend on your brokerage.

Types of Dividends

Dividends are broadly categorized into two types: Cash Dividends and Stock Dividends. As far as cash dividends are concerned, they are the dividends that are paid to the shareholders in the form of cash. On the other hand, Stock Dividends are dividends that are paid to the company in the form of common share equity.

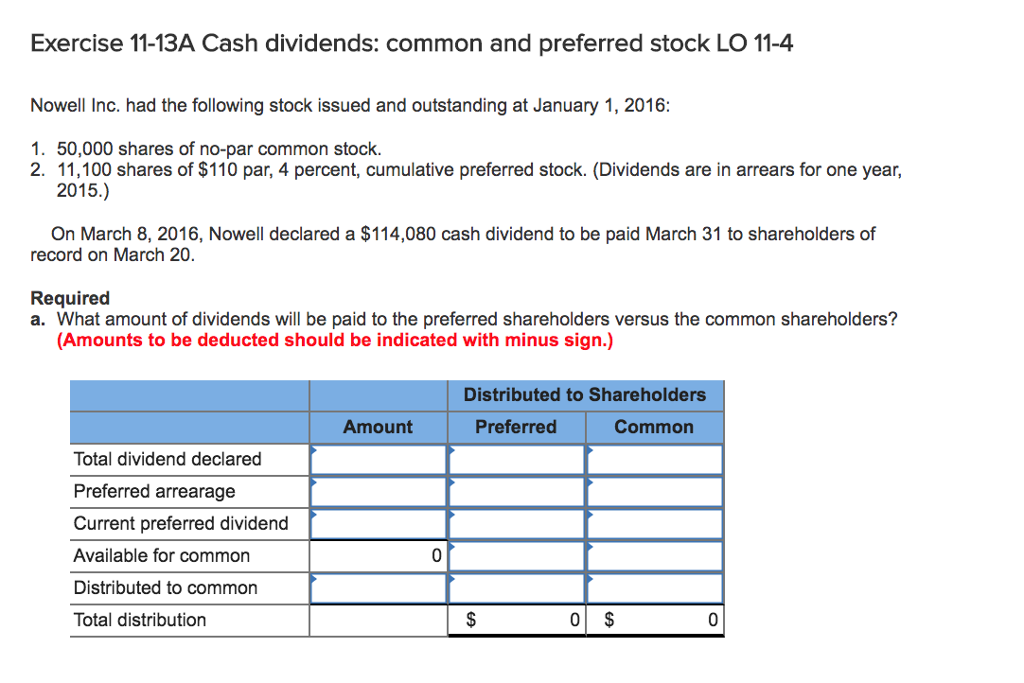

Cash Dividends Paid – Journal Entry

As mentioned earlier, dividend declaration date and dividend payout date might exist in different accounting periods. Therefore, once the dividends are actually paid out to the shareholders, the following journal entries are made:

The impact of Cash Dividends on the Financial Statements

Cash Dividends are mostly paid by companies in order to provide a return to the shareholders as a result of their investment. Therefore, cash dividends mostly impact cash, as well as shareholder equity accounts.

Cash Dividends vs Stock Dividends

In certain cases, companies also prefer paying stock dividends instead of cash dividends. When organizations choose to issue stock dividends, it results in an increase in the number of shares outstanding.

How do Stock Dividends impact the financial statements?

When stock dividends are declared, the amount is debited equivalent to the amount generated by multiplying the current stock price by the shares outstanding by the dividend percentage.

What is dividend payout?

Dividend Payouts Defined. Dividend payouts are payments that a company makes to its shareholders.

How much is a dividend paid per share?

Dividends are paid per share. If a company announces a dividend payment of $0.15 per share and you own 100 shares, your dividend payment will be $15 and will be deposited into your brokerage account.

Who decides the amount of dividends?

A company’s board of directors ultimately decides the details of each dividend payment. You’ll need to buy stock by a certain date in order to be eligible for a dividend payment. This date is called the ex-dividend date. The board decides the amount of the dividend, when it will be paid and and the ex-dividend date.

Understand Dividend Terminology

Stock Price on Ex-Dividend Date

- Stock market specialists will mark down the price of a stock on its ex-dividend date by the amount of the dividend. For example, if a stock trades at $50 per share and pays out a $0.25 quarterly dividend, the stock will be marked down to open at $49.75 per share. However, the market is guided by many other forces. If a stock is deemed to be underva...

Record and Payout Dates

- On the record and payout dates, there are no price adjustments made by the stock exchanges. Those dates are mainly administrative markers that don't affect the value of the stock. From an investment perspective, the important date is the ex-dividend date, as that is the date that determines whether you are entitled to a dividend or not. Payout dates are important to investor…

Taxation of Dividends

- Taxation is another concern for dividend investors. Although most corporate dividends are "qualified" and taxed at a special rate, you have to hold a stock for 61 days or more to earn that status. This means your first couple of dividends will be taxed at your ordinary income tax rate. If you intend to buy and sell stocks immediately before and after their ex-dividend dates simply to …